Reebok 2014 Annual Report Download - page 209

Download and view the complete annual report

Please find page 209 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2014 Annual Report

Consolidated Financial Statements

205

2014

Notes

/

04.8

/

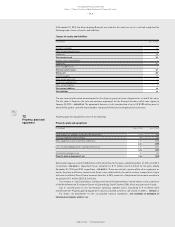

Contingent liabilities

Contingent liabilities are possible obligations that arise from past events and whose existence will be confirmed

only by the occurrence of one or more uncertain future events not wholly within the control of the Group.

Additionally, contingent liabilities may be present obligations that arise from past events but which are not

recognised because it is not probable that an outflow of resources will be required to settle the obligation or the

amount of the obligation cannot be measured with sufficient reliability. Contingent liabilities are not recognised

in the consolidated statement of financial position but are disclosed and explained in the Notes

/

SEE NOTE 38.

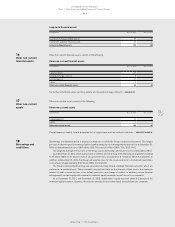

Treasury shares

When treasury shares recognised as equity are repurchased, the amount of the consideration paid, which includes

directly attributable costs, net of any tax effects, is recognised as a deduction from equity. The nominal value of

€ 1 per treasury share is debited to share capital. Any premium or discount to the nominal value is shown as an

adjustment to the retained earnings. If treasury shares are sold or re-issued, the nominal value of the shares will

be credited to share capital.

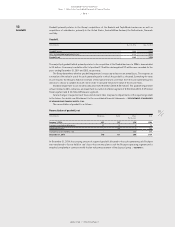

Recognition of revenues

Sales are recognised at the fair value of the consideration received or receivable, net of returns, trade discounts

and volume rebates, when the significant risks and rewards of ownership of the goods are transferred to the

buyer, and when it is probable that the economic benefits associated with the transaction will flow to the Group.

Royalty and commission income is recognised based on the contract terms on an accrual basis.

Advertising and promotional expenditures

Production costs for media campaigns are included in prepaid expenses (other current and non-current assets)

until the services are received, and upon receipt expensed in full. Significant media buying costs are expensed

over the intended duration of the broadcast.

Promotional expenses that involve payments, including one-time up-front payments for promotion contracts,

are expensed on a straight-line basis over the term of the agreement.

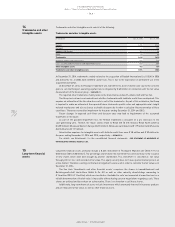

Interest

Interest is recognised as income or expense as incurred using the ‘effective interest method’ with the exception

of interest that is directly attributable to the acquisition, construction or production of a qualifying asset. This

interest is capitalised as part of the cost of the qualifying asset.

Income taxes

Current income taxes are computed in accordance with the applicable taxation rules established in the countries

in which the Group operates.

The Group computes deferred taxes for all temporary differences between the carrying amount and the tax

base of its assets and liabilities and tax loss carry-forwards. As it is not permitted to recognise a deferred tax

liability for goodwill, the Group does not compute any deferred taxes thereon.

Deferred tax assets arising from deductible temporary differences and tax loss carry-forwards which exceed

taxable temporary differences are only recognised to the extent that it is probable that the company concerned will

generate sufficient taxable income to realise the associated benefit.

Income tax is recognised in the income statement except to the extent that it relates to items recognised

directly in equity, in which case it is recognised in equity.