Reebok 2014 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

182

2014

Management Assessment of Performance, Risks and Opportunities, and Outlook

/

03.6

/

adidas Group

/

2014 Annual Report

Group Management Report – Financial Review

Beyond our financial performance, we also actively monitor the Group’s key non-financial KPIs on a

regular basis, as available. From a market share perspective, we continue to be very encouraged by

our strong performance compared to our major competitors in key emerging markets. In particular,

Greater China, Latin America and South Korea were notable standouts, as we further improved our

market share in these markets in 2014. In Western Europe, we saw momentum accelerate in 2014,

supported by the positive effects from the 2014 FIFA World Cup. Less pleasing, however, was our

underperformance in North America, which continued in 2014. As a result, we have made several

changes to our organisational set-up in the market and also announced that we will step up brand

investments to engage more closely with the US consumer. In the golf market, despite a challenging

year for TaylorMade-adidas Golf, we continue to enjoy healthy market share positions. We remain

market leader in key categories such as metalwoods and irons, with market shares above 30%

and 20%, respectively. A key focus for TaylorMade-adidas Golf in 2014 was the clean-up of retail

inventories, especially in the USA. In light of this, TaylorMade-adidas Golf made the strategic

decision to reduce the number of new product introductions compared to previous years.

We continued to maintain a very strong level of on-time in-full (OTIF) deliveries to our customers and

own-retail stores in 2014. As in prior years, the majority of our sales in 2014 were again generated

from products launched in the past 12 to 18 months. In addition, we received several awards and

industry recognitions for our new product innovations. Finally, our diligence and discipline in

sustainability matters continues to yield strong recognition for our Group. In 2014, for the 15th

consecutive time, we were selected to join the Dow Jones Sustainability Indexes (DJSI) and scored

industry-best ratings in the categories ‘Supply Chain Management’, ‘Product Stewardship’ and

‘Stakeholder Engagement’ in the sector ‘Textiles, Apparel & Luxury Goods’.

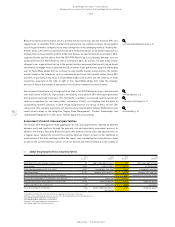

Assessment of overall risks and opportunities

The Group’s Risk Management team aggregates all risks and opportunities reported by different

business units and functions through the quarterly risk and opportunity assessment process. In

addition, the Group’s Executive Board discusses and assesses Group risks and opportunities on

a regular basis. Taking into account the potential financial impact as well as the likelihood of

materialising of the risks explained within this report, and considering the strong balance sheet

as well as the current business outlook, we do not foresee any material jeopardy to the viability of

