Duke Energy 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

security of plan benefits for participants. VEBA I is passively

managed.

The expected long-term rate of return of 8.00% for the plan’s

assets was developed using a weighted average calculation of

expected returns based primarily on future expected returns across

asset classes considering the use of active asset managers. The

weighted average returns expected by asset classes were 2.61% for

U.S. equities, 1.50% for Non-U.S. equities, 0.99% for global

equities, 1.69% for debt securities, 0.37% for global private equity,

0.24% for hedge funds, 0.30% for real estate and 0.30% for other

global securities.

Duke Energy discounted its future U.S. pension and other post-

retirement obligations using a rate of 5.1% as of December 31,

2011. The discount rates used to measure benefit plan benefit

obligations for financial reporting purposes should reflect rates at

which pension benefits could be effectively settled. As of

December 31, 2011, Duke Energy determined its discount rate for

U.S. pension and other post-retirement obligations using a bond

selection-settlement portfolio approach. This approach develops a

discount rate by selecting a portfolio of high quality corporate bonds

that generate sufficient cash flow to provide for the projected benefit

payments of the plan. The selected bond portfolio is derived from a

universe of non-callable corporate bonds rated Aa quality or higher.

After the bond portfolio is selected, a single interest rate is determined

that equates the present value of the plan’s projected benefit

payments discounted at this rate with the market value of the bonds

selected.

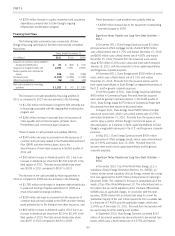

Future changes in plan asset returns, assumed discount rates and various other factors related to the participants in Duke Energy’s pension

and post-retirement plans will impact Duke Energy’s future pension expense and liabilities. Management cannot predict with certainty what

these factors will be in the future. The following table presents the approximate effect on Duke Energy’s 2011 pre-tax pension expense, pension

obligation and other post-retirement benefit obligation if a 0.25% change in rates were to occur:

