Duke Energy 2011 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

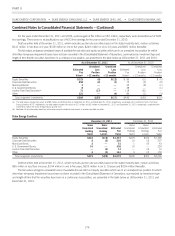

the security to make scheduled interest or principal payments and

any changes to the rating of the security by rating agencies. If it is

determined that a credit loss exists, the amount of impairment write-

down to fair value would be split between the credit loss, which

would be recognized in earnings, and the amount attributable to all

other factors, which would be recognized in other comprehensive

income. Since management believes, based on consideration of the

criteria above, that no credit loss exists as of December 31, 2011

and 2010, and management does not have the intent to sell such

investments in auction rate debt securities and the investments in

debt securities within its captive insurance investment portfolio, and

foreign operations investment portfolio, and it is not more likely than

not that management will be required to sell these securities before

the anticipated recovery of their cost basis, management concluded

that there were no other-than-temporary impairments necessary as of

December 31, 2011 and 2010. Accordingly, all changes in the

market value of investments in auction rate debt securities, captive

insurance investments, and foreign operation investments were

reflected as a component of other comprehensive income in 2011

and 2010. See Note 15 for additional information related to fair value

measurements for investments in auction rate debt securities.

Management will continue to monitor the carrying value of its

entire portfolio of investments in the future to determine if any

additional other-than-temporary impairment losses should be

recorded.

Investments in debt and equity securities are classified as either

short-term investments or long-term investments based on

management’s intent and ability to sell these securities, taking into

consideration liquidity factors in the current markets with respect to

certain short-term investments that have historically provided for a

high degree of liquidity, such as investments in auction rate debt

securities.

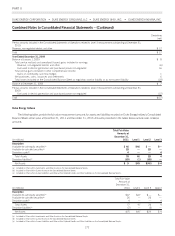

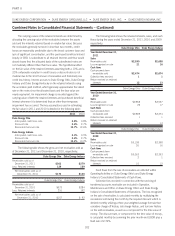

Short-term investments.

During the year ended December 31, 2011, Duke Energy

purchased $190 million of corporate debt securities using excess

cash from its foreign operations. These investments are classified as

Short-Term Investments on the balance sheet and are available for

current operations of Duke Energy’s foreign business. During the year

ended December 31, 2011, Duke Energy received proceeds on sales

of auction rate securities of approximately $59 million (par value).

During the year ended December 31 2010, there were no purchases

or sales of short-term investments.

Long-term investments.

Duke Energy classifies its investments in debt and equity

securities held in the Duke Energy Carolinas NDTF (see Note 15 for

further information), the Duke Energy Indiana grantor trust and the

captive insurance investment portfolio as long term. Additionally,

Duke Energy has classified $71 million carrying value ($89 million

par value) and $118 million carrying value ($149 million par value)

of investments in auction rate debt securities as long-term at

December 31, 2011 and 2010, respectively, due to market illiquidity

factors as a result of continued failed auctions. All of these

investments are classified as available-for-sale and, therefore, are

reflected on the Consolidated Balance Sheets at estimated fair value

based on either quoted market prices or management’s best estimate

of fair value based on expected future cash flow using appropriate

risk-adjusted discount rates. Since management does not intend to

use these investments in current operations, these investments are

classified as long term.

The cost of securities is determined using the specific

identification method.

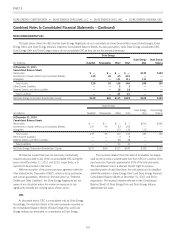

The estimated fair values of investments classified as

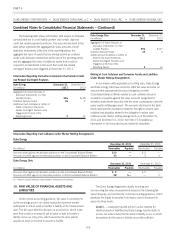

available-for-sale are as follows (in millions):

Duke Energy

December 31, 2011 December 31, 2010

Gross

Unrealized

Holding

Gains(a)

Gross

Unrealized

Holding

Losses(a)

Estimated

Fair

Value

Gross

Unrealized

Holding

Gains(a)

Gross

Unrealized

Holding

Losses(a)

Estimated

Fair

Value

Short-term Investments $— $— $190 $— $— $ —

Total short-term investments $— $— $190 $— $— $ —

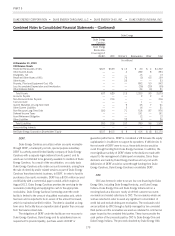

Equity Securities $448 $(18) $1,397 $481 $(16) $1,435

Corporate Debt Securities 9(3)25612 (3) 270

Municipal Bonds 3—79 1 (9) 69

U.S. Government Bonds 17 — 327 10 (1) 235

Auction Rate Debt Securities —(17)71 — (31) 118

Other 6(4)22911 (5) 274

Total long-term investments $483 $(42) $2,359 $515 $(65) $2,401

(a) The table above includes unrealized gains and losses of $473 million and $22 million, respectively, at December 31, 2011 and unrealized gains and losses of $505 million and $32

million, respectively, at December 31, 2010 associated with investments held in the Duke Energy Carolinas NDTF. Additionally, the table above includes unrealized gains of $6 million

and $1 million of unrealized losses at December 31, 2011, and unrealized gains of $6 million and an insignificant amount of unrealized losses, at December 31, 2010 associated with

investments held in the Duke Energy Indiana grantor trust. As discussed above, unrealized losses on investments within the NDTF and Duke Energy Indiana grantor trust are deferred as

a regulatory asset pursuant to regulatory accounting treatment.

175