Duke Energy 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

rates, political conditions and policies of foreign governments.

Changes in these factors are difficult to predict and may impact Duke

Energy’s future results.

Duke Energy also relies on access to both short-term money

markets and longer-term capital markets as a source of liquidity for

capital requirements not met by cash flow from operations. An

inability to access capital at competitive rates or at all could adversely

affect Duke Energy’s ability to implement its strategy. Market

disruptions or a downgrade of Duke Energy’s credit rating may

increase its cost of borrowing or adversely affect its ability to access

one or more sources of liquidity. For further information related to

management’s assessment of Duke Energy’s risk factors, see

Item 1A. “Risk Factors.”

RESULTS OF OPERATIONS

Duke Energy

In this section, Duke Energy provides analysis and discussion of

earnings and factors affecting earnings on both a GAAP and

non-GAAP basis.

Management evaluates financial performance in part based on

the non-GAAP financial measure, Adjusted Earnings, which is

measured as income from continuing operations after deducting

income attributable to noncontrolling interests, adjusted for the

impact of special items and the mark-to-market impacts of economic

hedges in the Commercial Power segment. Special items represent

certain charges and credits, which management believes will not be

recurring on a regular basis, although it is reasonably possible such

charges and credits could recur. Mark-to-market adjustments reflect

the mark-to-market impact of derivative contracts, which is

recognized in GAAP earnings immediately as such derivative

contracts do not qualify for hedge accounting or regulatory accounting

treatment, used in Duke Energy’s hedging of a portion of economic

value of its generation assets in the Commercial Power segment. The

economic value of the generation assets is subject to fluctuations in

fair value due to market price volatility of the input and output

commodities (e.g., coal, power) and, as such, the economic hedging

involves both purchases and sales of those input and output

commodities related to the generation assets. Because the operations

of the generation assets are accounted for under the accrual method,

management believes that excluding the impact of mark-to-market

changes of the economic hedge contracts from operating earnings

until settlement better matches the financial impacts of the hedge

contract with the portion of economic value of the underlying hedged

asset. Management believes that the presentation of Adjusted

Earnings provides useful information to investors, as it provides them

an additional relevant comparison of Duke Energy’s performance

across periods. Management uses this non-GAAP financial measure

for planning and forecasting and for reporting results to the Board of

Directors, employees, shareholders, analysts and investors

concerning Duke Energy’s financial performance. The most directly

comparable GAAP measure for Adjusted Earnings is net income

attributable to Duke Energy common shareholders, which includes

the impact of special items, the mark-to-market impacts of economic

hedges in the Commercial Power segment and discontinued

operations.

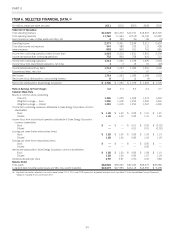

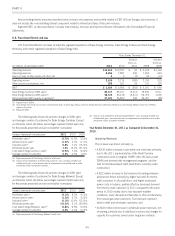

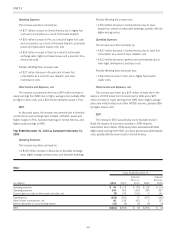

OVERVIEW

The following table reconciles the non-GAAP financial measure Adjusted Earnings to the GAAP measure Net income attributable to Duke

Energy (amounts are net of tax and, except for per-share amounts, are in millions):

Years Ended December 31,

2011 2010 2009

Amount

Per

diluted

share Amount

Per

diluted

share Amount

Per

diluted

share

Adjusted Earnings $1,943 $ 1.46 $1,882 $ 1.43 $1,577 $ 1.22

Economic Hedges (Mark-to-Market) (1) — 21 0.01 (38) (0.03)

Asset Sales ——154 0.12 — —

Costs to Achieve Mergers (51) (0.04) (17) (0.01) (15) (0.01)

Crescent Related Guarantees and Tax Adjustments —— — — (29) (0.02)

Edwardsport Impairment (135) (0.10) —— —

Emission Allowance Impairment (51) (0.04) —— —

Employee Severance and Office Consolidation ——(105) (0.08) —

Goodwill and Other Asset Impairments ——(602) (0.46) (410) (0.32)

Litigation Reserves ——(16) (0.01) —

International Transmission Adjustment —— — — (22) (0.02)

Income from Discontinued Operations 1— 3 — 12 0.01

Net income attributable to Duke Energy $1,706 $ 1.28 $1,320 $ 1.00 $1,075 $ 0.83

40