Reebok 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

40

2014

/

01.7

/

Our Share

To Our Shareholders

adidas Group

/

2014 Annual Report

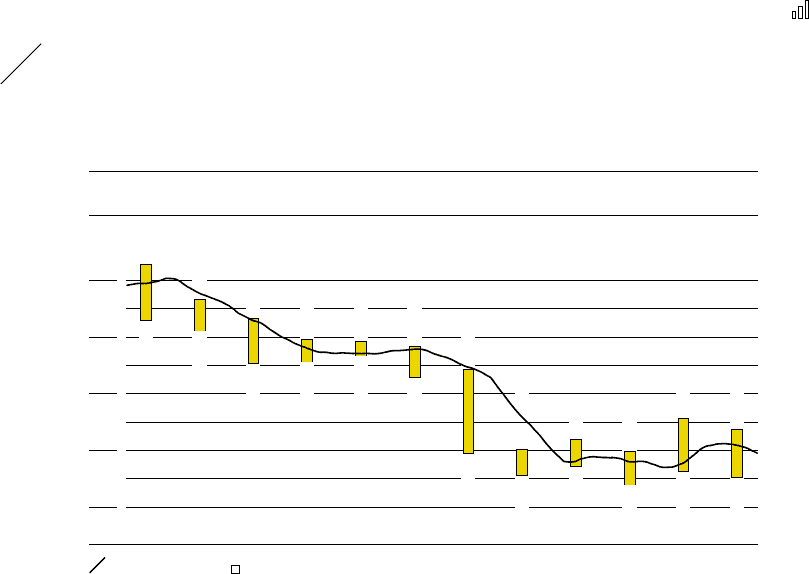

During the second quarter of 2014, the adidas AG share faced additional pressures, mainly as a

result of the overall equity market weakness. In particular, the continued depreciation of several

emerging market currencies versus the euro as well as geopolitical risk factors, such as the crisis

in Ukraine, negatively impacted the adidas AG share price development, given the adidas Group’s

high percentage of sales in emerging markets. In addition, negative newsflow with regard to the golf

market as well as unfavourable point-of-sale data in North America increased negative sentiment

towards the adidas AG share in June. On July 31, the adidas Group lowered its financial outlook for

2014 and postponed the delivery of its Route 2015 targets, mainly due to the continued weakness

in the golf market, negative developments in Russia/CIS as well as ongoing currency headwinds,

resulting in a significant share price decrease. Following the publication of the adidas Group’s

first half results on August 7, the adidas AG share suffered further losses, as market participants

remained concerned about the Group’s future top- and bottom-line development, waiting for

clear signals of better execution before turning more constructive on the adidas AG share again.

During the first half of the fourth quarter of 2014, the adidas AG share recovered and gained

steadily, supported by positive market feedback following the release of the nine months results

on November 7, with both top and bottom line exceeding market expectations. In particular, robust

sales momentum at both adidas and Reebok, ongoing strong performances in Western Europe

and emerging markets as well as Management’s confirmation of the full year 2014 guidance was

well received by market participants. However, towards the end of the year, the adidas AG share

again came under pressure, following several analyst reports indicating further margin pressure

in 2015, mainly due to the significant depreciation of the Russian rouble. As a result, the adidas AG

share closed 2014 at € 57.62, representing a 38% decrease over the year. This implies a market

capitalisation of € 11.8 billion at the end of 2014 versus € 19.4 billion at the end of 2013.

see Diagram 02

see Diagram 03

04

/

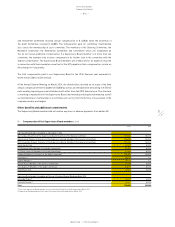

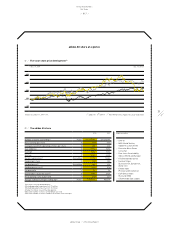

2014 adidas AG high and low share prices per month 1) (in €)

| Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec |

90

80

70

60

50

30-day moving average ■ High and low share prices Source: Bloomberg.

1) Based on daily Xetra closing prices.

92.9282.89

86.7381.02

83.4075.34

79.6075.57

79.3076.64

78.5072.86

74.3759.41

60.3055.50

62.0357.09

59.8653.89

65.7256.27

63.7455.14