Duke Energy 2011 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

Other Impairments.

As a result of project cost overages related to the Edwardsport

IGCC plant, Duke Energy Indiana recorded pre-tax charges to

earnings of $222 million in the third quarter of 2011 and $44

million in the third quarter of 2010.

Refer to Note 4 for a further discussion of the Edwardsport IGCC

project.

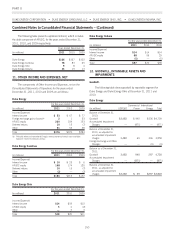

13. INVESTMENTS IN UNCONSOLIDATED AFFILIATES

AND RELATED PARTY TRANSACTIONS

Duke Energy

Investments in domestic and international affiliates that are not

controlled by Duke Energy, but over which it has significant

influence, are accounted for using the equity method. Significant

investments in affiliates accounted for under the equity method are as

follows:

Commercial Power.

As of December 31, 2011, 2010 and 2009, investments

accounted for under the equity method primarily consist of Duke

Energy’s approximate 50% ownership interest in the five Sweetwater

projects (Phase I-V), which are wind power assets located in Texas

that were acquired as part of the acquisition of Catamount and a

49% ownership interest in Suez-DEGS Solutions of Ashtabula LLC.

As of December 31, 2011, Duke Energy held a 50% ownership

interest INDU Solar Holdings, LLC.

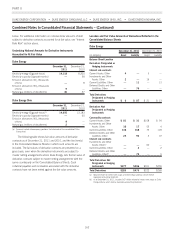

International Energy.

As of December 31, 2011, 2010 and 2009, Duke Energy

accounted for under the equity method a 25% indirect interest in

NMC, which owns and operates a methanol and MTBE business in

Jubail, Saudi Arabia.

As of December 31, 2011 and 2010, Duke Energy’s wholly-

owned subsidiary, CGP Global Greece Holdings S.A. (CGP Greece)

has as its only asset the 25% indirect interest in Attiki, and its only

third-party liability is a debt obligation that is secured by the 25%

indirect interest in Attiki. The debt obligation is also secured by Duke

Energy’s indirect wholly-owned interest in CGP Greece and is

otherwise non-recourse to Duke Energy. This debt obligation of $64

million and $66 million as of December 31, 2011 and 2010,

respectively, is reflected in Current Maturities of Long-Term Debt on

Duke Energy’s Consolidated Balance Sheets. As of December 31,

2011 and 2010, Duke Energy’s investment balance in Attiki was

$64 million and $66 million, respectively.

In November 2009, CGP Greece failed to make a scheduled

semi-annual installment payment of principal and interest on the debt

and in December 2009, Duke Energy decided to abandon its

investment in Attiki and the related non-recourse debt. The decision

to abandon the investment in Attiki was made in part due to the

non-strategic nature of the investment. In January 2010 the

counterparty to the debt issued a Notice of Event of Default, asserting

its rights to exercise CGP Greece’s voting rights in and receive CGP

Greece’s share of dividends paid by Attiki.

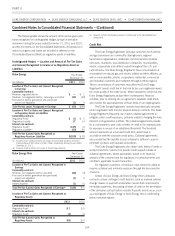

During 2010, the counterparty to the debt commenced a

process with the joint venture parties to find a buyer for CGP Greece’s

25% indirect interest in Attiki. Effective in January 2010, Duke

Energy no longer accounts for Attiki under the equity method, and the

investment balance remaining on Attiki was transferred to Other

within Assets on the Consolidated Balance Sheet as Duke Energy

retains legal ownership of the investment. In December 2011, Duke

Energy entered into an agreement to sell its ownership interest in

Attiki to an existing equity owner in a series of transactions that will

result in the full discharge of its debt obligations. If all conditions of

this agreement are met, Duke Energy expects the transaction to close

in March 2012.

Other.

As of December 31, 2011 and 2010, investments accounted

for under the equity method primarily include a 50% ownership

interest in the telecommunications investment, DukeNet. As of

December 31, 2009, investments accounted for under the equity

method primarily included telecommunications investments.

In December 2010, as discussed in Note 3, Duke Energy

completed an agreement with Alinda to sell a 50% ownership

interest in DukeNet. As a result of the disposition transaction,

DukeNet and Alinda are equal 50% owners in the new joint venture.

Subsequent to the closing of the DukeNet disposition transaction,

effective on December 21, 2010, DukeNet is no longer consolidated

into Duke Energy’s consolidated financial statements and is

accounted for by Duke Energy as an equity method investment.

On December 2, 2010, Duke Energy completed the sale of its

30% equity investment in Q-Comm to Windstream Corp.

(Windstream). The sale resulted in $165 million in net proceeds,

including $87 million of Windstream common shares and a $109

million pre-tax gain recorded in Gains (Losses) on Sales and

Impairments of Unconsolidated Affiliates on the Consolidated

Statements of Operations.

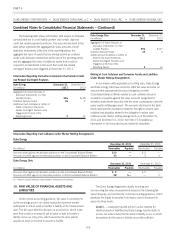

Additionally, Other included Duke Energy’s effective 50%

interest in Crescent which, as discussed further below, has a carrying

value of zero. Crescent emerged from bankruptcy in June 2010 and

following the bankruptcy proceeding, Duke Energy no longer has any

ownership interest in Crescent.

See Note 7 for a discussion of charges recorded in 2009 related

to performance guarantees issued by Duke Energy on behalf of

Crescent. Crescent filed Chapter 11 petitions in a U.S. Bankruptcy

Court in June 2009.

As of December 31, 2010 and 2009, the carrying amount of

investments in affiliates with carrying amounts greater than zero

approximated the amount of underlying equity in net assets.

155