Duke Energy 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

• A $107 million decrease in retail fuel and purchased power

expenses due to lower generation volumes driven by increased

customer switching levels in 2011 compared to 2010;

• A $64 million decrease in depreciation and amortization costs

primarily due to decreased regulatory transition charge

amortization;

• A $63 million decrease in regulated fuel expense primarily due

to reduced sales volumes and lower natural gas costs;

• A $24 million decrease in employee severance costs related to

the 2010 voluntary severance plan and the consolidation of

certain corporate office functions from the Midwest to

Charlotte, North Carolina.

Partially offsetting these decreases were:

• A $159 million increase in wholesale fuel expenses due to

higher generation volumes;

• A $72 million increase in operating and maintenance

expenses primarily from the recognition of Midwest ISO exit

fees and higher maintenance expenses; and

• A $29 million increase in mark-to-market fuel expense on

non-qualifying fuel hedge contracts, consisting of

mark-to-market losses of $3 million in 2011 compared to

gains of $26 million in 2010.

Other Income and Expenses, net.

The decrease in 2011 compared to 2010 is primarily

attributable to reduced interest income accrued for uncertain income

tax positions.

Income Tax Expense.

Income tax expense for 2011 increased compared to 2010

primarily due to increases in pre-tax income and in the effective tax

rate. The effective tax rate in 2011 was 33.1% compared to an

effective tax rate for the same period in 2010 of (43.0%). The

change in the effective tax rate is primarily due to a $677 million

non-deductible impairment of goodwill in 2010, as discussed above.

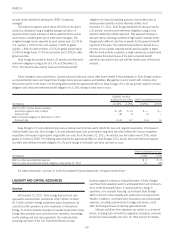

Matters Impacting Future Duke Energy Ohio Results

Duke Energy Ohio operated under an ESP that expired on

December 31, 2011. The PUCO approved Duke Energy Ohio’s new

ESP in November 2011. The new ESP effectively separates the

generation of electricity from Duke Energy Ohio’s retail load obligation

as of January 1, 2012. Duke Energy Ohio’s retail load obligation is

satisfied through competitive auctions, the costs of which are

recovered from customers. Duke Energy Ohio now earns retail margin

on the transmission and distribution of electricity only and not on the

cost of the underlying energy. Duke Energy Ohio’s coal-fired

generation assets no longer serve retail load customers or receive

negotiated pricing under the ESP. The coal-fired generation assets

began dispatching all of their electricity into unregulated markets in

January 2012 and going forward will receive wholesale energy

margins and capacity revenues from PJM at rates currently below

those previously collected under the prior ESP. These lower energy

margins and capacity revenues are expected to be partially offset by a

non-bypassable stability charge collected from Duke Energy Ohio’s

retail customers through 2014. As a result, Duke Energy’s operating

revenues and net income will be negatively impacted.

Duke Energy Ohio’s gas-fired non-regulated generation assets

earn capacity revenues from PJM. PJM capacity prices are

determined through an auction process for planning years from June

through May of the following year and are conducted approximately

three years in advance of the capacity delivery period. Capacity prices

for periods beginning June 2011 and continuing through May 2014,

will be significantly lower than current and historical capacity prices.

As a result, Duke Energy Ohio’s operating revenues and net income

will be negatively impacted through 2014.

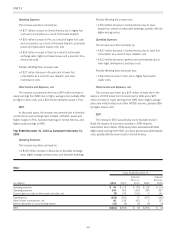

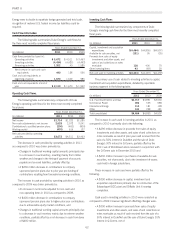

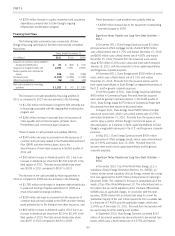

DUKE ENERGY INDIANA

INTRODUCTION

Management’s Discussion and Analysis should be read in

conjunction with the accompanying Consolidated Financial

Statements and Notes for the years ended December 31, 2011,

2010 and 2009.

BASIS OF PRESENTATION

The results of operations and variance discussion for Duke

Energy Indiana is presented in a reduced disclosure format in

accordance with General Instruction (I)(2)(a) of Form 10-K.

53