Reebok 2014 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Management Report – Financial Review

171

2014

/

03.5

/

adidas Group

/

2014 Annual Report

Risk and Opportunity Report

/

Financial Risks

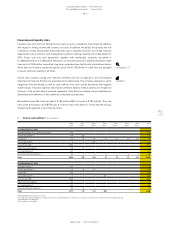

Risks related to product counterfeiting and imitation

As popular consumer brands which rely on technological and design innovation as defining

characteristics, the Group’s brands are frequent targets for counterfeiting and imitation. To reduce

the loss of sales and the potential damage to brand reputation resulting from counterfeit products,

the adidas Group makes use of extensive legal protection (generally through registration) and works

closely with law enforcement authorities, investigators and external legal counsel. Although we

have stepped up measures such as product security labelling with our authorised suppliers, the

development of these measures remains a key priority on an ongoing basis. In 2014, around twelve

million counterfeit adidas Group products were seized worldwide (2013: ten million).

Financial Risks

Currency risks

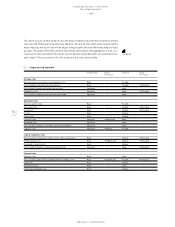

Currency risks for the adidas Group are a direct result of multi-currency cash flows within the

Group. Furthermore, translation impacts from the conversion of non-euro-denominated results

into our Group’s functional currency, the euro, might lead to a material negative impact on

our Group’s financial performance. The biggest single driver behind this risk results from the

mismatch of the currencies required for sourcing our products versus the denominations of our

sales. The vast majority of our sourcing expenses are in US dollars, while sales are denominated

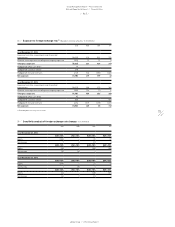

in other currencies to a large extent – most notably the euro. Our main exposures are presented

in the table. The exposure from firm commitments and forecasted transactions was calculated on

a one-year basis.

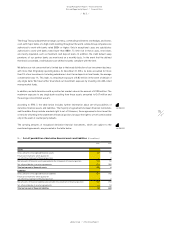

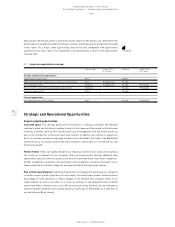

In line with IFRS 7 requirements, we have calculated the impact on net income and shareholders’

equity based on changes in our most important currency exchange rates. The calculated impacts

mainly result from changes in the fair value of our hedging instruments. The analysis does not

include effects that arise from the translation of our foreign entities’ financial statements into the

Group’s reporting currency, the euro. The sensitivity analysis is based on the net balance sheet

exposure, including intercompany balances from monetary assets and liabilities denominated

in foreign currencies. Moreover, all outstanding currency derivatives were re-evaluated using

hypothetical foreign exchange rates to determine the effects on net income and equity. The analysis

was performed on the same basis for both 2013 and 2014.

Based on this analysis, a 10% increase in the euro versus the US dollar at December 31, 2014

would have led to a € 7 million increase in net income. The more negative market values of the US

dollar hedges would have decreased shareholders’ equity by € 188 million. A 10% weaker euro at

December 31, 2014 would have led to a € 8 million decrease in net income. Shareholders’ equity

would have increased by € 233 million. The impacts of fluctuations of the US dollar against the

Russian rouble and of the euro against the British pound and the Japanese yen on net income and

shareholders’ equity are also included in accordance with IFRS requirements.

see Table 04

see Table 05