Duke Energy 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

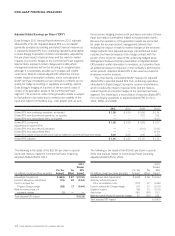

Indiana

Cost pressures have challenged our Edwardsport IGCC

project in Indiana during construction. A proposal pending

with the Indiana Utility Regulatory Commission would

cap our recoverable construction costs at $2.72 billion,

excluding financing costs. This is more than the

$2.35 billion previously approved, but less than our

current project estimate of $2.98 billion (also excluding

financing costs).

Though interveners to the cost increase proceedings

have alleged the company concealed information and

mismanaged the project, we presented a strong case on

the company’s behalf at extensive hearings before the

Indiana commission that concluded in January, including

extensive testimony from independent experts.

We believe the costs of the Edwardsport project were

reasonable, prudent and necessary. We do not expect a

commission decision before the end of the third quarter

of this year.

Ohio

We have spent the last year seeking longer-term clarity

on the regulatory mechanisms for generation in Ohio. The

returns from our Ohio retail electric business have declined

over the past several years, as customers switched to other

generation suppliers with lower market-based prices.

On November 22, 2011, the Public Utilities

Commission of Ohio (PUCO) approved a new ESP

for Duke Energy Ohio. This ESP, which extends

through May 2015, balances the needs of customers

and investors, while also recognizing Ohio’s preference

for competitive markets. It ensures that our customers

will be better able to take advantage of today’s low market

rates, and it also gives the company strategic flexibility.

Key terms of the ESP include a three-year non-bypassable

stability charge totaling $330 million that will be collected

through 2014, market-based customer rates established

through competitive auctions, and the ability to transfer

Duke Energy Ohio generating assets to a non-regulated

affiliate or subsidiary no later than the end of 2014.

The first wholesale generation auction under the

new ESP resulted in a 17.5 percent lower rate for

a typical Duke Energy Ohio customer. Additionally,

on January 1, 2012, we completed the move of

the Duke Energy Ohio and Duke Energy Kentucky

transmission systems from the Midwest Independent

System Operator (MISO) to the PJM Interconnection

regional transmission organization, connecting us

with new market opportunities.

Positioned for commercial success

In 2011, our domestic and international commercial

businesses contributed $984 million, or approximately

27 percent of our total adjusted segment EBIT, due in

large part to exceptional earnings from our international

business. In 2012, we expect our Commercial Power

and International businesses will deliver approximately

25 percent of our adjusted segment net income.

In October I visited our Duke Energy International

operations in Peru and Brazil. I can confirm that the

people and assets there are every bit as impressive

as their 2011 earnings results. It was clear to me that

our corporate culture of safety, customer service and

operational excellence translates seamlessly across

our company’s international operations.

We have invested more than $2.5 billion in our

commercial renewable energy business since 2007.

This will be a record year for wind energy development at

Duke Energy, as we are on schedule to complete a total of

five large-scale wind farms located in Kansas, Pennsylvania

and Texas. By the end of 2012, Duke Energy Renewables

will own and operate more than 1,800 MW of wind and

solar power, virtually all of which is underpinned by long-

term power purchase agreements with other utilities.

In 2011, we advanced our commercial transmission

business through formation of a joint venture with

American Transmission Company to develop critically

needed long-distance transmission projects across

North America. Pioneer Transmission, a Duke and

AEP joint venture, aims to build and operate 240 miles

CHAIRMAN’S LETTER TO STAKEHOLDERS

6 DUKE ENERGY CORPORATION 2011 ANNUAL REPORT