Duke Energy 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

beyond applicable grace periods could result in accelerated due dates

and/or termination of the agreements. As of December 31, 2011,

Duke Energy was in compliance with all covenants related to its

significant debt agreements. In addition, some credit agreements may

allow for acceleration of payments or termination of the agreements

due to nonpayment, or to the acceleration of other significant

indebtedness of the borrower or some of its subsidiaries. None of the

debt or credit agreements contain material adverse change clauses.

Credit Ratings.

Duke Energy and certain subsidiaries each hold credit ratings by

Standard & Poor’s (S&P) and Moody’s Investors Service (Moody’s).

Duke Energy’s corporate credit rating and issuer credit rating from S&P

and Moody’s, respectively, as of February 1, 2012 is A- and Baa2,

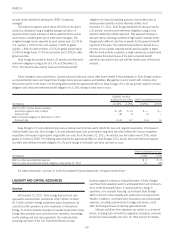

respectively. The following table summarizes the February 1, 2012

unsecured credit ratings from the rating agencies retained by Duke

Energy and its principal funding subsidiaries.

Senior Unsecured Credit Ratings Summary as of February 1, 2012

Standard

and

Poor’s

Moody’s

Investors

Service

Duke Energy Corporation BBB+ Baa2

Duke Energy Carolinas, LLC A- A3

Duke Energy Ohio, Inc. A- Baa1

Duke Energy Indiana, Inc. A- Baa1

Duke Energy Kentucky, Inc. A- Baa1

Duke Energy’s credit ratings are dependent on, among other

factors, the ability to generate sufficient cash to fund capital and

investment expenditures and pay dividends on its common stock,

while maintaining the strength of its current balance sheet. If, as a

result of market conditions or other factors, Duke Energy is unable to

maintain its current balance sheet strength, or if its earnings and cash

flow outlook materially deteriorates, Duke Energy’s credit ratings could

be negatively impacted.

Credit-Related Clauses.

Duke Energy may be required to repay certain debt should the

credit ratings at Duke Energy Carolinas fall to a certain level at S&P or

Moody’s. As of December 31, 2011, Duke Energy had $2 million of

senior unsecured notes which mature serially through 2012 that may

be required to be repaid if Duke Energy Carolinas’ senior unsecured

debt ratings fall below BBB- at S&P or Baa3 at Moody’s, and $12

million of senior unsecured notes which mature serially through 2016

that may be required to be repaid if Duke Energy Carolinas’ senior

unsecured debt ratings fall below BBB at S&P or Baa2 at Moody’s.

Other Financing Matters.

At December 31, 2011, Duke Energy Carolinas had $400

million principal amount of 5.625% senior unsecured notes due

November 2012 classified as Current maturities of long-term debt on

Duke Energy Carolinas’ Consolidated Balance Sheets. At

December 31, 2010, these notes were classified as Long-term Debt

on Duke Energy Carolinas’ Consolidated Balance Sheets. Duke

Energy Carolinas currently anticipates satisfying this obligation with

proceeds from additional borrowings.

At December 31, 2011, Duke Energy Carolinas had $750

million principal amount of 6.25% senior unsecured notes due

January 2012 classified as Current maturities of long-term debt on

Duke Energy Carolinas’ Consolidated Balance Sheets. At December 31,

2010, these notes were classified as Long-term Debt on Duke Energy

Carolinas’ Consolidated Balance Sheets. As noted above, in January

2012, Duke Energy Carolinas satisfied this obligation with proceeds

from borrowings under the December 31, 2011 debt issuance.

At December 31, 2011, Duke Energy Ohio had $500 million

principal amount of 5.70% debentures due September 2012

classified as Current maturities of long-term debt on Duke Energy

Ohio’s Consolidated Balance Sheets. At December 31, 2010, these

notes were classified as Long-term Debt on Duke Energy Ohio’s

Consolidated Balance Sheets. Duke Energy Ohio currently anticipates

satisfying this obligation with proceeds from additional borrowings.

In April 2011, Duke Energy filed a registration statement (Form

S-3) with the SEC to sell up to $1 billion variable denomination

floating rate demand notes, called PremierNotes. The Form S-3 states

that no more than $500 million of the notes will be outstanding at

any particular time. The notes are offered on a continuous basis and

bear interest at a floating rate per annum determined by the Duke

Energy PremierNotes Committee, or its designee, on a weekly basis.

The interest rate payable on notes held by an investor may vary

based on the principal amount of the investment. The notes have no

stated maturity date, but may be redeemed in whole or in part by

Duke Energy at any time. The notes are non-transferable and may be

redeemed in whole or in part at the investor’s option. Proceeds from

the sale of the notes will be used for general corporate purposes. The

balance as of December 31, 2011, is $79 million. The notes reflect

a short-term debt obligation of Duke Energy and are reflected as

Notes payable on Duke Energy’s Consolidated Balance Sheets.

In September 2010, Duke Energy filed a Form S-3 with the SEC.

Under this Form S-3, which is uncapped, Duke Energy, Duke Energy

Carolinas, Duke Energy Ohio and Duke Energy Indiana may issue debt

and other securities in the future at amounts, prices and with terms to

be determined at the time of future offerings. The registration statement

also allows for the issuance of common stock by Duke Energy.

Duke Energy has paid quarterly cash dividends for 86

consecutive years and expects to continue its policy of paying regular

cash dividends in the future. There is no assurance as to the amount

of future dividends because they depend on future earnings, capital

requirements, financial condition and are subject to the discretion of

the Board of Directors.

Dividend and Other Funding Restrictions of Duke Energy

Subsidiaries.

As discussed in Note 4 to the Consolidated Financial Statements

“Regulatory Matters”, Duke Energy’s wholly-owned public utility

operating companies have restrictions on the amount of funds that

can be transferred to Duke Energy via dividend, advance or loan as a

result of conditions imposed by various regulators in conjunction with

Duke Energy’s merger with Cinergy. Additionally, certain other Duke

Energy subsidiaries have other restrictions, such as minimum

working capital and tangible net worth requirements pursuant to debt

and other agreements that limit the amount of funds that can be

transferred to Duke Energy. At December 31, 2011, the amount of

66