Reebok 2014 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

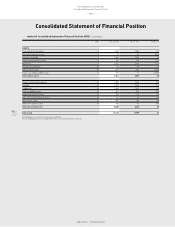

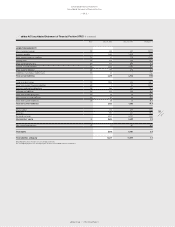

adidas Group

/

2014 Annual Report

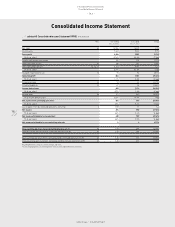

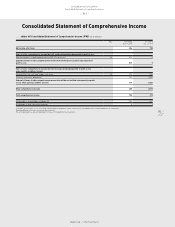

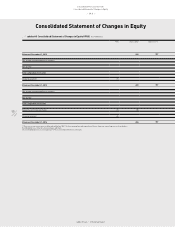

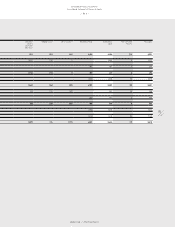

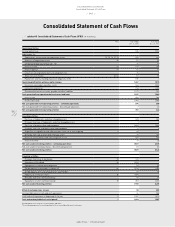

Consolidated Financial Statements

196

2014

Notes

/

04.8

/

The consolidated financial statements of adidas AG as at December 31, 2014 comprise adidas AG and its

subsidiaries and are prepared in compliance with International Financial Reporting Standards (IFRS), as adopted

by the European Union (EU) as at December 31, 2014, and the additional requirements pursuant to § 315a section 1

German Commercial Code (Handelsgesetzbuch – HGB).

The following new standards and interpretations and amendments to existing standards and interpretations

are applicable for the first time for financial years beginning on January 1, 2014:

/

IFRS 10 Consolidated Financial Statements (effective date: January 1, 2014): This new standard had no

material impact on the Group’s financial statements.

/

IFRS 11 Joint Arrangements (effective date: January 1, 2014): This new standard had no impact on the Group’s

financial statements.

/

IFRS 12 Disclosure of Interests in Other Entities (effective date: January 1, 2014): This new standard required

additional disclosures in the Group’s financial statements.

/

Consolidated Financial Statements, Joint Arrangements and Disclosure of Interests in Other Entities:

Transition Guidance (Amendments to IFRS 10, IFRS 11 and IFRS 12) (effective date: January 1, 2014): These

amendments had no material impact on the Group’s financial statements.

/

Investment Entities (Amendments to IFRS 10, IFRS 12 and IAS 27) (effective date: January 1, 2014): These

amendments had no impact on the Group’s financial statements.

/

IAS 27 Separate Financial Statements – Revised (2011) (effective date: January 1, 2014): This amendment had

no impact on the Group’s financial statements.

/

IAS 28 Investments in Associates and Joint Ventures – Revised (2011) (effective date: January 1, 2014): This

amendment had no impact on the Group’s financial statements.

/

IAS 32 Amendment – Offsetting Financial Assets and Financial Liabilities (effective date: January 1, 2014):

This amendment had no material impact on the Group’s financial statements.

/

IAS 39 Amendment – Novation of Derivatives and Continuation of Hedge Accounting (effective date: January 1,

2014): This amendment had no impact on the Group’s financial statements.

/

IFRIC 21 Levies (effective date: January 1, 2014): This new interpretation had no material impact on the Group’s

financial statements.

New standards and interpretations as well as amendments to existing standards and interpretations are usually

not applied by the Group before the effective date. One exception was the early application of the following

standard:

/

IAS 36 Amendment – Recoverable Amount Disclosures for Non-Financial Assets (effective date: January 1,

2014): By having applied this amendment early in the 2013 financial year, the unintentionally introduced

requirement to disclose the recoverable amounts of cash-generating units irrespective of whether an impairment

has actually occurred is waived.

New standards and interpretations and amendments to existing standards and interpretations that will be

effective for financial years beginning after January 1, 2014, and which have not been applied in preparing these

consolidated financial statements are:

/

IAS 19 Amendment – Defined Benefit Plans: Employee Contributions (effective date: July 1, 2014): This

amendment is not expected to have any material impact on the Group’s financial statements.

/

Improvements to IFRSs (2010 – 2012) (effective date: July 1, 2014): These improvements are expected to

require additional disclosures in the Group’s financial statements.

/

Improvements to IFRSs (2011 – 2013) (effective date: July 1, 2014): These improvements are not expected to

have any material impact on the Group’s financial statements.

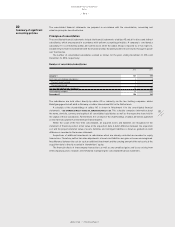

The consolidated financial statements have in principle been prepared on the historical cost basis with the

exception of certain items in the statement of financial position such as financial instruments valued at fair

value through profit or loss, available-for-sale financial assets, derivative financial instruments, plan assets and

receivables, which are measured at fair value.

The consolidated financial statements are presented in euros (€) and, unless otherwise stated, all values are

presented in millions of euros (€ in millions). Due to rounding principles, numbers presented may not sum up

exactly to totals provided.

01

General