Duke Energy 2011 Annual Report Download - page 240

Download and view the complete annual report

Please find page 240 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION

Combined Notes to Consolidated Financial Statements

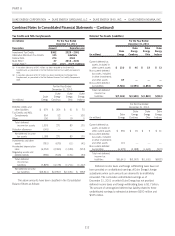

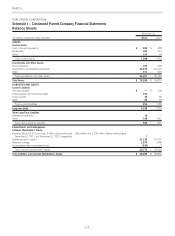

1. BASIS OF PRESENTATION

Duke Energy Corporation (Duke Energy) is a holding company

that conducts substantially all of its business operations through its

subsidiaries. As specified in the merger conditions issued by various

state commissions in connection with Duke Energy’s merger with

Cinergy Corp. (Cinergy) in April 2006, there are restrictions on Duke

Energy’s ability to obtain funds from certain of its subsidiaries through

dividends, loans or advances. For further information, see Note 4 to

the Consolidated Financial Statements, “Regulatory Matters.”

Accordingly, these condensed financial statements have been

prepared on a parent-only basis. Under this parent-only presentation,

Duke Energy’s investments in its consolidated subsidiaries are

presented under the equity method of accounting. In accordance with

Rule 12-04 of Regulation S-X, these parent-only financial statements

do not include all of the information and footnotes required by

Generally Accepted Accounting Principles (GAAP) in the United

States (U.S.) for annual financial statements. Because these parent-

only financial statements and notes do not include all of the

information and footnotes required by GAAP in the U.S. for annual

financial statements, these parent-only financial statements and other

information included should be read in conjunction with Duke

Energy’s audited Consolidated Financial Statements contained within

Part II, Item 8 of this Form 10-K for the year ended December 31,

2011.

Duke Energy and its subsidiaries file a consolidated federal

income tax return and other state and foreign jurisdictional returns as

required.ThetaxableincomeofDukeEnergy’swholly-owned

operating subsidiaries is reflected in Duke Energy’s U.S. federal and

state income tax returns. Duke Energy has a tax sharing agreement

with its wholly-owned operating subsidiaries, where the separate

return method is used to allocate tax expenses and benefits to the

wholly-owned operating subsidiaries whose investments or results of

operations provide these tax expenses and benefits. The accounting

for income taxes essentially represents the income taxes that Duke

Energy’s wholly-owned operating subsidiaries would incur if each

were a separate company filing its own tax return as a C-Corporation.

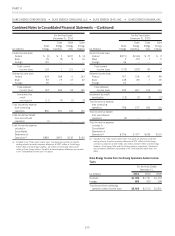

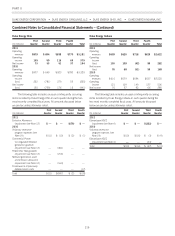

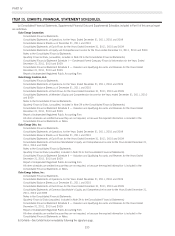

2. DEBT

Summary of Debt and Related Terms

(in millions)

Weighted-

Average

Rate Year Due

December 31,

2011 2010

Unsecured debt(a) 4.3% 2013 –2021 $3,878 $2,772

Notes Payable and

commercial paper(b) 0.5% 604 450

Total debt 4,482 3,222

Short-term notes payable

and commercial paper (154) —

Total long-term debt $4,328 $3,222

(a) As of December 31, 2011, this amount includes an intercompany loan of $105

million with Duke Energy’s affiliate, Bison Insurance Company Limited.

(b) Includes $450 million at December 31, 2011 and 2010 that was classified as Long-term

Debt on the Consolidated Balance Sheets due to the existence of long-term credit facilities

which back-stop these commercial paper balances, along with Duke Energy’s ability and

intent to refinance these balances on a long-term basis. The weighted-average days to

maturity was 17 days and 14 days as of December 31, 2011 and 2010, respectively.

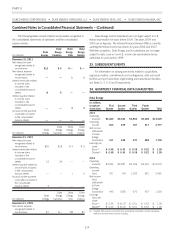

At December 31, 2011, Duke Energy has guaranteed

approximately $2.0 billion of debt issued by Duke Energy Carolinas,

LLC, one of Duke Energy’s wholly-owned operating subsidiaries.

In November 2011, Duke Energy issued $500 million of senior

notes, which carry a fixed interest rate of 2.15% and mature

November 15, 2016. Proceeds from the issuance will be used to

fund capital expenditures in Duke Energy’s unregulated businesses in

the U.S. and for general corporate purposes.

In August 2011, Duke Energy issued $500 million principal

amount of senior notes, which carry a fixed interest rate of 3.55%

and mature September 15, 2021. Proceeds from the issuance will

be used to repay a portion of Duke Energy’s commercial paper as it

matures, to fund capital expenditures in Duke Energy’s unregulated

businesses in the U.S. and for general corporate purposes.

In April 2011, Duke Energy filed a registration statement

(Form S-3) with the SEC to sell up to $1 billion of variable

denomination floating rate demand notes, called PremierNotes. The

Form S-3 states that no more than $500 million of the notes will be

outstanding at any particular time. The notes are offered on a

continuous basis and bear interest at a floating rate per annum

determined by the Duke Energy PremierNotes Committee, or its

designee, on a weekly basis. The interest rate payable on notes held

by an investor may vary based on the principal amount of the

investment. The notes have no stated maturity date, but may be

redeemed in whole or in part by Duke Energy at any time. The notes

arenon-transferableandmayberedeemedinwholeorinpartatthe

investor’s option. Proceeds from the sale of the notes will be used for

general corporate purposes. The balance as of December 31, 2011

is $79 million. The notes reflect a short-term debt obligation of Duke

220