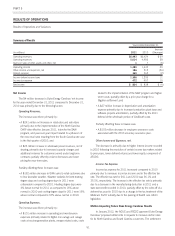

Qualified and Non-

qualified Pension Plans Other Post-Retirement Plans

(in millions) +0.25% -0.25% +0.25% -0.25%

Effect on 2011 pre-tax pension expense

Expected long-term rate of return $ (12) $ 12 $ — $ —

Discount rate (8) 8 (1) 1

Effect on benefit obligation at December 31, 2011

Discount rate (114) 117 (16) 16

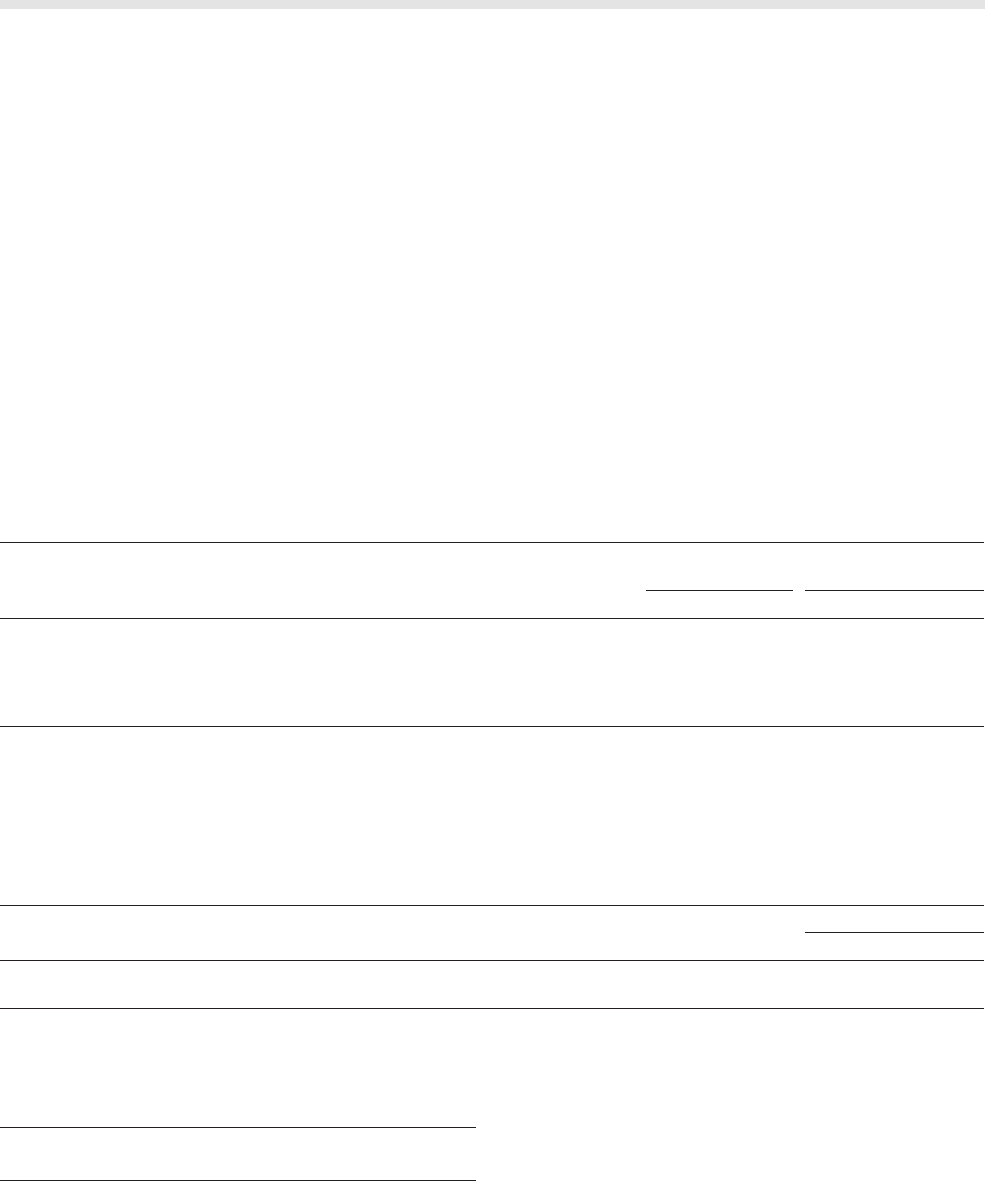

Duke Energy’s U.S. post-retirement plan uses a medical care trend rate which reflects the near and long-term expectation of increases in

medical health care costs. Duke Energy’s U.S. post-retirement plan uses a prescription drug trend rate which reflects the near and long-term

expectation of increases in prescription drug health care costs. As of December 31, 2011, the medical care trend rates were 8.75%, which

grades to 5.00% by 2020. The following table presents the approximate effect on Duke Energy’s 2011 pre-tax other post-retirement expense

and other post-retirement benefit obligation if a 1% point change in the health care trend rate were to occur:

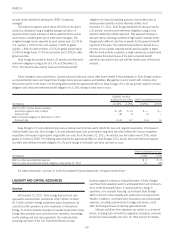

Other Post-Retirement Plans

(in millions) +1.0% -1.0%

Effect on other post-retirement expense $2 $(2)

Effect on other post-retirement benefit obligation at December 31, 2011 31 (28)

For further information, see Note 21 to the Consolidated Financial Statements, “Employee Benefit Plans.”

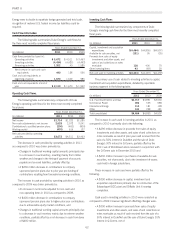

LIQUIDITY AND CAPITAL RESOURCES

Overview

At December 31, 2011, Duke Energy had cash and cash

equivalents and short-term investments of $2.3 billion, of which

$1.0 billion is held in foreign jurisdictions and is forecasted to be

used to fund the operations of and investments in International

Energy. To fund its domestic liquidity and capital requirements, Duke

Energy relies primarily upon cash flows from operations, borrowings,

and its existing cash and cash equivalents. The relatively stable

operating cash flows of the U.S. Franchised Electric and Gas

business segment compose a substantial portion of Duke Energy’s

cash flows from operations and it is anticipated that it will continue to

do so for the foreseeable future. A material adverse change in

operations, or in available financing, could impact Duke Energy’s

ability to fund its current liquidity and capital resource requirements.

Weather conditions, commodity price fluctuations and unanticipated

expenses, including unplanned plant outages and storms, could

affect the timing and level of internally generated funds.

Ultimate cash flows from operations are subject to a number of

factors, including, but not limited to, regulatory constraints, economic

trends and market volatility (see Item 1A. “Risk Factors” for details).

60