Duke Energy 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Partially offsetting these increases was:

• A $67 million decrease in retail electric revenues resulting

from lower sales volumes driven by increased customer

switching levels net of weather and higher retail pricing under

the ESP in 2010.

Operating Expenses.

The increase was primarily driven by:

• A $259 million increase in impairment charges consisting of

$672 million in 2010 compared to $413 million in 2009

related primarily to goodwill and generation assets associated

with non-regulated generation operations in the Midwest. See

Note 12 to the Consolidated Financial Statements, “Goodwill,

Intangible Assets and Impairments,” for additional information;

• A $277 million increase in wholesale fuel expenses due to

higher generation volumes and less favorable hedge

realizations in 2010 as compared to 2009;

• A $32 million increase in depreciation and administrative

expenses associated with wind projects placed in service and

the continued development of the renewable business in

2010; and

• A $70 million increase in operating expenses resulting from

the amortization of certain deferred plant maintenance

expenses and higher transmission costs in 2010 compared to

2009 net of lower administrative expenses;

Partially offsetting these increases was:

• An $85 million decrease in mark-to-market fuel expense on

non-qualifying fuel hedge contracts, consisting of

mark-to-market gains of $27 million in 2010 compared to

losses of $58 million in 2009; and

• A $14 million decrease in retail fuel and purchased power

expenses due to lower generation volumes net of higher

purchased power volumes in 2010 as compared to 2009.

Gains on Sales of Other Assets and Other, net.

The decrease in 2010 as compared to 2009 is attributable to

lower gains on sales of emission allowances in 2010.

EBIT.

The decrease is primarily attributable to higher impairment

charges in 2010 associated with goodwill and generation assets of

the non-regulated generation operations in the Midwest, higher

operating expenses resulting from the amortization of certain deferred

plant maintenance expenses and higher transmission costs, and

lower retail revenues driven by customer switching. These factors

were partially offset by higher retail revenue pricing as a result of the

ESP, higher wholesale margins due to increased generation volumes

and PJM capacity revenues and mark-to-market gains on

non-qualifying fuel and power hedge contracts in 2010 compared to

losses in 2009.

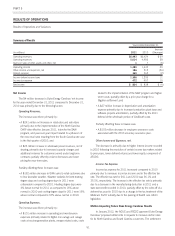

International Energy

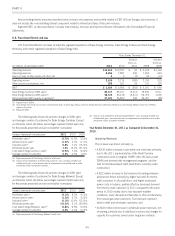

Years Ended December 31,

(in millions, except where noted) 2011 2010

Variance

2011 vs.

2010 2009

Variance

2010 vs.

2009

Operating revenues $1,467 $ 1,204 $ 263 $ 1,158 $ 46

Operating expenses 938 806 132 834 (28)

(Losses) gains on sales of other assets and other, net (1) (3) 2 — (3)

Operating income 528 395 133 324 71

Other income and expenses, net 174 110 64 63 47

Expense attributable to noncontrolling interest 23 19 4 22 (3)

EBIT $679$ 486 $ 193 $ 365 $ 121

Sales, GWh 18,889 19,504 (615) 19,978 (474)

Net proportional megawatt capacity in operation 4,277 4,203 74 4,053 150

Year Ended December 31, 2011 as Compared to December 31,

2010

Operating Revenues.

The increase was driven primarily by:

• A $111 million increase in Central America as a result of

favorable hydrology and higher average prices;

• A $95 million increase in Brazil due to favorable exchange

rates, and higher average contract prices and volumes; and

• An $80 million increase in Peru due to higher average prices

and volumes, and hydrocarbon prices.

Partially offsetting these increases was:

• A $25 million decrease in Ecuador as a result of lower

dispatch due to new hydro competitor commencing operations

in the fourth quarter of 2010.

48