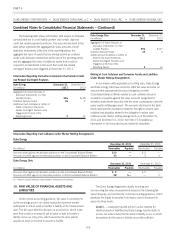

Duke Energy 2011 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

operations. As these undesignated contracts expire as late as 2021,

Duke Energy has entered into economic hedges that leave it

minimally exposed to changes in prices over the duration of these

contracts.

Duke Energy Carolinas uses derivative contracts as economic

hedges to manage the market risk exposures that arise from electricity

generation. As of December 31, 2011 Duke Energy Carolinas does

not have any undesignated commodity contracts.

Duke Energy Ohio uses derivative contracts as economic hedges

to manage the market risk exposures that arise from providing

electricity generation and capacity to large energy customers, energy

aggregators, retail customers and other wholesale companies.

Undesignated contracts at December 31, 2011 are primarily

associated with forward sales and purchases of power, coal and

emission allowances, for the Commercial Power segment.

Duke Energy Indiana uses derivative contracts as economic

hedges to manage the market risk exposures that arise from electric

generation. Undesignated contracts at December 31, 2011 are

primarily associated with forward purchases and sales of power,

forward purchases of natural gas and financial transmission rights.

The Duke Energy Registrants are exposed to risk resulting from

changes in interest rates as a result of their issuance or anticipated

issuance of variable and fixed-rate debt and commercial paper.

Interest rate exposure is managed by limiting variable-rate exposures

to a percentage of total debt and by monitoring the effects of market

changes in interest rates. To manage risk associated with changes in

interest rates, the Duke Energy Registrants may enter into financial

contracts; primarily interest rate swaps and U.S. Treasury lock

agreements. Additionally, in anticipation of certain fixed-rate debt

issuances, a series of forward starting interest rate swaps may be

executed to lock in components of the market interest rates at the

time and terminated prior to or upon the issuance of the

corresponding debt. When these transactions occur within a business

that meets the criteria for regulatory accounting treatment, these

contracts may be treated as undesignated and any pre-tax gain or

loss recognized from inception to termination of the hedges would be

recorded as a regulatory liability or asset and amortized as a

component of interest expense over the life of the debt. Alternatively,

these derivatives may be designated as hedges whereby, any pre-tax

gain or loss recognized from inception to termination of the hedges

would be recorded in AOCI and amortized as a component of interest

expenseoverthelifeofthedebt.

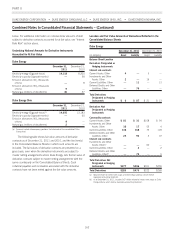

Interest Rate Risk

The following table shows the notional amounts for derivatives related to interest rate risk at December 31, 2011 and December 31,

2010.

Notional Amounts of Derivative Instruments Related to Interest Rate Risk

(in millions) Duke Energy

Duke Energy

Carolinas

Duke Energy

Ohio

Duke Energy

Indiana

Cash Flow Hedges(a) $841 $— $— $—

Undesignated Contracts 247 — 27 200

Fair Value Hedges 275 25 250 —

Total Notional Amount at December 31, 2011 $1,363 $25 $277 $200

(in millions) Duke Energy

Duke Energy

Carolinas

Duke Energy

Ohio

Cash Flow Hedges(a) $ 492 $— $—

Undesignated Contracts 561 500 27

Fair Value Hedges 275 25 250

Total Notional Amount at December 31, 2010 $1,328 $525 $277

(a) Includes amounts related to non-recourse variable rate long-term debt of VIEs of $466 million at December 31, 2011 and $492 million at December 31, 2010.

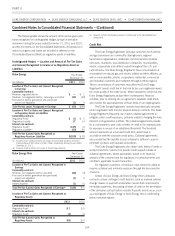

Volumes

The following tables show information relating to the volume of

Duke Energy and Duke Energy Ohio’s commodity derivative activity

outstanding as of December 31, 2011 and December 31, 2010.

Amounts disclosed represent the notional volumes of commodities

contracts accounted for at fair value. For option contracts, notional

amounts include only the delta-equivalent volumes which represent

the notional volumes times the probability of exercising the option

based on current price volatility. Volumes associated with contracts

qualifying for the NPNS exception have been excluded from the table

below. Amounts disclosed represent the absolute value of notional

amounts. Duke Energy and Duke Energy Ohio have netted

contractual amounts where offsetting purchase and sale contracts

exist with identical delivery locations and times of delivery. Where all

commodity positions are perfectly offset, no quantities are shown

161