Duke Energy 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

For the year ended December 31, 2011, Adjusted Earnings

was $1,943 million, or $1.46 per share, compared to Adjusted

Earnings of $1,882 million or $1.43 per share, for the same period

in 2010. The increase as compared to the prior year was primarily

due to:

• Increased earning associated with major construction projects

at USFE&G;

• Effect of prior year Duke Energy Foundation funding;

• Increased results in Brazil due to higher average contract

prices;

• Increased earnings from National Methanol Company (NMC);

• Lower corporate governance costs;

• Increased results in Peru due to additional capacity revenues

and an arbitration award; and

• Increased results in Central America due to higher average

prices and volumes.

Partially offset by

• Less favorable weather in 2011 compared to 2010 at

USFE&G;

• Increased operation and maintenance costs at USFE&G; and

• Lower volumes as a result of customer switching in Ohio, net

of retention by Duke Energy Retail Sales, LLC (Duke Energy

Retail) at Commercial Power.

For the year ended December 31, 2010, Adjusted Earnings

was $1,882 million, or $1.43 per share, compared to Adjusted

Earnings of $1,577 million or $1.22 per share, for the same period

in 2009. The increase as compared to the prior year was primarily

due to:

• Favorable weather at USFE&G;

• Increased earnings associated with major construction projects

at USF&G;

• Increased earnings due to 2009 North Carolina and South

Carolina rate cases at USFE&G; and

• Increased results from the Midwest gas assets due to both

volumes and price.

Partially offset by

• Increased operation and maintenance costs at USFE&G;

• Lower volumes as a result of customer switching in Ohio, net

of retention by Duke Energy Retail at Commercial Power; and

• Lower gains on coal and emission allowance sales at

Commercial Power.

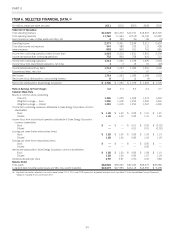

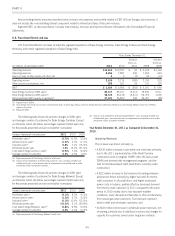

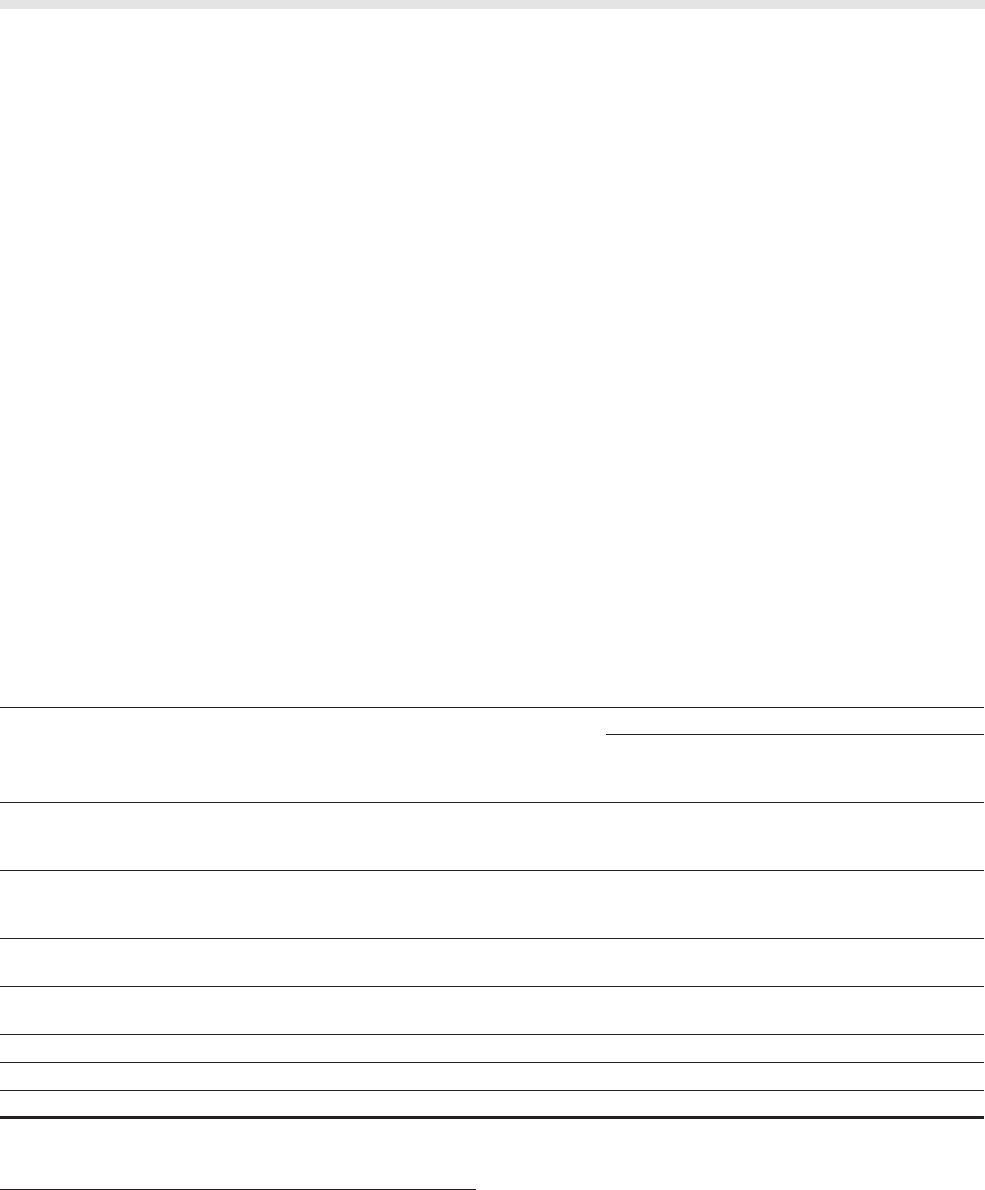

The following table contains summarized information from Duke Energy’s Consolidated Statements of Operations.

Years ended December 31,

(in millions) 2011 2010

Variance

2011 vs.

2010 2009

Variance

2010 vs.

2009

Operating revenues $14,529 $14,272 $ 257 $12,731 $1,541

Operating expenses 11,760 11,964 (204) 10,518 1,446

Gains on sales of other assets and other, net 8153 (145) 36 117

Operating income 2,777 2,461 316 2,249 212

Other income and expenses, net 547 589 (42) 333 256

Interest expense 859 840 19 751 89

Income from continuing operations before income taxes 2,465 2,210 255 1,831 379

Income tax expense from continuing operations 752 890 (138) 758 132

Income from continuing operations 1,713 1,320 393 1,073 247

Income from discontinued operations, net of tax 13(2)12(9)

Net income 1,714 1,323 391 1,085 238

Less: Net income attributable to noncontrolling interests 83510(7)

Net income attributable to Duke Energy Corporation $ 1,706 $ 1,320 $ 386 $ 1,075 $ 245

Consolidated Operating Revenues

Year Ended December 31, 2011 as Compared to

December 31, 2010. Consolidated operating revenues for 2011

increased $257 million compared to 2010. This change was

primarily driven by the following:

• A $263 million increase at International Energy. See

Operating Revenue discussion within “Segment Results” for

International Energy below for further information;

• A $43 million increase at Commercial Power. See Operating

Revenue discussion within “Segment Results” for Commercial

Power below for further information; and

• A $22 million increase at USFE&G. See Operating Revenue

discussion within “Segment Results” for USFE&G below for

further information.

41