Duke Energy 2011 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHAIRMAN’S LETTER TO STAKEHOLDERS

The 618-MW integrated gasification combined-cycle

(IGCC) Edwardsport project in Indiana is also nearing

completion. This plant will be one of the cleanest, most

efficient coal-fired plants in the world. We are proud that

during the construction of these plants, nearly 6,500

construction jobs were created.

Positioned for future generation

Duke Energy prudently maintains a fuel-diverse portfolio

of electric generating plants. Our fleet is 40.7 percent

coal-fired, 12.9 percent nuclear, 28.1 percent oil and

gas-fired, 15.5 percent hydro, and 2.7 percent wind and

solar. More than 25 percent of this portfolio produces

carbon-free electricity. Nuclear and coal-based generation

sources comprise approximately 88 percent of our 2011

U.S. generation as measured in megawatt-hours (MWh).

Carbon-free nuclear energy continues to be a key

component of our company’s long-term modernization

strategy. Throughout 2011, the U.S. Nuclear Regulatory

Commission (NRC) closely examined our entire nation’s

nuclear fleet, following the earthquakes and subsequent

tsunami in Japan in March. The NRC’s conclusions

support our view that nuclear energy is vital to the

world’s energy future. It is the only technology available

today to generate carbon-free, reliable, 24/7 baseload

electricity. We made investments to digitize protection

systems at our Oconee station in our continuing

commitment to upgrade and maintain the safety

and efficiency of our nuclear fleet.

Additionally, we are looking for ways to increase our

nuclear generation output. A series of nuclear uprate

projects will add additional net capacity of approximately

100 megawatts when completed in 2014 — at a cost of

less than $2 million per megawatt. We are also evaluating

the option to assume a 5 to 10 percent interest in the

V.C. Summer Nuclear Plant in South Carolina.

Firmly committed to retaining our option to build new

nuclear plants, we expect to receive the operating license

for our proposed Lee Nuclear Station in South Carolina in

2013. This two-reactor station could go on line as early

as 2021, but only if we get appropriate construction cost

recovery assurance from regulators in North Carolina.

At the same time, recent discovery of vast supplies

of domestic natural gas in the Midwest and Mid-Atlantic

shale formations could offer greater potential for this

already lower-cost fuel, which has roughly half the

carbon dioxide emissions of coal. In fact, our new Buck

gas-fired, combined-cycle plant in the Carolinas is now

being dispatched before our largest and most efficient

coal plants — a sign of today’s historically low gas prices.

Will this last? Commodity markets are cyclical, and

natural gas prices have historically been highly volatile.

Our existing and new natural gas plants enable us to take

advantage of low natural gas prices, and our retrofitted

and diverse fleet of coal, nuclear, hydroelectric, and

renewable generation positions us well to minimize

costs if natural gas prices increase.

Outlook for 2012 and beyond

Over the next five years, we anticipate growing our utility

rate base by approximately $5 billion, or a compounded

annual growth rate of around 6 percent, as we continue

our modernization and environmental retrofit programs.

We expect these investments to yield competitive returns

for our investors. Expected growth in international

markets and U.S. renewable energy will further increase

our diversified earnings base.

We also expect future growth from our wholesale

origination business, where we offer competitive power

supply options to a strong base of customers. Our

wholesale agreements involve creditworthy counterparties,

stable returns and formula rates that true up annually,

eliminating regulatory lag. We have recently extended

several full-requirements contracts and have attracted new

customers as well. For example, we have partnered with

South Carolina’s largest electric cooperative to provide

power under a long-term contract beginning in 2013.

Our 2012 outlook assumes slow economic recovery,

completion of our fleet modernization projects, and

subsequent recovery of those investments in customer

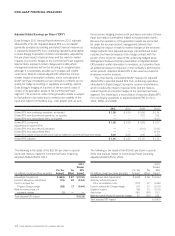

rates. We are targeting adjusted diluted earnings per share

8 DUKE ENERGY CORPORATION 2011 ANNUAL REPORT