Reebok 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Management Report – Financial Review

113

2014

/

03.2

/

adidas Group

/

2014 Annual Report

Group Business Performance

/

Income Statement

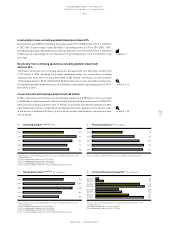

Income before taxes excluding goodwill impairment down 22%

Income before taxes (IBT) for the adidas Group decreased 25% to € 835 million from € 1.113 billion

in 2013. IBT as a percentage of sales declined 2.1 percentage points to 5.7% in 2014 (2013: 7.8%).

Excluding the goodwill impairment losses, IBT was down 22% to € 913 million from € 1.165 billion

in 2013 and, as a percentage of sales, decreased 1.9 percentage points to 6.3 % from 8.2% in the

prior year.

Net income from continuing operations excluding goodwill impairment

declines 22%

The Group’s net income from continuing operations decreased 27% to € 564 million in 2014 from

€ 773 million in 2013. Excluding the goodwill impairment losses, net income from continuing

operations was down 22% to € 642 million (2013: € 825 million). The Group’s tax rate increased

1.9 percentage points to 32.5% in 2014 (2013: 30.5%), mainly due to a less favourable earnings mix.

Excluding the goodwill impairment losses, the effective tax rate grew 0.5 percentage points to 29.7%

from 29.2% in 2013.

Losses from discontinued operations total € 68 million

In 2014, the Group incurred losses from discontinued operations of € 68 million, net of tax, related

to the Rockport operating segment, which is planned to be divested during the course of 2015 (2013:

gains from discontinued operations of € 17 million). Losses from discontinued operations in 2014

were mainly due to the loss recognised on the measurement to fair value less cost to sell, net of tax,

in the amount of negative € 82 million, partly offset by income from Rockport’s operating activities

of € 14 million.

