Duke Energy 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

GENERAL

Duke Energy Subsidiary Registrant Overview.

Duke Energy Carolinas.

Duke Energy Carolinas generates, transmits, distributes and sells

electricity in central and western North Carolina and western South

Carolina. Duke Energy Carolinas is subject to the regulatory provisions

oftheNCUC,thePSCSC,theNRCandFERC.DukeEnergyCarolinas

operates one reportable business segment, Franchised Electric, which

generates, transmits, distributes and sells electricity. Substantially all

of Franchised Electric operations are regulated and qualify for

regulatory accounting treatment. For additional information regarding

this business segment, including financial information, see Note 3 to

the Consolidated Financial Statements, “Business Segments.”

Duke Energy Carolinas’ service area covers 24,000 square

miles with an estimated population of 6.8 million and supplies

electric service to 2.4 million residential, commercial and industrial

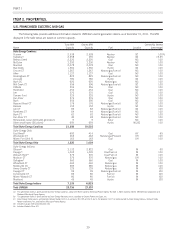

customers. See Item 2. “Properties” for further discussion of Duke

Energy Carolinas’ generating facilities, transmission and distribution.

The remainder of Duke Energy Carolinas’ operations is

presented as Other. Although it is not considered a business segment,

Other primarily consists of certain governance costs allocated by its

parent, Duke Energy.

Duke Energy Ohio.

Duke Energy Ohio is a wholly-owned subsidiary of Cinergy,

which is a wholly-owned subsidiary of Duke Energy. Duke Energy

Ohio is a combination electric and gas public utility that provides

service in southwestern Ohio and northern Kentucky through its

wholly-owned subsidiary Duke Energy Kentucky, as well as electric

generation in parts of Ohio, Illinois, Indiana and Pennsylvania. Duke

Energy Ohio’s principal lines of business include generation,

transmission and distribution of electricity, the sale of and/or

transportation of natural gas, and energy marketing. Duke Energy

Kentucky’s principal lines of business include generation,

transmission and distribution of electricity, as well as the sale of and/

or transportation of natural gas. References herein to Duke Energy

Ohio include Duke Energy Ohio and its subsidiaries. Duke Energy

Ohio is subject to the regulatory provisions of the PUCO, the KPSC

and FERC.

Duke Energy Ohio Business Segments. At December 31,

2011, Duke Energy Ohio operated two business segments, both of

which are considered reportable segments under the applicable

accounting rules: Franchised Electric and Gas and Commercial

Power. For additional information on each of these business

segments, including financial information, see Note 3 to the

Consolidated Financial Statements, “Business Segments.”

The following is a brief description of the nature of operations of

each of Duke Energy Ohio’s reportable business segments, as well as

Other:

Franchised Electric and Gas. Franchised Electric and Gas

consists of Duke Energy Ohio’s regulated electric and gas

transmission and distribution systems located in Ohio and Kentucky,

including its regulated electric generation in Kentucky. Franchised

Electric and Gas plans, constructs, operates and maintains Duke

Energy Ohio’s transmission and distribution systems, which generate,

transmit and distribute electric energy to consumers in southwestern

Ohio and northern Kentucky. Franchised Electric and Gas also

transports and sells natural gas in southwestern Ohio and northern

Kentucky. Substantially all of Franchised Electric and Gas’ operations

are regulated and, accordingly, these operations qualify for regulatory

accounting treatment.

Duke Energy Ohio’s Franchised Electric and Gas service area

covers 3,000 square miles with an estimated population of

2.1 million and supplies electric service to 830,000 residential,

commercial and industrial customers and provides regulated

transmission and distribution services for natural gas to 500,000

customers. See Item 2. “Properties” for further discussion of Duke

Energy Ohio’s Franchised Electric and Gas generating facilities.

Commercial Power. Commercial Power owns, operates and

manages power plants and engages in the wholesale marketing and

procurement of electric power, fuel and emission allowances related

to these plants, as well as other contractual positions. Commercial

Power’s generation operations consists of primarily coal-fired

generation assets located in Ohio which were dedicated under the

Duke Energy Ohio ESP through December 31, 2011 and are

dispatched into wholesale markets effective January 1, 2012 and

gas-fired non-regulated generation assets which are dispatched into

wholesale markets. These assets are comprised of 7,550 net MW of

power generation primarily located in the Midwestern U.S. The asset

portfolio has a diversified fuel mix with base-load and mid-merit coal-

fired units as well as combined cycle and peaking natural gas-fired

units. Duke Energy Ohio’s Commercial Power reportable operating

segment does not include the operations of DEGS or Duke Energy

Retail, which is included in the Commercial Power reportable

operating segment at Duke Energy. See Item 2. “Properties” for

further discussion of Duke Energy Ohio’s Commercial Power

generating facilities.

The PUCO approved Duke Energy Ohio’s new ESP in November

2011. The ESP includes competitive auctions for electricity supply for

a term of January 1, 2012 through May 31, 2015. The ESP also

includes a provision for a non-bypassable stability charge of $110

million per year to be collected from 2012-2014 and requires Duke

Energy Ohio to transfer its generation assets to a non-regulated

affiliate on or before December 31, 2014. The FE&G portion of Duke

Energy Ohio’s business successfully conducted initial auctions in

December 2011 to serve SSO customers effective January 2012.

New rates for Duke Energy Ohio went into effect for SSO customers

in January 2012.

See Note 4 to the Consolidated Financial Statements,

“Regulatory Matters,” for further discussion related to the ESP.

Through December 31, 2011, Duke Energy Ohio’s primarily

coal-fired assets, as excess capacity allows, also generate revenues

through sales outside the ESP load customer base, and such revenue

is termed wholesale. In 2011 and 2010 Duke Energy Ohio earned

approximately 24% and 13%, respectively, of its consolidated

operating revenues from PJM. These revenues relate to the sale of

capacity and electricity from the gas-fired non-regulated generation

assets. In 2009 no single counterparty contributed 10% or more of

consolidated operating revenue.

19