Duke Energy 2011 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

creditors of Duke Energy Carolinas. As a result of the securitization,

on a daily basis Duke Energy Carolinas sells certain accounts

receivable, arising from the sale of electricity and/or related services as

part of Duke Energy Carolinas’ franchised electric business, to DERF.

In order to fund its purchases of accounts receivable, DERF has a

$300 million secured credit facility with a commercial paper conduit,

which terminates in August 2013. The credit facility and related

securitization documentation contain several covenants, including

covenants with respect to the accounts receivable held by DERF, as

well as a covenant requiring that the ratio of Duke Energy Carolinas’

consolidated indebtedness to Duke Energy Carolinas’ consolidated

capitalization not exceed 65%. As of December 31, 2011 and

2010, the interest rate associated with the credit facility, which is

based on commercial paper rates, was 1.1% and 1.2%, respectively,

and $300 million was outstanding under the credit facility as of both

December 31, 2011 and 2010. The securitization transaction was

not structured to meet the criteria for sale accounting treatment under

the accounting guidance for transfers and servicing of financial assets

and, accordingly, is reflected as a secured borrowing in the

Consolidated Balance Sheets. As of December 31, 2011 and 2010,

the outstanding balance of the credit facility was secured by $581

million and $637 million, respectively, of accounts receivable held by

DERF. The obligations of DERF under the credit facility with a

commercial paper conduit are non-recourse to Duke Energy

Carolinas. DERF meets the accounting definition of a VIE and is

subject to the accounting rules for consolidation and transfers of

financial assets. See Note 17 for further information on VIEs.

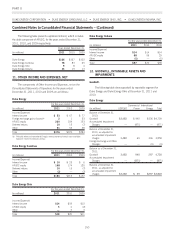

Floating Rate Debt.

Unsecured debt, secured debt and other debt includes floating-rate instruments. Floating-rate instruments are primarily based on

commercial paper rates or a spread relative to an index such as LIBOR for debt denominated in U.S. dollars. The following table shows floating

rate debt and the average interest rate associated with floating rate debt by registrant as of December 31, 2011 and 2010:

December 31, 2011 December 31, 2010

(in millions)

Floating Debt

Balance

Average Interest

Rate

Floating Debt

Balance

Average Interest

Rate

Duke Energy(a) $2,926 1.5% $2,851 1.6%

Duke Energy Carolinas 695 0.7% 695 0.8%

Duke Energy Ohio 525 0.5% 525 0.5%

Duke Energy Indiana 802 0.5% 502 0.4%

(a) Excludes $353 million and $376 million of Brazilian debt at December 31, 2011 and 2010, respectively, that is indexed annually to Brazilian inflation.

Maturities and Call Options

Annual Maturities as of December 31, 2011

(in millions) Duke Energy

Duke Energy

Carolinas

Duke Energy

Ohio

Duke Energy

Indiana

2012 $ 1,894 $1,178 $ 507 $ 6

2013 1,843 705 263 405

2014 1,609 46 46 5

2015 1,190 506 5 5

2016 1,762 655 54 479

Thereafter 12,275 6,184 1,680 2,559

Total long-term debt, including current maturities $20,573 $9,274 $2,555 $3,459

The Duke Energy Registrants have the ability under certain debt

facilities to call and repay the obligation prior to its scheduled

maturity. Therefore, the actual timing of future cash repayments

could be materially different than the above as a result of Duke

Energy Registrant’s ability to repay these obligations prior to their

scheduled maturity.

Available Credit Facilities.

In November 2011, Duke Energy entered into a new $6 billion,

five-year master credit facility, with $4 billion available at closing and

the remaining $2 billion available following successful completion of

the proposed merger with Progress Energy. The Duke Energy

Registrants each have borrowing capacity under the master credit

142