Duke Energy 2011 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

In September 2010, Duke Energy Carolinas converted $100

million of tax-exempt variable-rate demand bonds, to tax-exempt term

bonds, which carry a fixed interest rate of 4.625% and mature

November 1, 2040. In connection with the conversion, the

tax-exempt bonds were secured by a series of Duke Energy Carolinas’

first mortgage bonds.

In September 2010, Duke Energy Indiana refunded $70 million

of tax-exempt auction rate bonds through the issuance of $70 million

principal amount of tax-exempt term bonds, of which $60 million

carry a fixed interest rate of 3.375% and mature March 1, 2019 and

$10 million carry a fixed interest rate of 3.75% and mature April 1,

2022. In connection with the conversion, the tax-exempt bonds were

secured by a series of Duke Energy Indiana’s first mortgage bonds.

Non-Recourse Notes Payable of VIEs.

To fund the purchase of receivables, CRC borrows from third

parties and such borrowings fluctuate based on the amount of

receivables sold to CRC. The borrowings are secured by the assets of

CRCandarenon-recoursetoDukeEnergy.Thedebtisrecordedas

short term as the facility has an expiration date of October 2012. At

December 31, 2011 and 2010, CRC borrowings were $273 million

and $216 million, respectively, and are reflected as Non-Recourse

Notes Payable of VIEs on Duke Energy’s Consolidated Balance

Sheets.

Non-Recourse Long-Term Debt of VIEs.

In December 2010, Top of the World Wind Energy LLC, a

subsidiary of DEGS, an indirect wholly-owned subsidiary of Duke

Energy, entered into a long-term loan agreement for $193 million

principal amount maturing in December 2028. The collateral for this

loan is substantially all of the assets of Top of the World Windpower

LLC. The initial interest rate on the notes is the six month adjusted

LIBOR plus an applicable margin. In connection with this debt

issuance, DEGS entered into an interest rate swap to convert the

substantial majority of the loan interest payments from a variable rate

to a fixed rate of 3.465% plus the applicable margin, which was

2.375% as of December 31, 2011. Proceeds from the issuance will

be used to help fund the existing wind portfolio.

In May 2010, Green Frontier Wind Power, LLC, a subsidiary of

DEGS, an indirect wholly-owned subsidiary of Duke Energy, entered

into a long-term loan agreement for $325 million principal amount

maturing in 2025. The collateral for this loan is a group of five wind

farms located in Wyoming, Colorado and Pennsylvania. The initial

interest rate on the notes is the six month adjusted London Interbank

Offered Rate (LIBOR) plus an applicable margin. In connection with

this debt issuance, DEGS entered into an interest rate swap to convert

the substantial majority of the loan interest payments from a variable

rate to a fixed rate of 3.4% plus the applicable margin, which was

2.5% as of December 31, 2011. Proceeds from the issuance will be

used to help fund the existing wind portfolio. As this debt is

non-recourse to Duke Energy, the balance at December 31, 2011

and 2010 is classified within Non-Recourse Long-term Debt of VIEs

in Duke Energy’s Consolidated Balance Sheets.

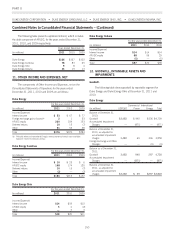

Money Pool.

The Subsidiary Registrants receive support for their short-term

borrowing needs through participation with Duke Energy and certain

of its subsidiaries in a money pool arrangement. Under this

arrangement, those companies with short-term funds may provide

short-term loans to affiliates participating under this arrangement. The

money pool is structured such that the Subsidiary Registrants

separately manage their cash needs and working capital

requirements. Accordingly, there is no net settlement of receivables

and payables between the money pool participants. Per the terms of

the money pool arrangement, the parent company, Duke Energy,

may loan funds to its participating subsidiaries, but may not borrow

funds through the money pool. Accordingly, as the money pool

activity is between Duke Energy and its wholly-owned subsidiaries,

all money pool balances are eliminated within Duke Energy’s

Consolidated Balance Sheets. The following table shows the

Subsidiary Registrants’ money pool balances and classification within

their respective Consolidated Balance Sheets as of December 31,

2011 and 2010.

December 31, 2011 December 31, 2010

(in millions) Receivables Notes Payable Long-term Debt Receivables Long-term Debt

Duke Energy Carolinas $923 $ — $300 $339 $300

Duke Energy Ohio 311 — — 480 —

Duke Energy Indiana — 300 150 115 150

Increases or decreases in money pool receivables are reflected

within investing activities on the respective Subsidiary Registrants

Consolidated Statements of Cash Flows, while increases or decreases

in money pool borrowings are reflected within financing activities on

the respective Subsidiary Registrants Consolidated Statements of

Cash Flows.

Accounts Receivable Securitization.

Duke Energy Carolinas securitizes certain accounts receivable

through Duke Energy Receivables Finance Company, LLC (DERF), a

bankruptcy remote, special purpose subsidiary. DERF is a wholly-

owned limited liability company with a separate legal existence from

its parent, and its assets are not intended to be generally available to

141