Duke Energy 2011 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

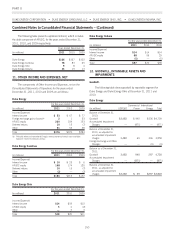

Combined Notes to Consolidated Financial Statements – (Continued)

Unsecured Debt.

In November 2011, Duke Energy issued $500 million of senior

notes, which carry a fixed interest rate of 2.15% and mature

November 15, 2016. Proceeds from the issuance will be used to

fund capital expenditures in Duke Energy’s unregulated businesses in

the U.S. and for general corporate purposes.

In August 2011, Duke Energy issued $500 million principal

amount of senior notes, which carry a fixed interest rate of 3.55%

and mature September 15, 2021. Proceeds from the issuance will

be used to repay a portion of Duke Energy’s commercial paper as it

matures, to fund capital expenditures in Duke Energy’s unregulated

businesses in the U.S. and for general corporate purposes.

In July 2010, International Energy issued $281 million

principal amount in Brazil, which carries an interest rate of 8.59%

plus IGP-M (Brazil’s monthly inflation index) non-convertible

debentures due July 2015. Proceeds of the issuance were used to

refinance Brazil debt related to DEIGP and for future debt maturities

in Brazil.

In March 2010, Duke Energy issued $450 million principal

amount of 3.35% senior notes due April 1, 2015. Proceeds from the

issuance were used to repay $274 million of borrowings under the

master credit facility and for general corporate purposes.

First Mortgage Bonds.

In December 2011, Duke Energy Carolinas issued $1 billion

principal amount of first mortgage bonds, of which $350 million

carry a fixed interest rate of 1.75% and mature December 15, 2016

and $650 million carry a fixed interest rate of 4.25% and mature

December 15, 2041. Proceeds from the issuances were used to

repay $750 million 6.25% senior unsecured notes which matured

January 15, 2012, with the remainder to fund capital expenditures

and for general corporate purposes.

In May 2011, Duke Energy Carolinas issued $500 million

principal amount of first mortgage bonds, which carry a fixed interest

rate of 3.90% and mature June 15, 2021. Proceeds from this

issuance were used to fund capital expenditures and for general

corporate purposes.

In July 2010, Duke Energy Indiana issued $500 million

principal amount of 3.75% first mortgage bonds due July 15, 2020.

Proceeds from the issuance were used to repay $123 million of

borrowings under Duke Energy’s master credit facility, to fund Duke

Energy Indiana’s ongoing capital expenditures and for general

corporate purposes.

In June 2010, Duke Energy Carolinas issued $450 million

principal amount of 4.30% first mortgage bonds due June 15,

2020. Proceeds from the issuance were used to fund Duke Energy

Carolinas’ ongoing capital expenditures and for general corporate

purposes.

Other Debt.

At December 31, 2011, Duke Energy Carolinas had $400

million principal amount of 5.625% senior unsecured notes due

November 2012 classified as Current maturities of long-term debt on

Duke Energy Carolinas’ Consolidated Balance Sheets. At

December 31, 2010, these notes were classified as Long-term Debt

on Duke Energy Carolinas’ Consolidated Balance Sheets. Duke

Energy Carolinas currently anticipates satisfying this obligation with

proceeds from additional borrowings.

At December 31, 2011, Duke Energy Carolinas had $750

million principal amount of 6.25% senior unsecured notes due

January 2012 classified as Current maturities of long-term debt on

Duke Energy Carolinas’ Consolidated Balance Sheets. At

December 31, 2010, these notes were classified as Long-term Debt

on Duke Energy Carolinas’ Consolidated Balance Sheets. As noted

above, in January 2012, Duke Energy Carolinas satisfied this

obligation with proceeds from borrowings under its December 2011

debt issuance.

At December 31, 2011, Duke Energy Ohio had $500 million

principal amount of 5.70% debentures due September 2012

classified as Current maturities of long-term debt on Duke Energy

Ohio’s Consolidated Balance Sheets. At December 31, 2010, these

notes were classified as Long-term Debt on Duke Energy Ohio’s

Consolidated Balance Sheets. Duke Energy Ohio currently anticipates

satisfying this obligation with proceeds from additional borrowings.

In April 2011, Duke Energy filed a registration statement

(Form S-3) with the SEC to sell up to $1 billion variable

denomination floating rate demand notes, called PremierNotes. The

Form S-3 states that no more than $500 million of the notes will be

outstanding at any particular time. The notes are offered on a

continuous basis and bear interest at a floating rate per annum

determined by the Duke Energy PremierNotes Committee, or its

designee, on a weekly basis. The interest rate payable on notes held

by an investor may vary based on the principal amount of the

investment. The notes have no stated maturity date, but may be

redeemed in whole or in part by Duke Energy at any time. The notes

arenon-transferableandmayberedeemedinwholeorinpartatthe

investor’s option. Proceeds from the sale of the notes will be used for

general corporate purposes. The balance as of December 31, 2011,

is $79 million. The notes reflect a short-term debt obligation of Duke

Energy and are reflected as Notes payable on Duke Energy’s

Consolidated Balance Sheets.

In September 2010, Duke Energy Carolinas converted $143

million of tax-exempt variable-rate demand bonds to tax-exempt term

bonds, which carry a fixed interest rate of 4.375% and mature

October 2031. Prior to the conversion, the bonds were held by Duke

Energy Carolinas as treasury bonds. In connection with the

conversion, the tax-exempt bonds were secured by a series of Duke

Energy Carolinas’ first mortgage bonds.

140