Reebok 2014 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2014 Annual Report

Consolidated Financial Statements

222

2014

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

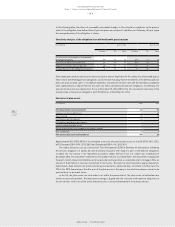

until June 30, 2018

/

by issuing new shares against contributions in cash once or several times by no more than € 20 million and,

subject to Supervisory Board approval, to exclude residual amounts from shareholders’ subscription rights and to

exclude shareholders’ subscription rights when issuing the new shares at a value not essentially below the stock

market price of shares with the same features; this exclusion of subscription rights can also be associated with

the listing of the company’s shares on a foreign stock exchange (Authorised Capital 2013/III). The authorisation to

exclude subscription rights pursuant to the previous sentence may, however, only be used to the extent that the

pro rata amount of the new shares in the nominal capital together with the pro rata amount in the nominal capital

of other shares which have been issued by the company since May 8, 2013, subject to the exclusion of subscription

rights pursuant to or in accordance with § 186 section 3 sentence 4 AktG on the basis of an authorised capital or

following a repurchase, or for which conversion or subscription rights or conversion or subscription obligations

were granted after May 8, 2013, through the issuance of convertible bonds and/or bonds with warrants, with

subscription rights excluded in accordance with § 186 section 3 sentence 4 AktG, does not exceed 10% of the

nominal capital existing on the date of the entry of this authorisation into the commercial register or – if this

amount is lower – as of the respective date on which the authorisation is used.

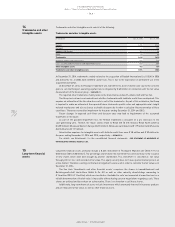

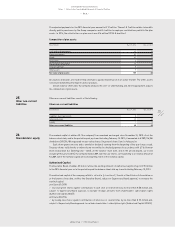

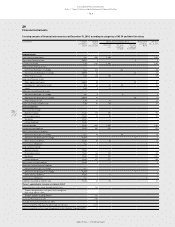

Contingent Capital

The following description of the Contingent Capital is based on § 4 sections 5 and 6 of the Articles of Association

of the company as well as on the underlying resolutions of the Annual General Meeting held on May 6, 2010 and

May 8, 2014. Additional contingent capital does not exist.

Contingent Capital 2010

At the balance sheet date, the nominal capital is conditionally increased by up to € 36 million divided into not more

than 36,000,000 registered shares (Contingent Capital 2010). The contingent capital increase will be implemented

only to the extent that holders or creditors of option or conversion rights or the persons obligated to exercise

option or conversion duties on bonds issued by the company or a subordinated Group company, pursuant to the

authorisation of the Executive Board granted by the resolution adopted by the Annual General Meeting of May 6,

2010, up to May 5, 2015 and guaranteed by the company, exercise their option or conversion rights or, if they are

obliged to exercise the option or conversion duties, meet their obligations to exercise the warrant or convert the

bond, or to the extent that the company exercises its rights to choose to deliver shares in the company for the

total amount or partially instead of a payment and insofar as no cash settlement, treasury shares or shares of

another public listed company are used to serve these rights. The new shares shall be issued at the respective

option or conversion price to be established in accordance with the aforementioned authorisation resolution.

The new shares shall carry dividend rights from the commencement of the financial year in which the shares

are issued. The Executive Board is authorised, subject to Supervisory Board approval, to stipulate any additional

details concerning the implementation of the contingent capital increase.

The Executive Board of adidas AG did not issue shares from the Contingent Capital 2010 in the 2014 financial

year or in the period beyond the balance sheet date up to and including February 13, 2015.

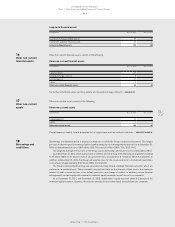

Contingent Capital 2014

At the balance sheet date, the nominal capital is conditionally increased by up to € 12.5 million divided into

not more than 12,500,000 registered shares (Contingent Capital 2014). The contingent capital increase will be

implemented only to the extent that holders or creditors of option or conversion rights or the persons obligated

to exercise option or conversion duties based on bonds issued by the company or a subordinated Group company,

pursuant to the authorisation of the Executive Board granted by the resolution adopted by the Annual General

Meeting on May 8, 2014 (Agenda Item 7), up to May 7, 2019 and guaranteed by the company, exercise their option

or conversion rights or, if they are obliged to exercise the option or conversion duties, meet their obligations to

exercise the warrant or convert the bond, or to the extent that the company exercises its rights to choose to deliver

shares in the company for the total amount or a part amount instead of payment of the amount due and insofar

as no cash settlement, treasury shares or shares of another public listed company are used to serve these rights.

The new shares will be issued at the respective option or conversion price to be established in accordance with the

aforementioned authorisation resolution. The new shares will carry dividend rights from the commencement of

the financial year in which the shares are issued. The Executive Board is authorised, subject to Supervisory Board

approval, to stipulate any additional details concerning the implementation of the contingent capital increase.

The Executive Board of adidas AG did not issue shares from the Contingent Capital 2014 in the 2014 financial

year or in the period beyond the balance sheet date up to and including February 13, 2015.