Duke Energy 2011 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

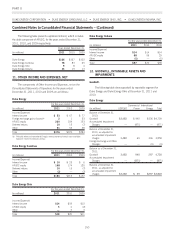

(in millions) USFE&G

Commercial

Power Total

Duke Energy Ohio

Balance at December 31, 2010:

Goodwill $1,137 $ 1,188 $ 2,325

Accumulated Impairment Charges (216) (1,188) (1,404)

Balance at December 31, 2010, as

adjusted for accumulated impairment

charges 921 — 921

Balance as of December 31, 2011:

Goodwill 1,137 1,188 2,325

Accumulated Impairment Charges (216) (1,188) (1,404)

Balance at December 31, 2011, as

adjusted for accumulated impairment

charges $ 921 $ — $ 921

Duke Energy.

Duke Energy is required to perform an annual goodwill

impairment test as of the same date each year and, accordingly,

performs its annual impairment testing of goodwill as of August 31.

Duke Energy updates the test between annual tests if events or

circumstances occur that would more likely than not reduce the fair

value of a reporting unit below its carrying value.

Duke Energy early adopted the revised goodwill impairment

accounting guidance during the third quarter of 2011 and applied

this revised guidance to its August 31, 2011 annual goodwill

impairment test. Pursuant to the revised guidance an entity may first

assess qualitative factors to determine whether it is necessary to

perform the two step goodwill impairment test. If deemed necessary,

the two-step impairment test shall be used to identify potential

goodwill impairment and measure the amount of a goodwill

impairment loss, if any, to be recognized. Duke Energy’s annual

qualitative assessments under the new accounting guidance include

reviews of current forecasts compared to prior forecasts, consideration

of recent fair value calculations, if any, review of Duke Energy’s, as

well as its peers, stock price performance, credit ratings of Duke

Energy’s significant subsidiaries, updates to weighted average cost of

capital (WACC) calculations or review of the key inputs to the WACC

and consideration of overall economic factors, recent regulatory

commission actions and related regulatory climates, and recent

financial performance. Duke Energy determined it was more likely

than not that the fair value of each of its reporting units exceeded

their carrying value at August 31, 2011 and that the two step

goodwill impairment test was not required.

In the second quarter of 2010, based on circumstances

discussed below, management determined that it was more likely

than not that the fair value of Commercial Power’s non-regulated

Midwest generation reporting unit was below its respective carrying

value. Accordingly, an interim impairment test was performed for this

reporting unit. Determination of reporting unit fair value was based on

a combination of the income approach, which estimates the fair

value of Duke Energy’s reporting units based on discounted future

cash flows, and the market approach, which estimates the fair value

of Duke Energy’s reporting units based on market comparables within

the utility and energy industries. Based on completion of step one of

the second quarter 2010 impairment analysis, management

determined that the fair value of Commercial Power’s non-regulated

Midwest generation reporting unit was less than its carrying value,

which included goodwill of $500 million.

Commercial Power’s non-regulated Midwest generation

reporting unit includes nearly 4,000 MW of primarily coal-fired

generation capacity in Ohio which was dedicated under the ESP

through December 31, 2011. Additionally, this reporting unit has

approximately 3,600 MW of gas-fired generation capacity in Ohio,

Pennsylvania, Illinois and Indiana which provides generation to

unregulated energy markets in the Midwest. The businesses within

Commercial Power’s non-regulated Midwest generation reporting unit

operate in unregulated markets which allow for customer choice

among suppliers. As a result, the operations within this reporting unit

are subjected to competitive pressures that do not exist in any of

Duke Energy’s regulated jurisdictions.

Commercial Power’s other businesses, including the renewable

generation assets, are in a separate reporting unit for goodwill

impairment testing purposes. No impairment existed with respect to

Commercial Power’s renewable generation assets.

The fair value of Commercial Power’s non-regulated Midwest

generation reporting unit is impacted by a multitude of factors,

including current and forecasted customer demand, forecasted power

and commodity prices, uncertainty of environmental costs,

competition, the cost of capital, valuation of peer companies and

regulatory and legislative developments. Management’s assumptions

and views of these factors continually evolve, and certain views and

assumptions used in determining the fair value of the reporting unit in

the 2010 interim impairment test changed significantly from those

used in the 2009 annual impairment test. These factors had a

significant impact on the valuation of Commercial Power’s

non-regulated Midwest generation reporting unit. More specifically,

the following factors significantly impacted management’s valuation

of the reporting unit:

•Sustained lower forward power prices —InOhio,Duke

Energy’s Commercial Power segment provided power to retail

customers under the ESP, which utilizes rates approved by the

PUCO through 2011. These rates in 2010 were above market

prices for generation services, resulting in customers switching

to other generation providers. As discussed in Note 4, Duke

Energy Ohio will establish a new SSO for retail load customers

for generation after the current ESP expires on December 31,

2011. Given forward power prices, which declined from the

time of the 2009 impairment, significant uncertainty existed

with respect to the generation margin that would be earned

under the new SSO.

•Potentially more stringent environmental regulations from the

U.S. EPA—In May and July of 2010, the EPA issued

151