see Internal Group Management System, p. 98

see Global Operations, p. 66

see Research and Development, p. 73

see Sustainability, p. 89

01

/

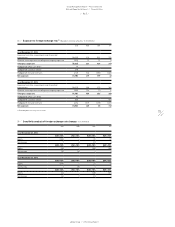

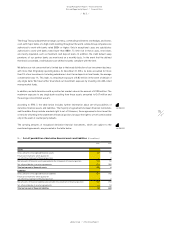

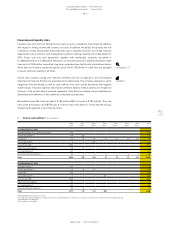

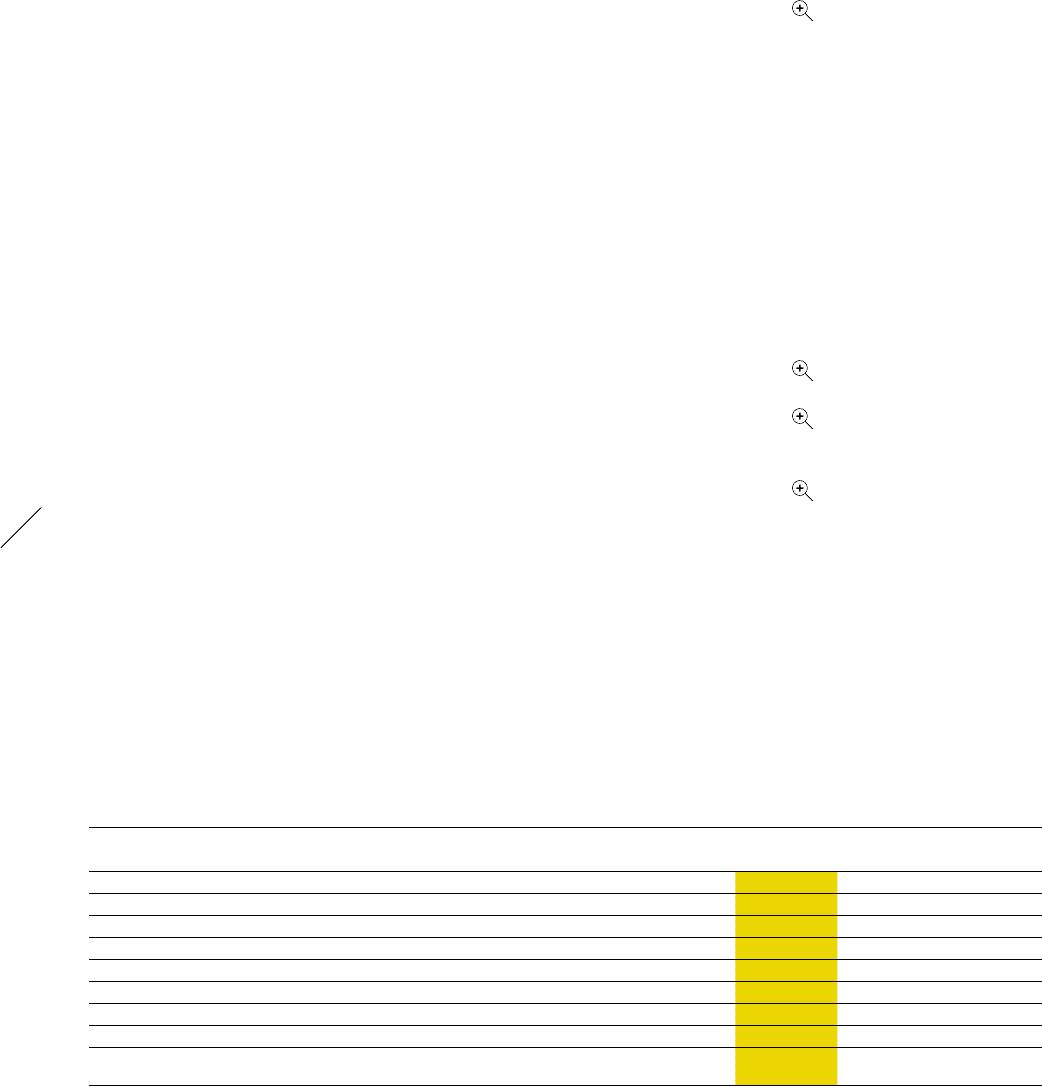

adidas Group targets versus actual key metrics

2013

Results 1)

2014

Targets 1)

2014

Results 2)

2015

Outlook 2)

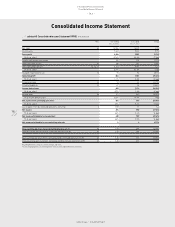

Sales (year-over-year change, currency-neutral) 3% high-single-digit increase 6% mid-single-digit increase

Gross margin 49.3% 49.5% to 49.8% 47.6% 47.5% to 48.5%

Other operating expenses (in % of sales) 42.3% around prior year level 42.7% around prior year level

Operating margin 8.7% 3) between 8.5% and 9.0% 6.6% 4) between 6.5% and 7.0%

Net income from continuing operations (€ in million) – – 642 4) increase at a rate of 7% to 10%

Net income attributable to shareholders (€ in million) 839 3) 830 to 930 568 4) 5) –

Average operating working capital (in % of net sales) 20.9% moderate decline 22.4% moderate decline

Capital expenditure (€ in millions) 6) 479 500 to 550 554 5) around 600

Gross borrowings (€ in millions) 1,334 further reduction of gross

borrowings

1,873 5) moderate decline

1) As published on March 5, 2014. The outlook was updated over the course of the year.

2) Figures reflect continuing operations as a result of the planned divestiture of the Rockport business.

3) Excluding goodwill impairment of € 52 million.

4) Excluding goodwill impairment of € 78 million.

5) Includes continuing and discontinued operations.

6) Excluding acquisitions and finance leases.