Duke Energy 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

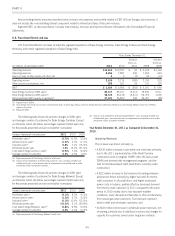

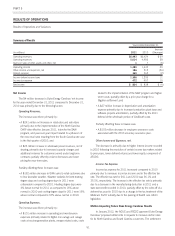

Year Ended December 31, 2011 as Compared to December 31,

2010

Operating Revenues.

The decrease was driven primarily by the deconsolidation of

DukeNet Communications, LLC (DukeNet) in December 2010 and

the subsequent accounting for Duke Energy’s investment in DukeNet

as an equity method investment.

Operating Expenses.

The decrease was driven primarily by $172 million of 2010

employee severance costs related to the voluntary severance plan and

the consolidation of certain corporate office functions from the

Midwest to Charlotte, North Carolina, prior year donations of $56

million to the Duke Energy Foundation, which is a nonprofit

organization funded by Duke Energy shareholders that makes

charitable contributions to selected nonprofits and government

subdivisions, a decrease as a result of the DukeNet deconsolidation

in December 2010 and the subsequent accounting for Duke Energy’s

investment in DukeNet as an equity method investment, lower

corporate costs, and a prior year litigation reserve; partially offset by

higher costs related to the proposed merger with Progress Energy.

Gains/ (Losses) on sales of other assets and other, net.

The decrease was primarily due to the $139 million gain from

the sale of a 50% ownership interest in DukeNet in the prior year.

Other Income and Expenses, net.

ThedecreasewasdueprimarilytothesaleofDukeEnergy’s

ownership interest in Q-Comm in the prior year of $109 million;

partially offset by prior year impairments and 2011 gains on sales of

investments.

EBIT.

As discussed above, the decrease was due primarily to gains

recognized in 2010 on the sale of a 50% ownership interest in

DukeNet, the sale of Duke Energy’s ownership interest in Q-Comm in

the prior year and higher costs related to the proposed merger;

partially offset by prior year employee severance costs, prior year

donations to the Duke Energy Foundation, lower corporate costs and

a prior year litigation reserve.

Matters Impacting Future Other Results

Duke Energy previously held an effective 50% interest in

Crescent, which was a real estate joint venture formed by Duke

Energy in 2006 that filed for Chapter 11 bankruptcy protection in

June 2009. On June 9, 2010, Crescent restructured and emerged

from bankruptcy and Duke Energy forfeited its entire 50% ownership

interest to Crescent debt holders. This forfeiture caused Duke Energy

to recognize a tax loss, for tax purposes, on its interest in the second

quarter of 2010. Although Crescent has reorganized and emerged

from bankruptcy with creditors owning all Crescent interest, there

remains uncertainty as to the tax treatment associated with the

restructuring. Based on this uncertainty, it is possible that Duke

Energy could incur a future tax liability related to the tax losses

associated with its partnership interest in Crescent and the resolution

of issues associated with Crescent’s emergence from bankruptcy.

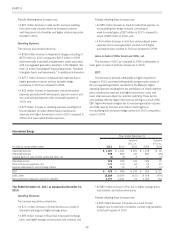

Year Ended December 31, 2010 as Compared to December 31,

2009

Operating Expenses.

The increase was driven primarily by $172 million of employee

severance costs related to the 2010 voluntary severance plan and the

consolidation of certain corporate office functions from the Midwest to

Charlotte, North Carolina, donations of $56 million to the Duke

Energy Foundation, which is a nonprofit organization funded by Duke

Energy shareholders that makes charitable contributions to selected

nonprofits and government subdivisions and a litigation reserve.

Gains/ (Losses) on sales of other assets and other, net.

The increase was primarily due to the $139 million gain from

the sale of a 50% ownership interest in DukeNet in the fourth quarter

of 2010.

Other Income and Expenses, net.

TheincreasewasdueprimarilytothesaleofDukeEnergy’s

ownership interest in Q-Comm, and a 2009 charge related to certain

guarantees Duke Energy had issued on behalf of Crescent.

EBIT.

As discussed above, the decrease was due primarily to

employee severance costs, donations to the Duke Energy Foundation,

and a litigation reserve; partially offset by gains recognized on the sale

of a 50% ownership interest in DukeNet and the sale of Duke

Energy’s ownership interest in Q-Comm.

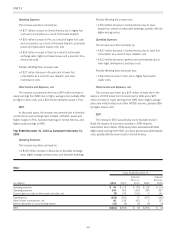

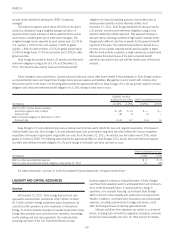

DUKE ENERGY CAROLINAS

INTRODUCTION

Management’s Discussion and Analysis should be read in

conjunction with the accompanying Consolidated Financial

Statements and Notes for the years ended December 31, 2011,

2010 and 2009.

BASIS OF PRESENTATION

The results of operations and variance discussion for Duke

Energy Carolinas is presented in a reduced disclosure format in

accordance with General Instruction (I)(2)(a) of Form 10-K.

50