Duke Energy 2011 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

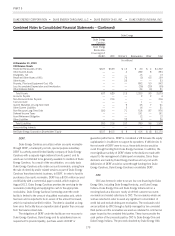

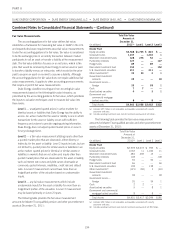

Duke Energy’s policy is to fund amounts on an actuarial basis to

provide assets sufficient to meet benefit payments to be paid to plan

participants. The following table includes information related to Duke

Energy’s contributions to its U.S. qualified defined benefit pension

plans.

For the Years Ended

December 31,

(in millions) 2012 2011 2010 2009

Contributions made — $200 $400 $800

Anticipated contributions $200 ———

Actuarial gains and losses subject to amortization are amortized

over the average remaining service period of the active employees.

The average remaining service period of active employees covered by

the qualified retirement plans is ten years. The average remaining

service period of active employees covered by the non-qualified

retirement plans is nine years. Duke Energy determines the market-

related value of plan assets using a calculated value that recognizes

changes in fair value of the plan assets in a particular year on a

straight line basis over the next five years.

Net periodic benefit costs disclosed in the tables below for the

qualified, non-qualified and other post-retirement benefit plans

represent the cost of the respective benefit plan for the periods

presented. However, portions of the net periodic benefit costs

disclosed in the tables below have been capitalized as a component

of property, plant and equipment.

Duke Energy uses a December 31 measurement date for its

defined benefit retirement plan assets and obligations.

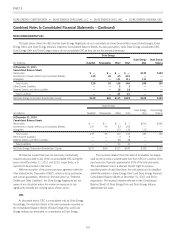

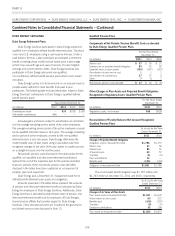

Qualified Pension Plans

Components of Net Periodic Pension Costs: Qualified Pension

Plans

For the Years Ended

December 31,

(in millions) 2011(a) 2010(a) 2009(a)

Service cost $96 $96 $85

Interest cost on projected benefit

obligation 232 248 257

Expected return on plan assets (384) (378) (362)

Amortization of prior service cost 657

Amortization of actuarial loss 77 50 2

Settlement and contractual termination

benefit cost —13 —

Other 18 18 17

Net periodic pension costs $45 $52 $ 6

(a) These amounts exclude $14 million, $16 million and $10 million for the years ended

December 31, 2011, 2010 and 2009, respectively, of regulatory asset amortization

resulting from purchase accounting adjustments associated with Duke Energy’s merger

with Cinergy in April 2006.

Other Changes in Plan Assets and Projected Benefit Obligations

Recognized in Accumulated Other Comprehensive Income and

Regulatory Assets: Qualified Pension Plans

For the Years Ended

December 31,

(in millions) 2011 2010

Regulatory assets, net increase $152 $ 350

Accumulated other comprehensive (income) loss(a)

Deferred income tax asset (10) 143

Actuarial losses (gains) arising during the

year 60 (5)

Amortization of prior year actuarial losses (8) (16)

Reclassification of actuarial gains (losses) to

regulatory assets 8(365)

Amortization of prior year prior service cost (1) (3)

Reclassification of prior service cost to

regulatory assets —(19)

Net amount recognized in accumulated other

comprehensive (income) loss $49 $(265)

(a) Excludes actuarial losses of $2 million in 2011 and $3 million in 2010 recognized in

other accumulated comprehensive income, net of tax, associated with a Brazilian

retirement plan.

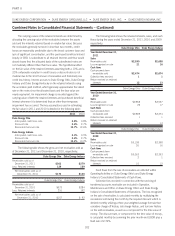

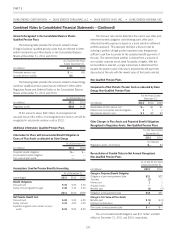

Reconciliation of Funded Status to Net Amount Recognized:

Qualified Pension Plans

As of and for the Years

Ended December 31,

(in millions) 2011 2010

Change in Projected Benefit Obligation

Obligation at prior measurement date $4,861 $4,695

Service cost 96 96

Interest cost 232 248

Actuarial (gains) losses (7) 190

Plan amendments 18 2

Settlement and contractual termination

benefit cost —13

Benefits paid (320) (383)

Obligation at measurement date $4,880 $4,861

The accumulated benefit obligation was $4,661 million and

$4,611 million at December 31, 2011 and 2010, respectively.

As of and for the Years

Ended December 31,

(in millions) 2011 2010

Change in Fair Value of Plan Assets

Plan assets at prior measurement date $4,797 $4,224

Actual return on plan assets 64 556

Benefits paid (320) (383)

Employer contributions 200 400

Plan assets at measurement date $4,741 $4,797

188