Duke Energy 2011 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

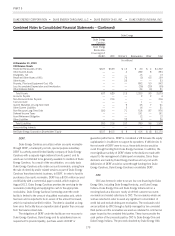

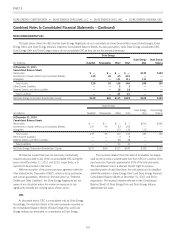

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

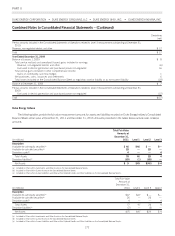

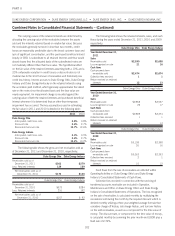

Duke Energy

Duke Energy

Carolinas

Duke Energy

Receivables

Financing LLC

(DERF) CRC CinCap V Renewables Other Total

(in millions)

At December 31, 2010

VIE Balance Sheets

Restricted Receivables of VIEs $637 $629 $ 12 $ 20 $ 4 $1,302

Other Current Assets — — 4 282 8 294

Intangibles, net — — — 13 — 13

Restricted Other Assets of VIEs — — 76 (2) 65 139

Other Assets — — 23 — — 23

Property, Plant and Equipment Cost, VIEs — — — 892 50 942

Less Accumulated Depreciation and Amortization — — — (26) (29) (55)

Other Deferred Debits — — — 24 (3) 21

Total Assets 637 629 115 1,203 95 2,679

Accounts Payable — — — 2 2 4

Non-Recourse Notes Payable — 216 — — — 216

Taxes Accrued — — — 1 — 1

Current Maturities of Long-Term Debt — — 9 45 7 61

Other Current Liabilities — — 5 16 — 21

Non-Recourse Long-Term Debt 300 — 71 518 87 976

Deferred Income Taxes — — — 191 — 191

Asset Retirement Obligation — — — 12 — 12

Other Liabilities — — 22 4 — 26

Total Liabilities 300 216 107 789 96 1,508

Noncontrolling interests — — — — 1 1

Net Duke Energy Corporation Shareholders’ Equity $337 $413 $ 8 $ 414 $ (2) $1,170

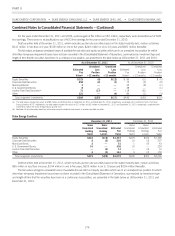

DERF.

Duke Energy Carolinas securitizes certain accounts receivable

through DERF, a bankruptcy remote, special purpose subsidiary.

DERF is a wholly-owned limited liability company of Duke Energy

Carolinas with a separate legal existence from its parent, and its

assets are not intended to be generally available to creditors of Duke

Energy Carolinas. As a result of the securitization, on a daily basis

Duke Energy Carolinas sells certain accounts receivable, arising from

the sale of electricity and/or related services as part of Duke Energy

Carolinas’ franchised electric business, to DERF. In order to fund its

purchases of accounts receivable, DERF has a $300 million secured

credit facility with a commercial paper conduit, which expires in

August 2013. Duke Energy Carolinas provides the servicing for the

receivables (collecting and applying the cash to the appropriate

receivables). Duke Energy Carolinas’ borrowing under the credit

facility is limited to the amount of qualified receivables sold, which

has been and is expected to be in excess of the amount borrowed,

which is maintained at $300 million. The debt is classified as long-

term since the facility has an expiration date of greater than one year

from the balance sheet date.

The obligations of DERF under the facility are non-recourse to

Duke Energy Carolinas. Duke Energy and its subsidiaries have no

requirement to provide liquidity, purchase assets of DERF or

guarantee performance. DERF is considered a VIE because the equity

capitalization is insufficient to support its operations. If deficiencies in

thenetworthofDERFweretooccur,thosedeficiencieswouldbe

cured through funding from Duke Energy Carolinas. In addition, the

most significant activity of DERF relates to the decisions made with

respect to the management of delinquent receivables. Since those

decisions are made by Duke Energy Carolinas and any net worth

deficiencies of DERF would be cured through funding from Duke

Energy Carolinas, Duke Energy Carolinas consolidates DERF.

CRC.

CRC was formed in order to secure low cost financing for Duke

Energy Ohio, including Duke Energy Kentucky, and Duke Energy

Indiana. Duke Energy Ohio and Duke Energy Indiana sell on a

revolving basis at a discount, nearly all of their customer accounts

receivable and related collections to CRC. The receivables which are

sold are selected in order to avoid any significant concentration of

credit risk and exclude delinquent receivables. The receivables sold

are securitized by CRC through a facility managed by two unrelated

third parties and the receivables are used as collateral for commercial

paper issued by the unrelated third parties. These loans provide the

cash portion of the proceeds paid by CRC to Duke Energy Ohio and

Duke Energy Indiana. The proceeds obtained by Duke Energy Ohio

179