Reebok 2014 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

adidas Group

/

2014 Annual Report

Consolidated Financial Statements

206

2014

Notes

/

04.8

/

Estimation uncertainties and judgements

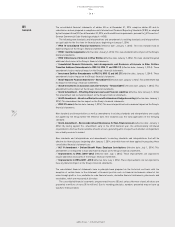

The preparation of financial statements in conformity with IFRS requires the use of assumptions and estimates

that affect reported amounts and related disclosures. Although such estimates are based on Management’s best

knowledge of current events and actions, actual results may ultimately differ from these estimates.

The key assumptions concerning the future and other key sources of estimation uncertainty at the balance

sheet date which have a significant risk of causing a material adjustment to the carrying amounts of assets

and liabilities within the next financial year are outlined in the respective Notes, in particular goodwill

/

SEE

NOTE 13, trademarks

/

SEE NOTE 14, other provisions

/

SEE NOTE 20, pensions

/

SEE NOTE 24, derivatives

/

SEE NOTE 29,

deferred taxes

/

SEE NOTE 34 as well as litigation and other legal risks

/

SEE NOTE 38.

Judgements have, for instance, been used in classifying leasing arrangements as well as in determining

valuation methods for intangible assets.

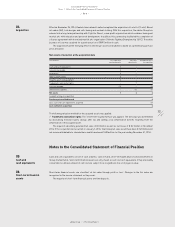

Plans to sell the Rockport operating segment became concrete towards the end of 2014 and a divestiture within

the next twelve months is considered as highly probable. For this reason, the Rockport operating segment is

reported as discontinued operations at December 31, 2014. The focus and the strategic direction of the Group’s

brand portfolio primarily lies in the field of sports with the result that the Rockport operating segment is no longer

regarded as significant in terms of the Group’s strategic direction.

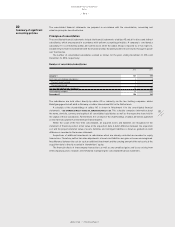

The Rockport operating segment was neither classified as assets held for sale nor as discontinued operations

at December 31, 2013. The 2013 figures of the consolidated income statement and the consolidated statement of

cash flows have been restated to show the discontinued operations separately from continuing operations.

The results of the Rockport operating segment are shown as discontinued operations in the consolidated

income statement for all periods:

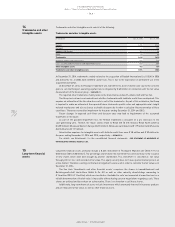

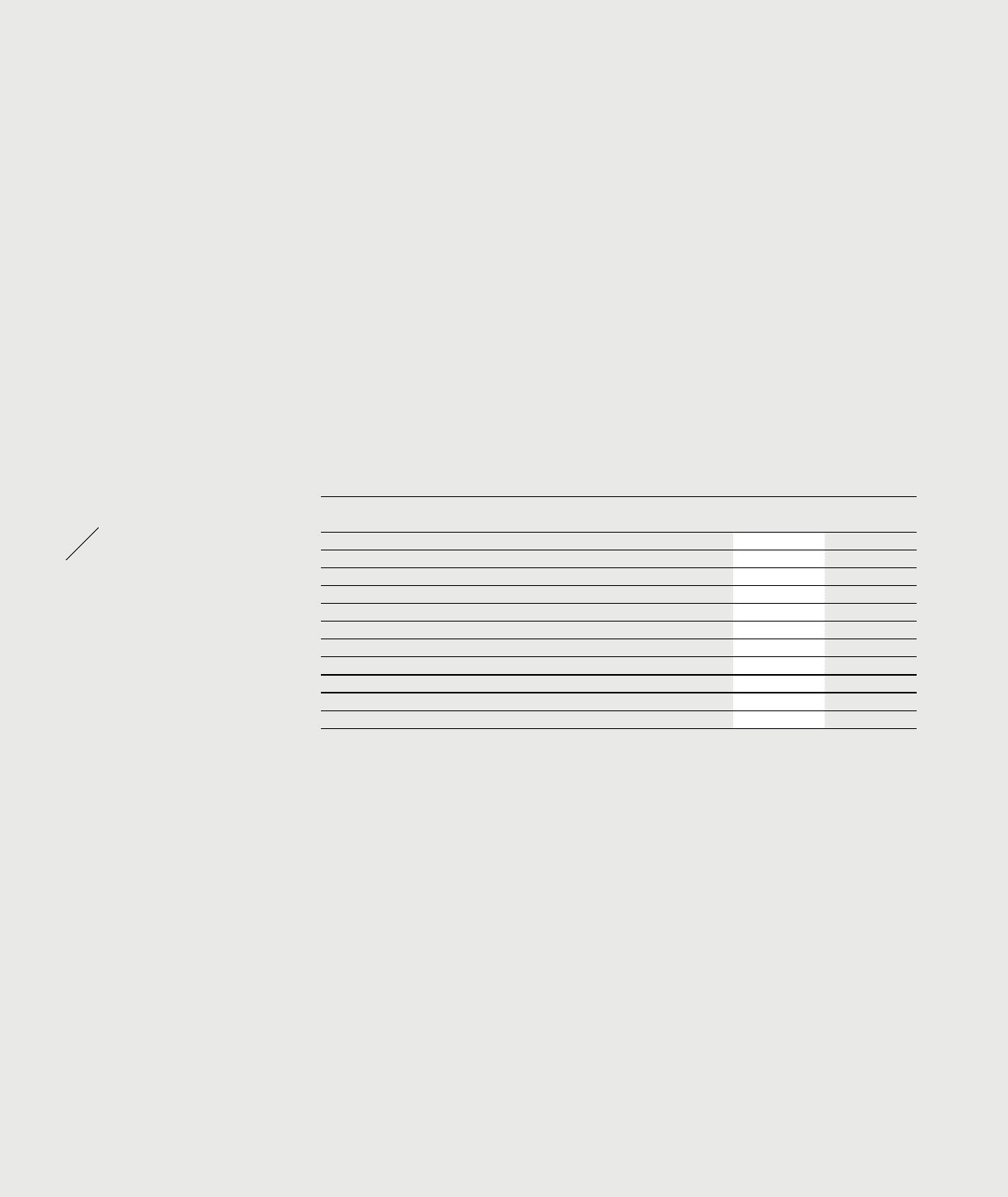

Discontinued operations

(€ in millions) Dec. 31, 2014 Dec. 31, 2013

Net sales 283 289

Expenses 264 268

Income from operating activities 19 21

Income taxes 5 4

Income from operating activities, net of tax 14 17

Loss recognised on the measurement to fair value less costs to sell (110) –

Income taxes 28 –

Loss recognised on the measurement to fair value less costs to sell, net of tax (82) –

Losses/gains from discontinued operations, net of tax (68) 17

Basic earnings per share from discontinued operations (€) (0.32) 0.08

Diluted earnings per share from discontinued operations (€) (0.32) 0.08

Losses from discontinued operations in an amount of € 68 million (2013: gains of € 17 million) are entirely

attributable to the shareholders of adidas AG.

03

Discontinued

operations