see Diagram 27

see Note 34, p. 236

see Note 03, p. 206

25

/

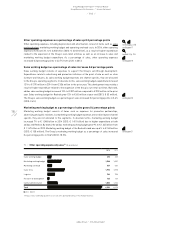

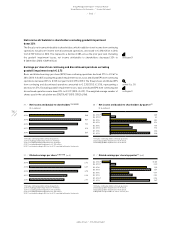

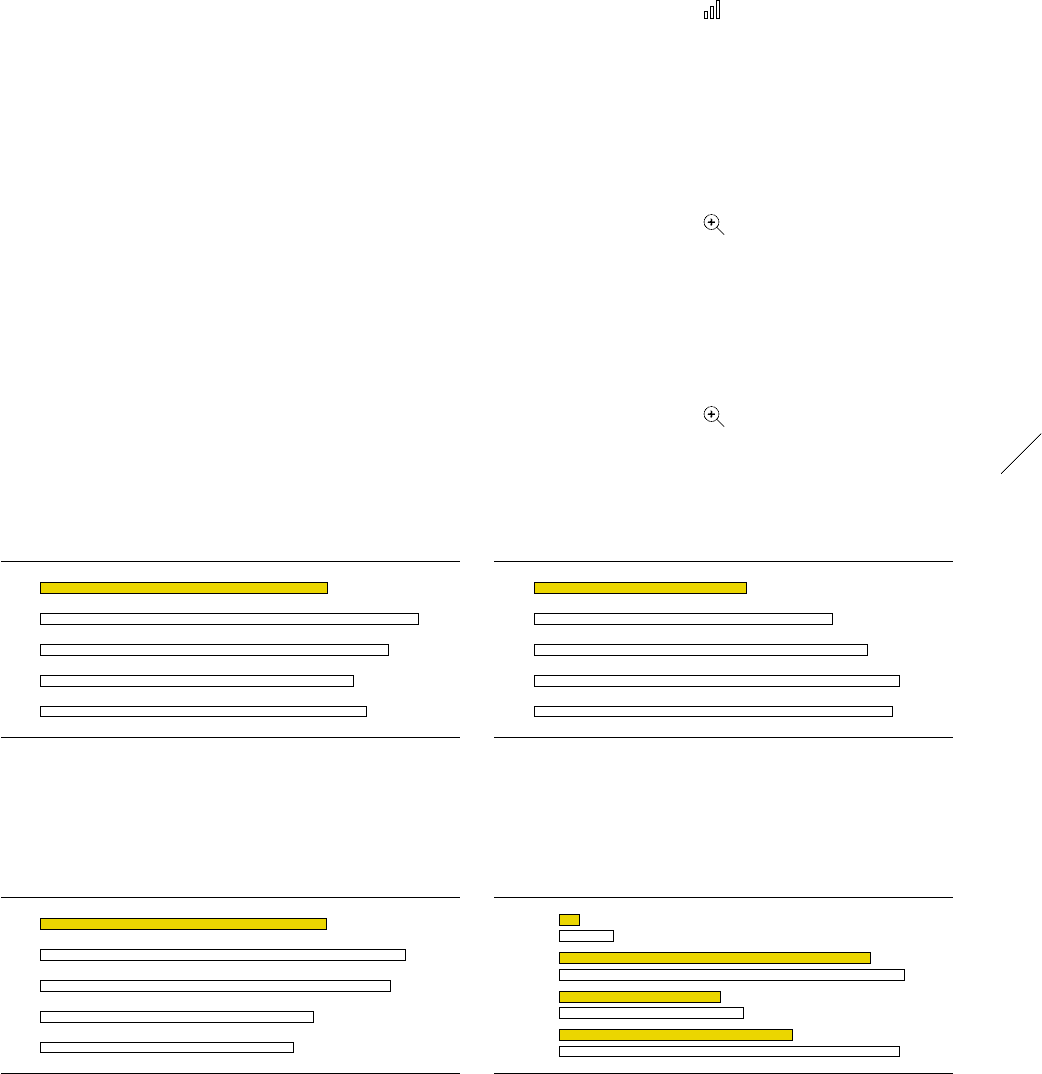

Operating margin 1) 2) 3) 4) 5) (in %)

2014 6.6

2013 8.7

2012 8.0

2011 7.2

2010 7.5

1) 2014 and 2013 reflect continuing operations as a result of the planned divestiture of the

Rockport business.

2) 2014 exluding goodwill impairment of € 78 million.

3) 2013 excluding goodwill impairment of € 52 million.

4) 2012 excluding goodwill impairment of € 265 million.

5) 2011 restated according to IAS 8 in the 2012 consolidated financial statements.

26

/

Financial expenses 1) (€ in millions)

2014 67

2013 94

2012 105

2011 115

2010 113

1) 2011 restated according to IAS 8 in the 2012 consolidated financial statements.

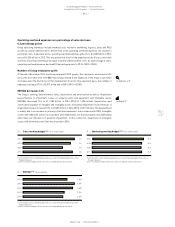

27

/

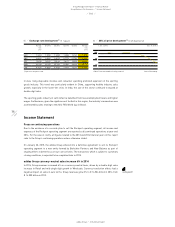

Income before taxes 1) 2) 3) 4) 5) (€ in millions)

2014 913

2013 1,165

2012 1,116

2011 869

2010 806

1) 2014 and 2013 reflect continuing operations as a result of the planned divestiture of the

Rockport business.

2) 2014 exluding goodwill impairment of € 78 million.

3) 2013 excluding goodwill impairment of € 52 million.

4) 2012 excluding goodwill impairment of € 265 million.

5) 2011 restated according to IAS 8 in the 2012 consolidated financial statements.

28

/

Income before taxes by quarter 1) (€ in millions)

Q4 2014 2) 25

Q4 2013 3) 68

Q3 2014 392

Q3 2013 436

Q2 2014 203

Q2 2013 232

Q1 2014 294

Q1 2013 430

1) Figures reflect continuing operations as a result of the planned divestiture of the

Rockport business.

2) Excluding goodwill impairment of € 78 million.

3) Excluding goodwill impairment of € 52 million.