Reebok 2014 Annual Report Download - page 236

Download and view the complete annual report

Please find page 236 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2014 Annual Report

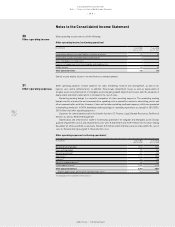

Consolidated Financial Statements

232

2014

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

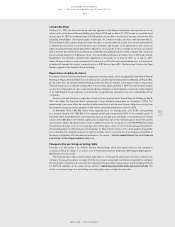

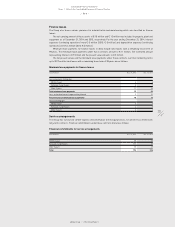

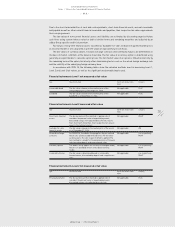

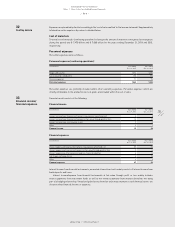

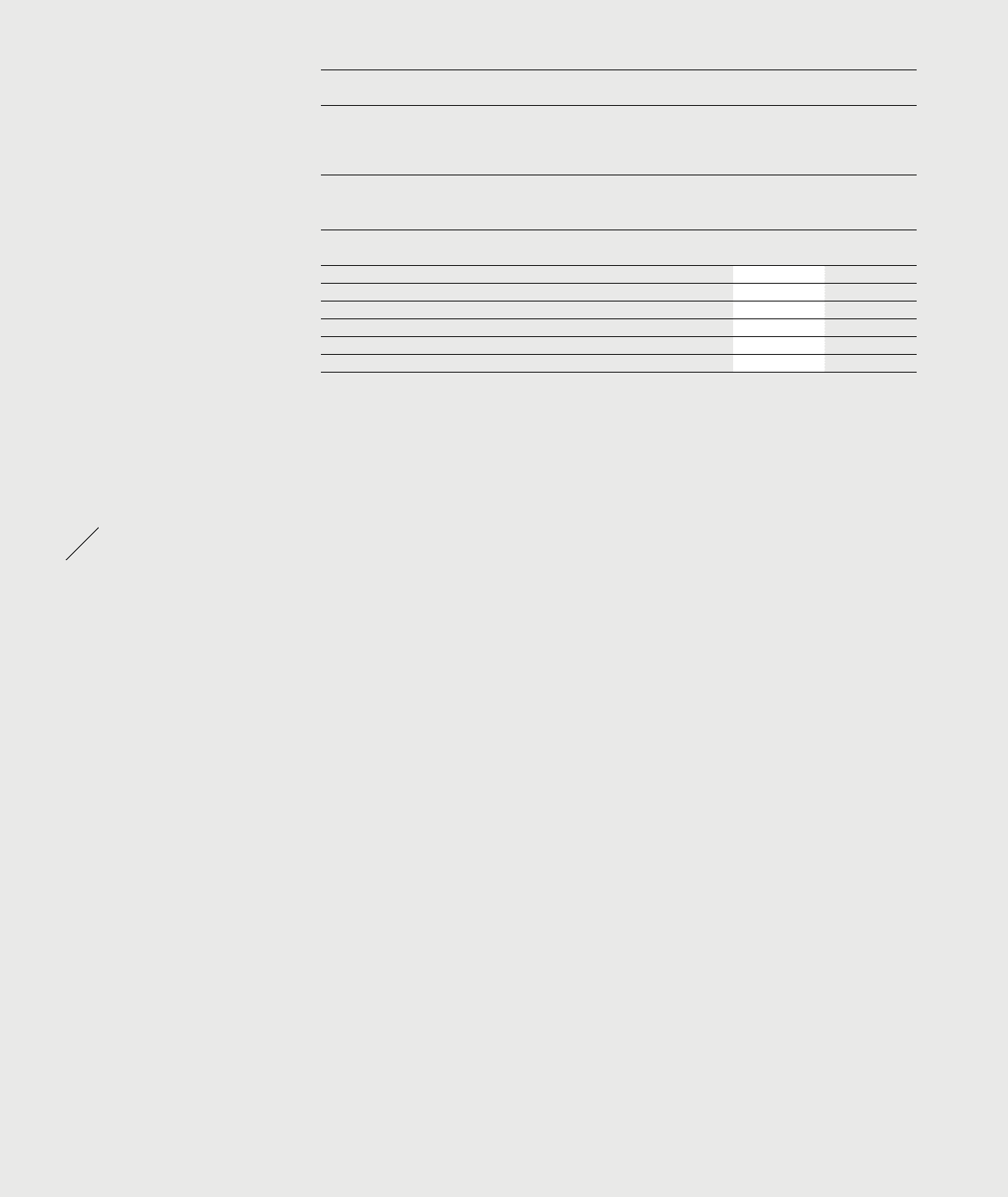

Financial instruments Level 3 measured at fair value

Type Valuation method Significant unobservable

inputs

Category

Investment in

FC Bayern

München AG

This equity security does not have a quoted market price

in an active market. Existing contractual arrangements

(based on the externally observable dividend policy of

Bayern München AG) are used in order to calculate the

fair value as at December 31, 2014.

