Duke Energy 2011 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

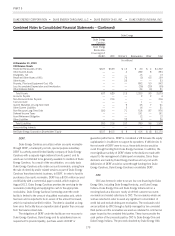

The carrying values of the retained interests are determined by

allocating the carrying value of the receivables between the assets

sold and the interests retained based on relative fair value. Because

the receivables generally turnover in less than two months, credit

losses are reasonably predictable due to the broad customer base and

lack of significant concentration, and the purchased beneficial interest

(equity in CRC) is subordinate to all retained interests and thus would

absorb losses first, the allocated basis of the subordinated notes are

not materially different than their face value. The hypothetical effect

on the fair value of the retained interests assuming both a 10% and a

20% unfavorable variation in credit losses or discount rates is not

material due to the short turnover of receivables and historically low

credit loss history. Interest accrues to Duke Energy Ohio, Duke Energy

Indiana and Duke Energy Kentucky on the retained interests using

the accretable yield method, which generally approximates the stated

rate on the notes since the allocated basis and the face value are

nearly equivalent. An impairment charge is recorded against the

carrying value of both the retained interests and purchased beneficial

interest whenever it is determined that an other-than-temporary

impairment has occurred. The key assumptions used in estimating

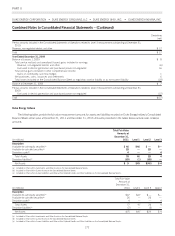

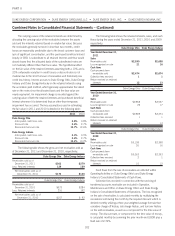

the fair value in 2011 and 2010 is detailed in the following table:

2011 2010

Duke Energy Ohio

Anticipated credit loss ratio 0.8% 0.8%

Discount rate 2.6% 2.7%

Receivable turnover rate 12.7% 12.6%

Duke Energy Indiana

Anticipated credit loss ratio 0.4% 0.5%

Discount rate 2.6% 2.7%

Receivable turnover rate 10.2% 10.2%

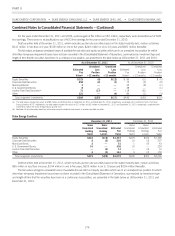

The following table shows the gross and net receivables sold as

of December 31, 2011 and December 31, 2010, respectively:

Duke Energy Ohio Duke Energy Indiana

Receivables sold as of

December 31, 2011 $302 $279

Less: Retained interests 129 139

Net receivables sold as of

December 31, 2011 $173 $140

Duke Energy Ohio Duke Energy Indiana

Receivables sold as of

December 31, 2010 $373 $284

Less: Retained interests 216 192

Net receivables sold as of

December 31, 2010 $157 $ 92

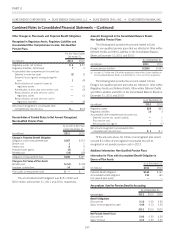

The following table shows the retained interests, sales, and cash

flows during the years ended December 31, 2011, 2010 and 2009

respectively:

Duke Energy Ohio Duke Energy Indiana

Year Ended December 31,

2011

Sales

Receivables sold $2,390 $2,658

Loss recognized on sale 21 16

Cash flows

Cash proceeds from

receivables sold $2,474 $2,674

Collection fees received 11

Return received on retained

interests 12 13

Duke Energy Ohio Duke Energy Indiana

Year Ended December 31,

2010

Sales

Receivables sold $2,858 $2,537

Loss recognized on sale 26 17

Cash flows

Cash proceeds from

receivables sold $2,809 $2,474

Collection fees received 1 1

Return received on retained

interests 15 13

Duke Energy Ohio Duke Energy Indiana

Year Ended December 31,

2009

Sales

Receivables sold $3,108 $2,398

Loss recognized on sale 26 16

Cash flows

Cash proceeds from

receivables sold $3,063 $2,353

Collection fees received 2 1

Return received on retained

interests 15 12

Cash flows from the sale of receivables are reflected within

Operating Activities on Duke Energy Ohio’s and Duke Energy

Indiana’s Consolidated Statements of Cash Flows.

Collection fees received in connection with the servicing of

transferred accounts receivable are included in Operation,

Maintenance and Other on Duke Energy Ohio’s and Duke Energy

Indiana’s Consolidated Statements of Operations. The loss recognized

on the sale of receivables is calculated monthly by multiplying the

receivables sold during the month by the required discount which is

derived monthly utilizing a three year weighted average formula that

considers charge-off history, late charge history, and turnover history

on the sold receivables, as well as a component for the time value of

money. The discount rate, or component for the time value of money,

is calculated monthly by summing the prior month-end LIBOR plus a

fixed rate of 2.39%.

182