Duke Energy 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

available at that time, including, but not limited to, income levels,

deductions and credits. In accordance with interim tax reporting

rules, a tax expense or benefit is recorded every quarter to adjust for

the difference in tax expense computed based on the actual

year-to-date ETR versus the forecasted annual ETR.

Duke Energy recognizes tax benefits for positions taken or

expected to be taken on tax returns, including the decision to exclude

certain income or transactions from a return, when a more-likely-

than-not threshold is met for a tax position and management believes

that the position will be sustained upon examination by the taxing

authorities. Duke Energy records the largest amount of the tax benefit

that is greater than 50% likely of being realized upon settlement.

Management evaluates each position based solely on the technical

merits and facts and circumstances of the position, assuming the

position will be examined by a taxing authority having full knowledge

of all relevant information. Significant management judgment is

required to determine recognition thresholds and the related amount

of tax benefits to be recognized in the Consolidated Financial

Statements. Management reevaluates tax positions each period in

which new information about recognition or measurement becomes

available. The portion of the tax benefit which is uncertain is

disclosed in the notes to the Consolidated Financial Statements.

Undistributed foreign earnings associated with International Energy’s

operations are considered indefinitely reinvested, thus no U.S. tax is

recorded on such earnings. This assertion is based on management’s

determination that the cash held in International Energy’s foreign

jurisdictions is not needed to fund the operations of its U.S. operations and

that International Energy either has invested or has intentions to reinvest

such earnings. While management currently intends to indefinitely reinvest

all of International Energy’s unremitted earnings, should circumstances

change, Duke Energy may need to record additional income tax expense

in the period in which such determination changes. The cumulative

undistributed earnings as of December 31, 2011, on which Duke Energy

has not provided deferred U.S. income taxes and foreign withholding taxes

is $1.7 billion. The amount of unrecognized deferred tax liability related to

these undistributed earnings is estimated at between $250 million and

$325 million.

For further information, see Note 22 to the Consolidated

Financial Statements, “Income Taxes.”

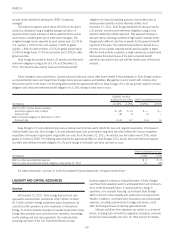

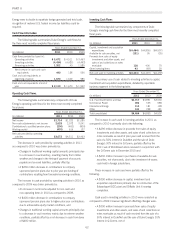

Pension and Other Post-Retirement Benefits

The calculation of pension expense, other post-retirement

benefit expense and pension and other post-retirement liabilities

require the use of assumptions. Changes in these assumptions can

result in different expense and reported liability amounts, and future

actual experience can differ from the assumptions. Duke Energy

believes that the most critical assumptions for pension and other

post-retirement benefits are the expected long-term rate of return on

plan assets and the assumed discount rate. Additionally, medical and

prescription drug cost trend rate assumptions are critical to Duke

Energy’s estimates of other post-retirement benefits.

Funding requirements for defined benefit plans are determined

by government regulations. Duke Energy made voluntary

contributions to its defined benefit retirement plans of $200 million in

2011, $400 million in 2010 and $800 million in 2009. In 2012,

Duke Energy anticipates making $200 million of contributions to its

defined benefit plans.

Duke Energy and its subsidiaries maintain non-contributory

defined benefit retirement plans. The plans cover most U.S.

employees using a cash balance formula. Under a cash balance

formula, a plan participant accumulates a retirement benefit

consisting of pay credits that are based upon a percentage (which

may vary with age and years of service) of current eligible earnings

and current interest credits. Certain employees are covered under

plans that use a final average earnings formula. Under a final average

earnings formula, a plan participant accumulates a retirement benefit

equal to a percentage of their highest 3-year average earnings, plus a

percentage of their highest 3-year average earnings in excess of

covered compensation per year of participation (maximum of 35

years), plus a percentage of their highest 3-year average earnings

times years of participation in excess of 35 years. Duke Energy also

maintains non-qualified, non-contributory defined benefit retirement

plans which cover certain executives.

Duke Energy and most of its subsidiaries also provide some

health care and life insurance benefits for retired employees on a

contributory and non-contributory basis. Certain employees are

eligible for these benefits if they have met age and service

requirements at retirement, as defined in the plans.

Duke Energy recognized pre-tax qualified pension cost of $45

million in 2011. In 2012, Duke Energy’s pre-tax qualified pension

cost is expected to be $17 million higher than in 2011 resulting

primarily from an increase in net actuarial loss amortization, primarily

attributable to the effect of negative actual returns on assets from

2008. Duke Energy recognized pre-tax nonqualified pension cost of

$11 million and pre-tax other post-retirement benefits cost of $26

million, in 2011. In 2012, pre-tax non-qualified pension cost is

expected to be approximately the same amount as in 2011. In

2012, pre-tax other post-retirement benefits costs are expected to be

approximately $8 million lower than in 2011 resulting primarily from

an increase in net actuarial gain accretion and a decrease in net

transition obligation amortization.

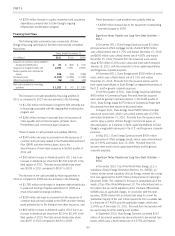

For both pension and other post-retirement plans, Duke Energy

assumes that its plan’s assets will generate a long-term rate of return

of 8.00% as of December 31, 2011. The assets for Duke Energy’s

pension and other post-retirement plans are maintained in a master

trust. The investment objective of the master trust is to achieve

reasonable returns on trust assets, subject to a prudent level of

portfolio risk, for the purpose of enhancing the security of benefits for

plan participants. The asset allocation targets were set after

considering the investment objective and the risk profile. U.S. equities

are held for their high expected return. Non-U.S. equities, debt

securities, hedge funds, real estate and other global securities are

held for diversification. Investments within asset classes are to be

diversified to achieve broad market participation and reduce the

impact of individual managers or investments. Duke Energy regularly

reviews its actual asset allocation and periodically rebalances its

investments to its targeted allocation when considered appropriate.

Duke Energy also invests other post-retirement assets in the Duke

Energy Corporation Employee Benefits Trust (VEBA I). The

investment objective of VEBA I is to achieve sufficient returns, subject

to a prudent level of portfolio risk, for the purpose of promoting the

59