Duke Energy 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

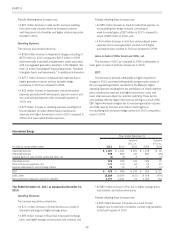

Operating Expenses.

The increase was driven primarily by:

• A $315 million increase in fuel expense (including purchased

power and natural gas purchases for resale) primarily due to

higher volume of coal and gas used in electric generation

resulting from favorable weather conditions, and higher coal

prices, partially offset by lower natural gas prices to full-service

retail customers;

• A $162 million increase in operating and maintenance

expenses primarily due to costs related to the implementation

of the save-a-watt program, higher customer service

operations costs, higher benefit costs, higher nuclear, power

and gas delivery maintenance costs, higher outage costs at

fossil generation stations, and the disallowance in 2010 of a

portion of previously deferred costs in Ohio related to the 2008

Hurricane Ike wind storm, partially offset by overall lower

storm costs, including the establishment of a regulatory asset

to defer previously recognized costs related to an ice storm in

Indiana in early 2009;

• A $96 million increase in depreciation and amortization due

primarily to increases in depreciation as a result of additional

capital spending and amortization of regulatory assets; and

• A $44 million disallowance charge related to the Edwardsport

IGCC plant that is currently under construction. See Note 4 to

the Consolidated Financial Statements, “Regulatory Matters,”

for additional information.

Gains on Sales of Other Assets and Other, net.

The decrease is attributable primarily to lower net gains on sales

of emission allowances in 2010 compared to 2009.

Other Income and Expenses, net.

The increase resulted primarily from a higher equity component

of AFUDC from additional capital spending for increased construction

expenditures related to new generation and higher deferred returns.

EBIT.

As discussed above, the increase resulted primarily from overall

net higher retail pricing and rate riders, favorable weather, higher

equity component of AFUDC, higher wholesale power revenues, and

higher weather adjusted sales volumes. These positive impacts were

partially offset by higher operating and maintenance expenses,

increased depreciation and amortization, and the disallowance

charge related to the Edwardsport IGCC plant that is currently under

construction.

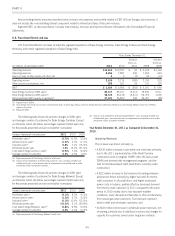

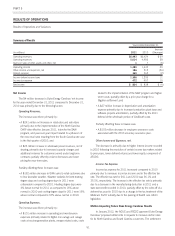

Commercial Power

Years Ended December 31,

(in millions, except where noted) 2011 2010

Variance

2011 vs.

2010 2009

Variance

2010 vs.

2009

Operating revenues $2,491 $ 2,448 $ 43 $ 2,114 $ 334

Operating expenses 2,275 2,710 (435) 2,134 576

Gains on sales of other assets and other, net 14 6812(6)

Operating income (loss) 230 (256) 486 (8) (248)

Other income and expenses, net 835 (27) 35 —

Expense attributable to noncontrolling interest 13 85—8

EBIT $225$ (229) $ 454 $ 27 $ (256)

Actual plant production, GWh 32,531 28,754 3,777 26,962 1,792

Net proportional megawatt capacity in operation 8,325 8,272 53 8,005 267

Year Ended December 31, 2011 as compared to December 31,

2010

Operating Revenues.

The increase was primarily driven by:

• A $240 million increase in wholesale electric revenues due to

higher generation volumes, net of lower pricing and lower

margin earned from participation in wholesale auctions in

2011; and

• A $53 million increase in renewable generation revenues due

to additional renewable generation facilities placed in service

after 2010 and a full year of operations for renewable

generation facilities placed in service throughout 2010.

Partially offsetting these increases were:

• A $178 million decrease in retail electric revenues resulting

from lower sales volumes driven by increased customer

switching levels and unfavorable weather net of higher retail

pricing under the ESP in 2011; and

• A $66 million decrease in DEGS revenues, excluding

renewables, due primarily to a contract termination and plant

maintenance.

46