Duke Energy 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

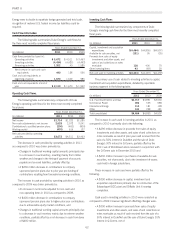

Pension Plan Assets.

Duke Energy maintains investments to help fund the costs of

providing non-contributory defined benefit retirement and other post-

retirement benefit plans. These investments are exposed to price

fluctuations in equity markets and changes in interest rates. The

equity securities held in Duke Energy’s pension plans are diversified

to achieve broad market participation and reduce the impact of any

single investment, sector or geographic region. Duke Energy has

established asset allocation targets for its pension plan holdings,

which take into consideration the investment objectives and the risk

profile with respect to the trust in which the assets are held. These

target allocations are presented in the table below.

Target Asset allocation for Pension Plan Assets

Asset Target Allocation %

Equity Securities 56%

Debt Securities 32%

Other 12%

A significant decline in the value of plan asset holdings could

require Duke Energy to increase its funding of the pension plan in

future periods, which could adversely affect cash flows in those periods.

Additionally, a decline in the fair value of plan assets, absent additional

cash contributions to the plan, could increase the amount of pension

cost required to be recorded in future periods, which could adversely

affect Duke Energy’s results of operations in those periods. The

Subsidiary Registrants’ proportionate share of Duke Energy’s costs of

providing non-contributory defined benefit retirement and other post-

retirement benefit plans are dependent upon a number of factors, such

as the rates of return on plan assets, discount rate, the rate of increase

in health care costs and contributions made to the plans. During 2011,

Duke Energy contributed $200 million to its qualified pension plan of

which $33 million was funded by Duke Energy Carolinas, $48 million

was funded by Duke Energy Ohio and $52 million was funded by

Duke Energy Indiana. Duke Energy intends to contribute $200 million

to its qualified pension plan in 2012. See Note 21 to the Consolidated

Financial Statements, “Employee Benefit Plans,” for additional

information on pension plan assets.

NDTF.

As required by the NRC and the NCUC, Duke Energy Carolinas

maintains trust funds to fund the costs of nuclear decommissioning

(see Note 9 to the Consolidated Financial Statements, “Asset

Retirement Obligations”). As of December 31, 2011, these funds

were invested primarily in domestic and international equity

securities, debt securities, fixed-income securities, cash and cash

equivalents and short-term investments. Per the NRC and the NCUC

requirements, these funds may be used only for activities related to

nuclear decommissioning. The investments in equity securities are

exposed to price fluctuations in equity markets. Accounting for

nuclear decommissioning recognizes that costs are recovered through

Duke Energy Carolinas’ rates; therefore, fluctuations in equity prices

do not affect Duke Energy Carolinas’ Consolidated Statements of

Operations as changes in the fair value of these investments are

deferred as regulatory assets or regulatory liabilities pursuant to an

Order by the NCUC. Earnings or losses of the fund will ultimately

impact the amount of costs recovered through Duke Energy Carolinas’

rates. See Note 9 to the Consolidated Financial Statements, “Asset

Retirement Obligations” for additional information regarding nuclear

decommissioning costs. See Note 16 to the Consolidated Financial

Statements, “Investments in Debt and Equity Securities” for additional

information regarding NTDF assets.

Foreign Currency Risk

Duke Energy is exposed to foreign currency risk from

investments in international affiliate businesses owned and operated

in foreign countries and from certain commodity-related transactions

within domestic operations that are denominated in foreign

currencies. To mitigate risks associated with foreign currency

fluctuations, contracts may be denominated in or indexed to the

U.S. Dollar/inflation rates and/or local inflation rates, or investments

may be naturally hedged through debt denominated or issued in the

foreign currency. Duke Energy may also use foreign currency

derivatives, where possible, to manage its risk related to foreign

currency fluctuations. To monitor its currency exchange rate risks,

Duke Energy uses sensitivity analysis, which measures the impact of

devaluation of the foreign currencies to which it has exposure.

In 2011, Duke Energy’s primary foreign currency rate exposure

was to the Brazilian Real. The table below summarizes the potential

effect of foreign currency devaluations on Duke Energy’s Consolidated

Statement of Operations and Consolidated Balance Sheets, based on

a sensitivity analysis performed as of December 31, 2011 and

December 31, 2010.

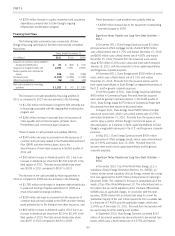

Summary of Sensitivity Analysis for Foreign Currency Risks

($ in millions)

Assuming 10% devaluation in the currency

exchange rates in all exposure currencies

As of December 31,

2011

As of December 31,

2010

Income Statement Impact(a) $ (20) $ (20)

Balance Sheet Impact(b) $(160) $(180)

(a) Amounts represent the potential annual net pre-tax loss on the translation of local

currency earnings to the Consolidated Statement of Operations in 2012 and 2011,

respectively.

(b) Amounts represent the potential impact to the currency translation through the

cumulative translation adjustment in Accumulated Other Comprehensive Income

(AOCI) on the Consolidated Balance Sheets.

Other Issues

General.

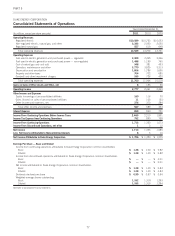

The Duke Energy Registrants’ fixed charges coverage ratios, as

calculated using SEC guidelines, are included in the table below.

Years Ended December 31,

2011 2010 2009

Duke Energy 3.2 3.0 3.0

Duke Energy Carolinas 3.7 3.6 3.5

Duke Energy Ohio 3.4 (a) (a)

Duke Energy Indiana 2.2 3.6 2.9

(a) Duke Energy Ohio’s earnings were insufficient to cover fixed charges by $317 million

in 2010 and $244 million in 2009 due primarily to non-cash goodwill and other asset

impairment charges of $677 million in 2010 and $727 million in 2009, respectively.

72