Duke Energy 2011 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

not the regulated utility operations of Duke Energy Ohio. DECAM

meets its funding needs through an intercompany loan agreement

from a subsidiary of Duke Energy. The intercompany loan agreement

was executed in February 2011. An additional intercompany loan

agreement was executed in October 2011 so that DECAM can also

loan money to the subsidiary of Duke Energy. DECAM had no

outstanding intercompany loan payable with the subsidiary of Duke

Energy as of December 31, 2011. DECAM had a $90 million

intercompany loan receivable with the subsidiary of Duke Energy as

of December 31, 2011.

In January 2012, Duke Energy Vermillion, an indirect wholly-

owned subsidiary of Duke Energy Ohio, sold its 75% undivided

ownership interest in Vermillion Generating Station to Duke Energy

Indiana and WVPA. Refer to Notes 2 and 5 for further discussion.

During the years ended December 31, 2011 and 2009, Duke

Energy Ohio paid dividends to its parent, Cinergy of $485 million and

$360 million, respectively.

Duke Energy Indiana

Duke Energy Indiana engages in related party transactions,

which are generally performed at cost and in accordance with the

applicable state and federal commission regulations. Balances due to

or due from related parties included in the Consolidated Balance

Sheets are as follows:

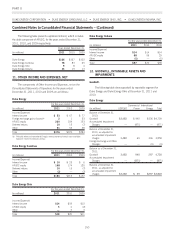

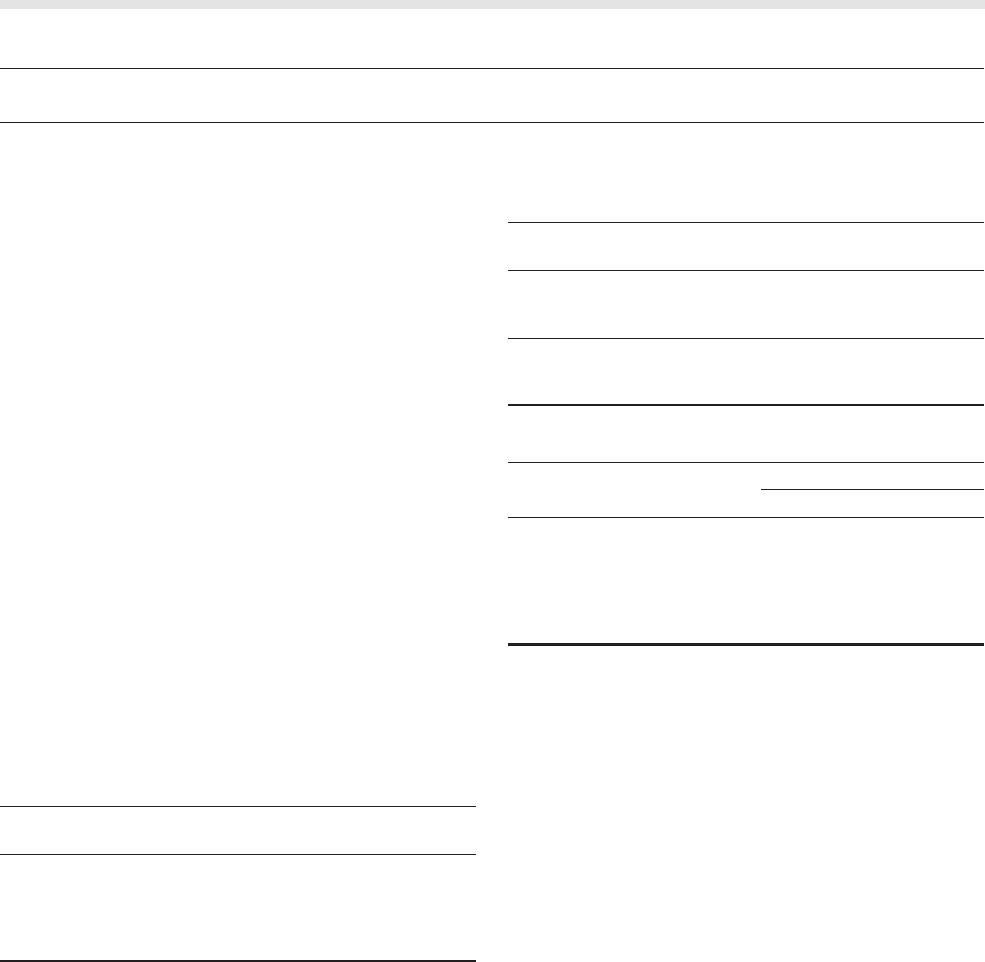

Assets/(Liabilities)

(in millions)

December 31,

2011(a)

December 31,

2010(a)

Current assets(b) $18 $51

Non-current assets(c) 2—

Current liabilities(d) (97) (69)

Non-current liabilities(e) (22) (20)

Net deferred tax liabilities(f) (914) (932)

(a) Balances exclude assets or liabilities associated with accrued pension and other post-

retirement benefits, CRC and money pool arrangements as discussed below.

