Duke Energy 2011 Annual Report Download - page 7

Download and view the complete annual report

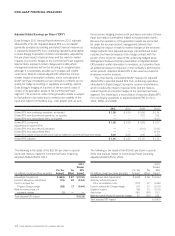

Please find page 7 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.modernize our power plants and reduce our environmental

impacts. Our strong S&P and Moody’s investment-grade

credit ratings remained stable throughout 2011. At year-

end, our total available liquidity, which was supported by a

new five-year, $4 billion credit facility, was approximately

$4.5 billion, compared to $3.4 billion at the end of 2010.

Positioned for sustainability

The strength of our 2011 financial performance in a

continuing weak economy underscores the hard work

and dedication of our employees. They remained focused

on our goals: to safely deliver affordable, reliable and

increasingly clean energy, to provide exceptional customer

service, and to generate solid returns for our investors.

The women and men of Duke Energy position us

to do business profitably, in a way that is good for

people and the planet. This corporate commitment was

recognized in 2011, when Duke Energy was named to the

Dow Jones Sustainability World Index for the second year

in a row. We were one of only 13 utilities selected out of

102 candidates in our sector worldwide.

We also ranked on the Dow Jones Sustainability

North America Index for the sixth consecutive year.

You can read about our sustainability initiatives in our

2011|2012 Sustainability Report, which will be available

in April at www.duke-energy.com.

We have also made good progress on meeting our

energy efficiency goals. Throughout the nation, consumers

are using electricity more wisely in their homes and

businesses, due to more efficient appliances and a greater

focus on energy conservation. Our own customers have

benefited from incentives that encourage them to use less

electricity. These programs, and associated advanced

metering, have also helped us improve system reliability.

Positioned for regulatory success

Building advanced power plants — and improving the

environmental performance of existing plants — doesn’t

come cheaply. Power plants take years to permit and

construct, and require enormous amounts of capital.

In fact, electric utilities are among the nation’s most

capital-intensive industries, with one of the longest

investment cycles. We recover those investments through

customer rates over the operating lives of the plants, which

span many decades.

It is important to put these rate increases in context.

The decisions we make today to modernize our power

system must stand the test of time, and last several

generations. Thanks in part to the investments we made

in low-cost nuclear and coal-fired power plants decades

ago, Duke Energy offers some of the most competitive

electricity rates in the U.S. It’s also worth noting that

the real cost of electricity, averaged and adjusted for

inflation, actually declined over the past 50 years. Not

many industries can point to price declines and operating

efficiencies over such an extended period.

By the end of 2012, however, we expect regulatory

approval of rate increases in four of our five jurisdictions

— to recover our modernization investments. Our objective

is to continue to keep our customer rates as low as

possible as we build a cleaner, more efficient power system

to support economic growth in our service territories.

Carolinas

In January 2012, both the North Carolina Utilities

Commission and the Public Service Commission of

South Carolina gave final approval to raise rates for a

typical residential customer by approximately 7.2 percent

and 6.0 percent, respectively. We know this is a difficult

time for our customers to absorb rate increases. But our

company has made significant investments to modernize

our power system since we last requested rate increases

in 2009. Recovery of those investments keeps our

balance sheet strong and allows us to access low-cost

debt for future projects, which ultimately means savings

for customers.

As we complete our current construction program,

we expect to file for additional rate increases in both

North Carolina and South Carolina later this year,

primarily related to our investments in the new Cliffside

and Dan River plants. We would expect these new rates

to go into effect in 2013.

CHAIRMAN’S LETTER TO STAKEHOLDERS

DUKE ENERGY CORPORATION 2011 ANNUAL REPORT 5