Duke Energy 2011 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

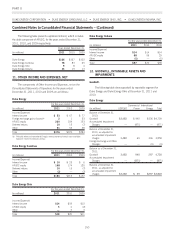

Combined Notes to Consolidated Financial Statements – (Continued)

7. GUARANTEES AND INDEMNIFICATIONS

Duke Energy and its subsidiaries have various financial and

performance guarantees and indemnifications which are issued in the

normal course of business. As discussed below, these contracts

include performance guarantees, stand-by letters of credit, debt

guarantees, surety bonds and indemnifications. Duke Energy and its

subsidiaries enter into these arrangements to facilitate commercial

transactions with third parties by enhancing the value of the

transaction to the third party.

On January 2, 2007, Duke Energy completed the spin-off of its

natural gas businesses to shareholders. Guarantees that were issued

by Duke Energy or its affiliates, or were assigned to Duke Energy prior

to the spin-off remained with Duke Energy subsequent to the spin-off.

Guarantees issued by Spectra Energy Capital, LLC (Spectra Capital)

or its affiliates prior to the spin-off remained with Spectra Capital

subsequent to the spin-off, except for certain guarantees that are in

the process of being assigned to Duke Energy. During this

assignment period, Duke Energy has indemnified Spectra Capital

against any losses incurred under these guarantee obligations. The

maximum potential amount of future payments associated with the

guarantees issued by Spectra Capital is $206 million.

Duke Energy has issued performance guarantees to customers

and other third parties that guarantee the payment and performance

of other parties, including certain non-wholly-owned entities, as well

as guarantees of debt of certain non-consolidated entities and less

than wholly-owned consolidated entities. If such entities were to

default on payments or performance, Duke Energy would be required

under the guarantees to make payments on the obligations of the less

than wholly-owned entity. The maximum potential amount of future

payments Duke Energy could have been required to make under

these guarantees as of December 31, 2011 was $291 million. Of

this amount, $50 million relates to guarantees issued on behalf of

less than wholly-owned consolidated entities, with the remainder

related to guarantees issued on behalf of third parties and

unconsolidated affiliates of Duke Energy.

Of the guarantees noted above, $330 million of the guarantees

expire between 2012 and 2028, with the remaining performance

guarantees having no contractual expiration.

Included in the maximum potential amount of future payments

discussed above is $40 million of maximum potential amounts of

future payments associated with guarantees issued to customers or

other third parties related to the payment or performance obligations

of certain entities that were previously wholly-owned by Duke Energy

but which have been sold to third parties, such as DukeSolutions,

Inc. (DukeSolutions) and Duke Engineering & Services, Inc. (DE&S).

These guarantees are primarily related to payment of lease

obligations, debt obligations, and performance guarantees related to

provision of goods and services. Duke Energy has received

back-to-back indemnification from the buyer of DE&S indemnifying

Duke Energy for any amounts paid related to the DE&S guarantees.

Duke Energy also received indemnification from the buyer of

DukeSolutions for the first $2.5 million paid by Duke Energy related

to the DukeSolutions guarantees. Further, Duke Energy granted

indemnification to the buyer of DukeSolutions with respect to losses

arising under some energy services agreements retained by

DukeSolutions after the sale, provided that the buyer agreed to bear

100% of the performance risk and 50% of any other risk up to an

aggregate maximum of $2.5 million (less any amounts paid by the

buyer under the indemnity discussed above). Additionally, for certain

performance guarantees, Duke Energy has recourse to subcontractors

involved in providing services to a customer. These guarantees have

various terms ranging from 2012 to 2021, with others having no

specific term.

Duke Energy has guaranteed certain issuers of surety bonds,

obligating itself to make payment upon the failure of a former

non-wholly-owned entity to honor its obligations to a third party, as

well as used bank-issued stand-by letters of credit to secure the

performance of non-wholly-owned entities to a third party or

customer. Under these arrangements, Duke Energy has payment

obligations which are triggered by a draw by the third party or

customer due to the failure of the non-wholly-owned entity to perform

according to the terms of its underlying contract. Substantially all of

these guarantees issued by Duke Energy relate to projects at Crescent

that were under development at the time of the joint venture creation

in 2006. Crescent filed Chapter 11 petitions in a U.S. Bankruptcy

Court in June 2009. During 2009, Duke Energy determined that it

was probable that it will be required to perform under certain of these

guarantee obligations and recorded a charge of $26 million

associated with these obligations, which represented Duke Energy’s

best estimate of its exposure under these guarantee obligations. At the

time the charge was recorded, the face value of the guarantees was

$70 million, which has since been reduced to $18 million as of

December 31, 2011, as Crescent continues to complete some of its

obligations under these guarantees.

Duke Energy has entered into various indemnification

agreements related to purchase and sale agreements and other types

of contractual agreements with vendors and other third parties. These

agreements typically cover environmental, tax, litigation and other

matters, as well as breaches of representations, warranties and

covenants. Typically, claims may be made by third parties for various

periods of time, depending on the nature of the claim. Duke Energy’s

potential exposure under these indemnification agreements can range

from a specified amount, such as the purchase price, to an unlimited

dollar amount, depending on the nature of the claim and the

particular transaction. Duke Energy is unable to estimate the total

potential amount of future payments under these indemnification

agreements due to several factors, such as the unlimited exposure

under certain guarantees.

At December 31, 2011, the amounts recorded on the

Consolidated Balance Sheets for the guarantees and indemnifications

mentioned above, including performance guarantees associated with

projects at Crescent for which it is probable that Duke Energy will be

required to perform, is $19 million. This amount is primarily recorded

145