Reebok 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

1

98

2014

Internal Group Management System

/

03.1

/

adidas Group

/

2014 Annual Report

Group Management Report – Financial Review

Internal Group Management System

The adidas Group’s principal financial goal for increasing shareholder value is maximising

operating cash flow. We strive to achieve this goal by continually improving our top- and

bottom-line performance while at the same time optimising the use of invested capital.

Our Group’s planning and controlling system is therefore designed to provide a variety

of tools to assess our current performance and to align future strategic and investment

decisions to best utilise commercial and organisational opportunities.

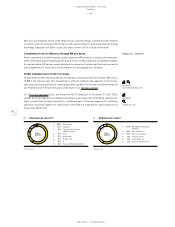

Operating cash flow as Internal Group Management focus

We believe operating cash flow is the most important driver to increase shareholder value. To

support this, Group Management focuses on four major financial key performance indicators

(KPIs). Increasing net sales and operating profit are the main contributors to improve operating

cash flow. In addition, strict management of operating working capital and value-enhancing capital

expenditure are beneficial for operating cash flow development. As a result, in order to maximise

operating cash flow generation across our organisation, management of our operating segments

have responsibility for improving net sales and operating profit as well as optimising operating

working capital and capital expenditure. In addition, in order to keep senior management focused

on long-term performance improvements, we have KPIs in place, which measure the development

of the business units over a multi-year period.

Operating margin as important measure of operational progress

Operating margin (defined as operating profit as a percentage of net sales) is our Group’s key focus

measure to drive and improve our operational performance. It highlights the quality of our top line

and operational efficiency. The primary drivers central to enhancing operating margin are as follows:

/

Sales and gross margin development: Management focuses on identifying and exploiting growth

opportunities that not only provide for future top-line improvements, but also have potential to

increase gross margin. Major levers for enhancing our Group’s sales and gross margin include:

/

Optimising our product mix.

/

Minimising clearance activities.

/

Improving the quality of distribution, with a particular focus on controlled space.

/

Realising supply chain efficiency initiatives.

see Glossary, p. 258

see Diagram 01

adidas Group financial KPIs

/

Net sales and operating profit

see Glossary, p. 258

01

/

Financial key performance indicators (KPIs) of the adidas Group

Net sales

Operating cash flow

Operating profit

Change in operating working capital

Capital expenditure 1)

1) Less depreciation and amortisation.