Reebok 2014 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2014 Annual Report

Consolidated Financial Statements

200

2014

Notes

/

04.8

/

The Group documents the relationship between hedging instruments and hedge objects at transaction inception,

as well as the risk management objectives and strategies for undertaking various hedge transactions. This

process includes linking all derivatives designated as hedges to specific firm commitments and forecasted

transactions. The Group also documents its assessment of whether the derivatives that are used in hedging

transactions are highly effective by using different methods of effectiveness testing, such as the ‘dollar offset

method’ or the ‘hypothetical derivative method’.

The fair values of currency options, forward exchange contracts and commodity futures are determined on

the basis of market conditions on the reporting dates. The fair value of a currency option is determined using

generally accepted models to calculate option prices. The fair market value of an option is influenced not only

by the remaining term of the option but also by additional factors, such as the actual foreign exchange rate and

the volatility of the underlying foreign currency base. Fair values are determined taking into consideration the

counterparty risk. Due to immateriality, no adjustment has been recorded. The adidas Group has exercised

the option to calculate the amounts on counterparty level according to IFRS 13 ‘Fair Value Measurement’,

paragraph 48.

Cash and cash equivalents

Cash and cash equivalents represent cash at banks, cash on hand and short-term deposits with maturities of

three months or less from the date of acquisition.

Cash equivalents are short-term, highly liquid investments that are readily convertible to known amounts of

cash and which are subject to an insignificant risk of changes in value.

Receivables and other financial assets

Receivables and other financial assets are recognised at fair value, which corresponds to the nominal value for

current receivables and other financial assets. For non-current receivables and other financial assets, the fair

value is estimated as the present value of future cash flows discounted at the market rate of interest at the

balance sheet date. Subsequently, these are measured at amortised cost using the ‘effective interest method’.

Required allowances, if necessary, are determined on the basis of individual risk assessments, and on the ageing

structure of receivables past due.

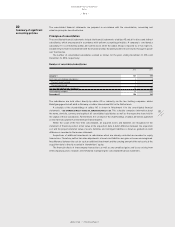

Inventories

Merchandise and finished goods are valued at the lower of cost or net realisable value, which is the estimated

selling price in the ordinary course of business less the estimated costs of completion and the estimated costs

necessary to make the sale. Costs are determined using a standard valuation method: the ‘average cost method’.

Costs of finished goods include cost of raw materials, direct labour and the components of the manufacturing

overheads which can reasonably be attributed. The allocation of overheads is based on the planned average

utilisation. The net realisable value allowances are computed consistently throughout the Group based on the age

and expected future sales of the items on hand.

Assets/liabilities and disposal groups classified as held for sale

Assets/liabilities and disposal groups classified as held for sale are primarily non-current assets and liabilities

expected to be recovered principally through sale rather than through continuing use. These are measured at

the lower of their carrying amount and fair value less costs to sell. Assets classified as held for sale are not

depreciated on a straight-line basis.

Property, plant and equipment

Property, plant and equipment are measured at amortised cost. This comprises any costs directly attributable

to bringing the asset to the condition necessary for it to be capable of operating in the manner intended by

Management less accumulated depreciation (except for land and construction in progress) and accumulated

impairment losses. Depreciation is recognised over the estimated useful life utilising the ‘straight-line method’

and taking into account any potential residual value, except where the ‘declining-balance method’ is more

appropriate in light of the actual utilisation pattern. Parts of an item of property, plant and equipment with a cost

that is significant in relation to the total cost of the item are depreciated separately.