See column ‘Valuation

method’

FAHfT

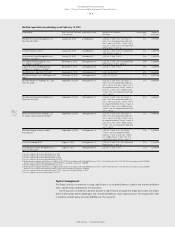

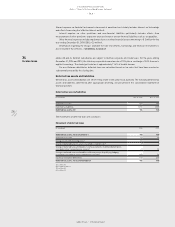

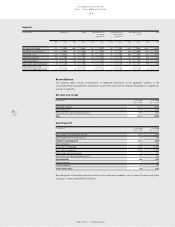

Net gains/losses on financial instruments recognised in the consolidated income statement

(€ in millions) Year ending

Dec. 31, 2014

Year ending

Dec. 31, 2013

Financial assets or financial liabilities at fair value through profit or loss (13) (16)

Thereof: designated as such upon initial recognition – –

Thereof: classified as held for trading (13) (16)

Loans and receivables (26) (13)

Available-for-sale financial assets – –

Financial liabilities measured at amortised cost 12 15

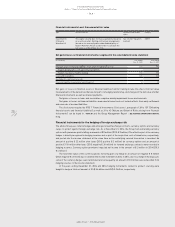

Net gains or losses on financial assets or financial liabilities held for trading include the effects from fair value

measurements of the derivatives that are not part of a hedging relationship, and changes in the fair value of other

financial instruments as well as interest payments.

Net gains or losses on loans and receivables comprise mainly impairment losses and reversals.

Net gains or losses on financial liabilities measured at amortised cost include effects from early settlement

and reversals of accrued liabilities.

The disclosures required by IFRS 7 ‘Financial Instruments: Disclosures’, paragraphs 13A to 13F (‘Offsetting

financial assets and financial liabilities’) as well as 31 to 42 (‘Nature and Extent of Risks arising from Financial

Instruments’) can be found in

/

NOTE 07 and the Group Management Report

/

SEE RISK AND OPPORTUNITY REPORT,

P. 154.

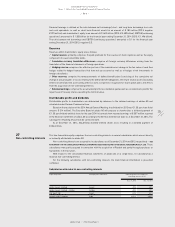

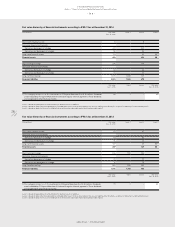

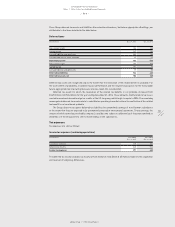

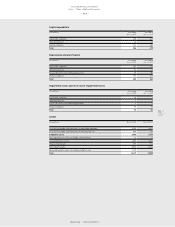

Financial instruments for the hedging of foreign exchange risk

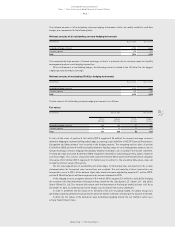

The adidas Group uses natural hedges and arranges forward exchange contracts, currency options and currency

swaps to protect against foreign exchange risk. As at December 31, 2014, the Group had outstanding currency

options with premiums paid totalling an amount of € 0 million (2013: € 2 million). The effective part of the currency

hedges is directly recognised in hedging reserves and as part of the acquisition costs of inventories, respectively,

and posted into the income statement at the same time as the underlying secured transaction is recorded. An

amount of positive € 22 million after taxes (2013: positive € 2 million) for currency options and an amount of

positive € 154 million after taxes (2013: negative € 34 million) for forward exchange contracts were recorded in

hedging reserves. Currency option premiums impacted net income in the amount of € 3 million in 2014 (2013:

€ 4 million).

The total time value of the currency options not being part of a hedge in an amount of negative € 0 million

(2013: negative € 4 million) was recorded in the income statement in 2014. In 2014, due to a change in the exposure,

some of the currency hedges were terminated and consequently an amount of € 0 million was reclassified from

hedging reserves to the income statement.

In the years ending December 31, 2014 and 2013, hedging instruments related to product sourcing were

bought to hedge a total net amount of US $ 5.6 billion and US $ 5.2 billion, respectively.