Duke Energy 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

and the pending IGCC Rider proceedings are expected no sooner

than the end of the third quarter 2012. Duke Energy Indiana is

unabletopredicttheultimateoutcomeoftheseproceedings.Inthe

event the IURC disallows a portion of the plant costs, including

financing costs, or if cost estimates for the plant increase, additional

charges to expense, which could be material, could occur.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The application of accounting policies and estimates is an

important process that continues to develop as Duke Energy’s

operations change and accounting guidance evolves. Duke Energy

has identified a number of critical accounting policies and estimates

that require the use of significant estimates and judgments.

Management bases its estimates and judgments on historical

experience and on other various assumptions that it believes are

reasonable at the time of application. The estimates and judgments

may change as time passes and more information about Duke

Energy’s environment becomes available. If estimates and judgments

are different than the actual amounts recorded, adjustments are

made in subsequent periods to take into consideration the new

information. Duke Energy discusses its critical accounting policies

and estimates and other significant accounting policies with senior

members of management and the audit committee, as appropriate.

Duke Energy’s critical accounting policies and estimates are

discussed below.

Regulatory Accounting

Duke Energy’s regulated operations (the substantial majority of

U.S. Franchised Electric and Gas’s operations) meet the criteria for

application of regulatory accounting treatment. As a result, Duke

Energy records assets and liabilities that result from the regulated

ratemaking process that would not be recorded under GAAP in the

U.S. for non-regulated entities. Regulatory assets generally represent

incurred costs that have been deferred because such costs are

probable of future recovery in customer rates. Regulatory liabilities

generally represent obligations to make refunds to customers for

previous collections for costs that either are not likely to or have yet to

be incurred. Management continually assesses whether the

regulatory assets are probable of future recovery by considering

factors such as applicable regulatory environment changes, historical

regulatory treatment for similar costs in Duke Energy’s jurisdictions,

recent rate orders to other regulated entities, and the status of any

pending or potential deregulation legislation. Based on this continual

assessment, management believes the existing regulatory assets are

probable of recovery. This assessment reflects the current political

and regulatory climate at the state and federal levels, and is subject to

change in the future. If future recovery of costs ceases to be probable,

the asset write-offs would be required to be recognized in operating

income. Additionally, the regulatory agencies can provide flexibility in

the manner and timing of the depreciation of property, plant and

equipment, recognition of nuclear decommissioning costs and

amortization of regulatory assets or may disallow recovery of all or a

portion of certain assets. Total regulatory assets were $4,046 million

as of December 31, 2011, and $3,390 million as of December 31,

2010. Total regulatory liabilities were $3,006 million as of

December 31, 2011 and $3,155 million as of December 31, 2010.

For further information, see Note 4 to the Consolidated Financial

Statements, “Regulatory Matters.”

In order to apply regulatory accounting treatment and record

regulatory assets and liabilities, certain criteria must be met. In

determining whether the criteria are met for its operations,

management makes significant judgments, including determining

whether revenue rates for services provided to customers are subject

to approval by an independent, third-party regulator, whether the

regulated rates are designed to recover specific costs of providing the

regulated service, and a determination of whether, in view of the

demand for the regulated services and the level of competition, it is

reasonable to assume that rates set at levels that will recover the

operations’ costs can be charged to and collected from customers.

This final criterion requires consideration of anticipated changes in

levels of demand or competition, direct and indirect, during the

recovery period for any capitalized costs.

The regulatory accounting rules require recognition of a loss if it

becomes probable that part of the cost of a plant under construction

or a recently completed plant will be disallowed for ratemaking

purposes and a reasonable estimate of the amount of the

disallowance can be made. Such assessments can require significant

judgment by management regarding matters such as the ultimate

cost of a plant under construction, regulatory recovery implications,

etc. As discussed in Note 4, “Regulatory Matters,” during 2011 and

2010 Duke Energy Indiana recorded disallowance charges of $222

million and $44 million, respectively, related to the IGCC plant

currently under construction in Edwardsport, Indiana. Management

will continue to assess matters as the construction of the plant and

the related regulatory proceedings continue, and further charges

could be required in 2012 or beyond.

As discussed further in Note 1, “Summary of Significant

Accounting Policies”, and Note 4, “Regulatory Matters,” Duke Energy

Ohio discontinued the application of regulatory accounting treatment

to portions of its generation operations in November 2011 in

conjunction with the approval of its new Electric Security Plan by the

Public Utilities Commission of Ohio. The effect of this change was

immaterial to the financial statements.

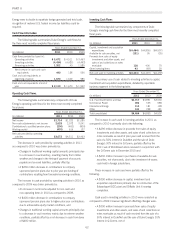

Goodwill Impairment Assessments

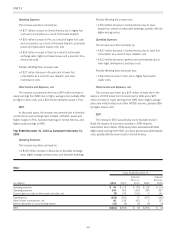

Duke Energy’s goodwill balances are included in the following

table.

December 31,

(in millions) 2011 2010

U.S. Franchised Electric and Gas $3,483 $3,483

Commercial Power 69 69

International Energy 297 306

Total Duke Energy goodwill $3,849 $3,858

The majority of Duke Energy’s goodwill relates to the acquisition

of Cinergy in April 2006, whose assets are primarily included in the

U.S. Franchised Electric and Gas and Commercial Power segments.

Commercial Power also has $69 million of goodwill that resulted

from the September 2008 acquisition of Catamount Energy

Corporation, a leading wind power company located in Rutland,

55