(b) The balance at December 31, 2011, is classified as Receivables on the Consolidated

Balance Sheets. Of the balance at December 31, 2010, $27 million is classified as

Receivables and $24 million is classified as Other within Current Assets on the

Consolidated Balance Sheets.

(c) The balance at December 31, 2011 is classified as Other within Investments and

Other Assets on the Consolidated Balance Sheets.

(d) Of the balance at December 31, 2011, $(72) million is classified as Accounts payable

and $(25) million is classified as Taxes accrued on the Consolidated Balance Sheets.

Of the balance at December 31, 2010 $(67) million is classified as Accounts payable

and $(2) million is classified as Taxes accrued on the Consolidated Balance Sheets.

(e) The balances at December 31, 2011 and 2010, are classified as Other within

Deferred Credits and Other Liabilities on the Consolidated Balance Sheets.

(f) Of the balance at December 31, 2011, $(927) million is classified as Deferred income

taxes and $13 million is classified as Other within Current Assets on the Consolidated

Balance Sheets. Of the balance at December 31, 2010, $(973) million is classified as

Deferred income taxes and $41 million is classified as Other within Current Assets on

the Consolidated Balance Sheets.

As discussed further in Note 21, Duke Energy Indiana

participates in Duke Energy’s qualified pension plan, non-qualified

pension plan and other post-retirement benefit plans and is allocated

its proportionate share of expenses associated with these plans.

Additionally, Duke Energy Indiana has been allocated accrued

pension and other post-retirement benefit obligations as shown in the

following table:

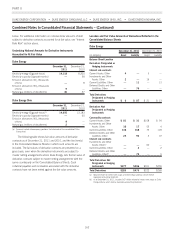

(in millions)

December 31,

2011

December 31,

2010

Other current liabilities $2 $2

Accrued pension and other post-

retirement benefit costs 231 270

Total allocated accrued pension and

other post-retirement benefit

obligations $233 $272

Other Related Party Amounts

For the Years Ended December 31,

(in millions) 2011 2010 2009

Corporate governance and shared

service expenses(a) $415 $364 $343

Indemnification coverages(b) 7810

Rental income and other charged

expenses, net(c) 1812

CRC interest income(d) 14 13 12

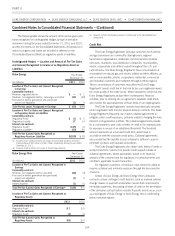

(a) Duke Energy Indiana is charged its proportionate share of corporate governance and

other costs by an unconsolidated affiliate that is a consolidated affiliate of Duke Energy.

Corporate governance and other shared services costs are primarily related to human

resources, employee benefits, legal and accounting fees, as well as other third party

costs. These amounts are recorded in Operation, Maintenance and Other within

Operating Expenses on the Consolidated Statements of Operations.

(b) Duke Energy Indiana incurs expenses related to certain indemnification coverages

through Bison, Duke Energy’s wholly-owned captive insurance subsidiary. These

expenses are recorded in Operation, Maintenance and Other within Operating

Expenses on the Consolidated Statements of Operations.

(c) Duke Energy Indiana records income associated with the rental of office space to a

consolidated affiliate of Duke Energy, as well as its proportionate share of certain

charged expenses from affiliates of Duke Energy.

(d) As discussed in Note 11, certain trade receivables have been sold by Duke Energy

Indiana to CRC, an unconsolidated entity formed by a subsidiary of Duke Energy. The

proceeds obtained from the sales of receivables are largely cash but do include a

subordinated note from CRC for a portion of the purchase price. The interest income

associated with the subordinated note is recorded in Other Income and Expenses, net

on the Consolidated Statements of Operations.

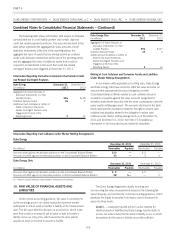

As discussed further in Note 6, Duke Energy Indiana

participates in a money pool arrangement with Duke Energy and

other Duke Energy subsidiaries. Interest income associated with

money pool activity, which is recorded in Other Income and

Expenses, net on the Consolidated Statements of Operations, was

insignificant for the years ended December 31, 2011 and 2010 and

$1 million for the year ended December 31, 2009. Interest expense

associated with money pool activity, which is recorded in Interest

Expense on the Consolidated Statements of Operations, was $1

million for the years ended December 31, 2011, 2010 and 2009.

In January 2012, Duke Energy Vermillion, an indirect wholly-

owned subsidiary of Duke Energy Ohio, sold its 75% undivided

ownership interest in the Vermillion Generating Station to Duke Energy

Indiana and WVPA. Refer to Note 2 and 5 for further discussion.

During the year ended December 31, 2010 and 2009, Duke

Energy Indiana received $350 million and $140 million,

respectively, in capital contributions, from its parent, Cinergy.

159