Duke Energy 2011 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

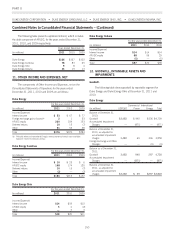

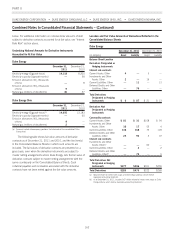

Combined Notes to Consolidated Financial Statements – (Continued)

proposed rules associated with the regulation of CCRs to

address risks from the disposal of CCRs (e.g., ash ponds) and

to limit the interstate transport of emissions of NOxand SO2.

These proposed regulations, along with other pending EPA

regulations, could result in significant expenditures for coal

fired generation plants, and could result in the early retirement

of certain generation assets, which do not currently have

control equipment for NOxand SO2, as soon as 2014.

•Customer switching — ESP customers have increasingly

selected alternative generation service providers, as allowed by

Ohio legislation, which further erodes margins on sales. In the

second quarter of 2010, Duke Energy Ohio’s residential class

became the target of an intense marketing campaign offering

significant discounts to residential customers that switch to

alternate power suppliers. Customer switching levels were at

approximately 55% at June 30, 2010 compared to

approximately 29% in the third quarter of 2009.

As a result of the factors above, a non-cash goodwill impairment

charge of $500 million was recorded during the second quarter of

2010. This impairment charge represented the entire remaining

goodwill balance for Commercial Power’s non-regulated Midwest

generation reporting unit. In addition to the goodwill impairment

charge, and as a result of factors similar to those described above,

Commercial Power recorded $160 million of pre-tax impairment

charges related to certain generating assets and emission allowances

primarily associated with these generation assets in the Midwest to

write-down the value of these assets to their estimated fair value. The

generation assets that were subject to this impairment charge were

those coal-fired generating assets that do not have certain

environmental emissions control equipment, causing these

generation assets to be heavily impacted by the EPA’s proposed rules

on emissions of NOxand SO2. These impairment charges are

recorded in Goodwill and Other Impairment Charges on Duke

Energy’s Consolidated Statement of Operations.

During 2009, in connection with the annual goodwill

impairment test, Duke Energy recorded an approximate $371 million

impairment charge to write-down the carrying value of Commercial

Power’s non-regulated Midwest generation reporting unit to its

implied fair value. Additionally, in 2009 and as a result of factors

similar to those described above, Commercial Power recorded $42

million of pre-tax impairment charges related to certain generating

assets in the Midwest to write-down the value of these assets to their

estimated fair value. These impairment charges are recorded in

Goodwill and Other Impairment Charges on Duke Energy’s

Consolidated Statement of Operations. As management is not aware

of any recent market transactions for comparable assets with

sufficient transparency to develop a market approach fair value, Duke

Energy relied heavily on the income approach to estimate the fair

value of the impaired assets.

The fair value of Commercial Power’s non-regulated Midwest

generation reporting unit in 2009 was impacted by a multitude of

factors, including current and forecasted customer demand, current

and forecasted power and commodity prices, impact of the economy

on discount rates, valuation of peer companies, competition, and

regulatory and legislative developments. These factors had a

significant impact on the risk-adjusted discount rate and other inputs

used to value the non-regulated Midwest generation reporting unit.

More specifically, as of August 31, 2009, the following factors

significantly impacted management’s valuation of the reporting unit

that consequently resulted in an approximate $371 million non-cash

goodwill impairment charge during the third quarter of 2009:

•Decline in load (electricity demand) forecast —Asaresultof

lower demand due to the continuing economic recession,

forecasts evolved throughout 2009 that indicate that lower

demand levels may persist longer than previously anticipated.

The potential for prolonged suppressed sales growth, lower

sales volume forecasts and greater uncertainty with respect to

sales volume forecasts had a significant impact to the

valuation of this reporting unit.

•Depressed market power prices — Low natural gas and coal

prices put downward pressure on market prices for power. As

the economic recession continued throughout 2009, demand

for power remained low and market prices were at lower levels

than previously forecasted. In Ohio in 2009, Duke Energy

provides power to retail customers under an ESP, which

utilized rates approved by the PUCO through 2011. These

rates were above market prices for generation services. The

low levels of market prices impacted price forecasts and

placed uncertainty over the pricing of power after the

expiration of the ESP at the end of 2011. Additionally,

customers began to select alternative energy generation service

providers, as allowed by Ohio legislation, which further eroded

margins on sales.

•Carbon legislation/regulation developments — On June 26,

2009, the U.S. House of Representatives passed The

American Clean Energy and Security Act of 2009 (ACES) to

encourage the development of clean energy sources and

reduce greenhouse gas emissions. The ACES would create an

economy-wide cap and trade program for large sources of

greenhouse gas emissions. In September 2009, the U.S.

Senate made significant progress toward their own version of

climate legislation and, also in 2009, the EPA began actions

that could lead to its regulation of greenhouse gas emissions

absent carbon legislation. Climate legislation has the potential

to significantly increase the costs of coal and other carbon-

intensive electricity generation throughout the U.S., which

could impact the value of the coal fired generating plants,

particularly in non-regulated environments.

The fair values of Commercial Power’s non-regulated Midwest

generation reporting unit and generating assets for which

impairments were recorded were determined using significant

152