Duke Energy 2011 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

and Duke Energy Indiana from the sales of receivables are cash and

a subordinated note from CRC (subordinated retained interest in the

sold receivables) for a portion of the purchase price (typically

approximates 25% of the total proceeds). The amount borrowed by

CRC against these receivables is non-recourse to the general credit of

Duke Energy, and the associated cash collections from the accounts

receivable sold is the sole source of funds to satisfy the related debt

obligation. Borrowing is limited to approximately 75% of the

transferred receivables. Losses on collection in excess of the discount

are first absorbed by the equity of CRC and next by the subordinated

retained interests held by Duke Energy Ohio and Duke Energy

Indiana. The discount on the receivables reflects interest expense plus

an allowance for bad debts net of a servicing fee charged by Duke

Energy Ohio and Duke Energy Indiana. Duke Energy Ohio and Duke

Energy Indiana are responsible for the servicing of the receivables

(collecting and applying the cash to the appropriate receivables).

Depending on the experience with collections, additional equity

infusionstoCRCmayberequiredtobemadebyDukeEnergyin

order to maintain a minimum equity balance of $3 million. For the

years ended December 31, 2011, 2010 and 2009, respectively,

Duke Energy infused $6 million, $10 million and $11 million of

equity to CRC to remedy net worth deficiencies. The amount

borrowed fluctuates based on the amount of receivables sold. The

debt is short term because the facility has an expiration date of less

than one year from the balance sheet date. The current expiration

date is October 2012. CRC is considered a VIE because the equity

capitalization is insufficient to support its operations, the power to

direct the most significant activities of the entity are not performed by

the equity holder, Cinergy, and deficiencies in the net worth of CRC

are not funded by Cinergy, but by Duke Energy. The most significant

activity of CRC relates to the decisions made with respect to the

management of delinquent receivables. These decisions, as well as

the requirement to make up deficiencies in net worth, are made by

Duke Energy and not by Duke Energy Ohio, Duke Energy Kentucky

or Duke Energy Indiana. Thus, Duke Energy consolidates CRC. Duke

Energy Ohio and Duke Energy Indiana do not consolidate CRC.

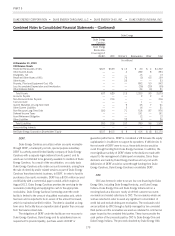

CinCap V.

CinCap V was created to finance and execute a power sale

agreement with Central Maine Power Company for approximately 35

MW of capacity and energy. This agreement expires in 2016. CinCap

V is considered a VIE because the equity capitalization is insufficient

to support its operations. As Duke Energy has the power to direct the

most significant activities of the entity, which are the decisions to

hedge and finance the power sales agreement, CinCap V is

consolidated by Duke Energy.

Renewables.

Duke Energy’s renewable energy facilities include Green Frontier

Windpower, LLC, Top of The World Wind Energy LLC and various

solar projects, all subsidiaries of DEGS, an indirect wholly-owned

subsidiary of Duke Energy.

These renewable energy facilities are VIEs due to power

purchase agreements with terms that approximate the expected life of

the projects. These fixed price agreements effectively transfer the

commodity price risk to the buyer of the power. Duke Energy has

consolidated these entities since inception because the most

significant activities that impact the economic performance of these

renewable energy facilities were the decisions associated with the

siting, negotiation of the purchase power agreement, engineering,

procurement and construction, and decisions associated with

ongoing operations and maintenance related activities, all of which

were made solely by Duke Energy.

The debt held by these renewable energy facilities is

non-recourse to the general credit of Duke Energy. Duke Energy and

its subsidiaries have no requirement to provide liquidity or purchase

the assets of these renewable energy facilities. Duke Energy does not

guarantee performance except for an immaterial multi-purpose letter

of credit and various immaterial debt service reserve and operations

and maintenance reserve guarantees. The assets are restricted and

they cannot be pledged as collateral or sold to third parties without

the prior approval of the debt holders.

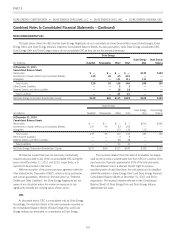

Other.

Duke Energy has other VIEs with restricted assets and

non-recourse debt. These VIEs include certain on-site power

generation facilities. Duke Energy consolidates these particular on-site

power generation entities because Duke Energy has the power to

direct the majority of the most significant activities, which, most

notably involve the oversight of operation and maintenance related

activities that impact the economic performance of these entities.

During the second quarter of 2011, the customer for one of

these on-site generation facilities canceled its contract. As a result, the

entity providing the on-site generation services no longer has any

activity or assets, other than a receivable with payments to be

collected through 2017. As of December 31, 2011, Duke Energy no

longer consolidates this entity.

180