Duke Energy 2011 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

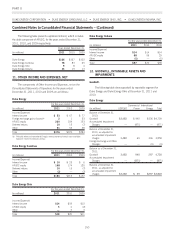

facility up to specified sublimits for each borrower. However, Duke

Energy has the unilateral ability at any time to increase or decrease

the borrowing sublimits of each borrower, subject to a maximum

sublimit for each borrower. See the table below for the borrowing

sublimits for each of the borrowers as of December 31, 2011. The

amount available under the master credit facility has been reduced,

as indicated in the table below, by the use of the master credit facility

to backstop the issuances of commercial paper, letters of credit and

certain tax-exempt bonds. As indicated, borrowing sub limits for the

Subsidiary Registrants are also reduced for amounts outstanding

under the money pool arrangement.

Master Credit Facility Summary as of December 31, 2011 (in millions)(a)(b)

Duke Energy

(Parent)

Duke Energy

Carolinas

Duke Energy

Ohio

Duke Energy

Indiana

Total

Duke Energy

Facility Size(c) $1,250 $1,250 $800 $ 700 $4,000

Less:

Notes Payable and Commercial Paper(d) (75) (300) — (150) (525)

Outstanding Letters of Credit (51) (7) (27) — (85)

Tax-Exempt Bonds — (95) (84) (81) (260)

Available Capacity $1,124 $ 848 $689 $ 469 $3,130

(a) This summary only includes Duke Energy’s master credit facility and, accordingly, excludes certain demand facilities and committed facilities that are insignificant in size or which

generally support very specific requirements, which primarily include facilities that backstop various outstanding tax-exempt bonds. These facilities that backstop various outstanding

tax-exempt bonds generally have non-cancelable terms in excess of one year from the balance sheet date, such that the Duke Energy Registrants have the ability to refinance such

borrowings on a long-term basis. Accordingly, such borrowings are reflected as Long-term Debt on the Consolidated Balance Sheets of the respective Duke Energy Registrant.

(b) Credit facility contains a covenant requiring the debt-to-total capitalization ratio to not exceed 65% for each borrower.

(c) Represents the sublimit of each borrower at December 31, 2011. The Duke Energy Ohio sublimit includes $100 million for Duke Energy Kentucky.

(d) Duke Energy issued $450 million of Commercial Paper and loaned the proceeds through the money pool to Duke Energy Carolinas and Duke Energy Indiana (see money pool table

above). The balances are classified as long-term borrowings within Long-term Debt in Duke Energy Carolinas’ and Duke Energy Indiana’s Consolidated Balance Sheets. Duke Energy

issued an additional $75 million of Commercial Paper in 2011. The balance is classified as Notes payable and commercial paper on Duke Energy’s Consolidated Balance Sheets.

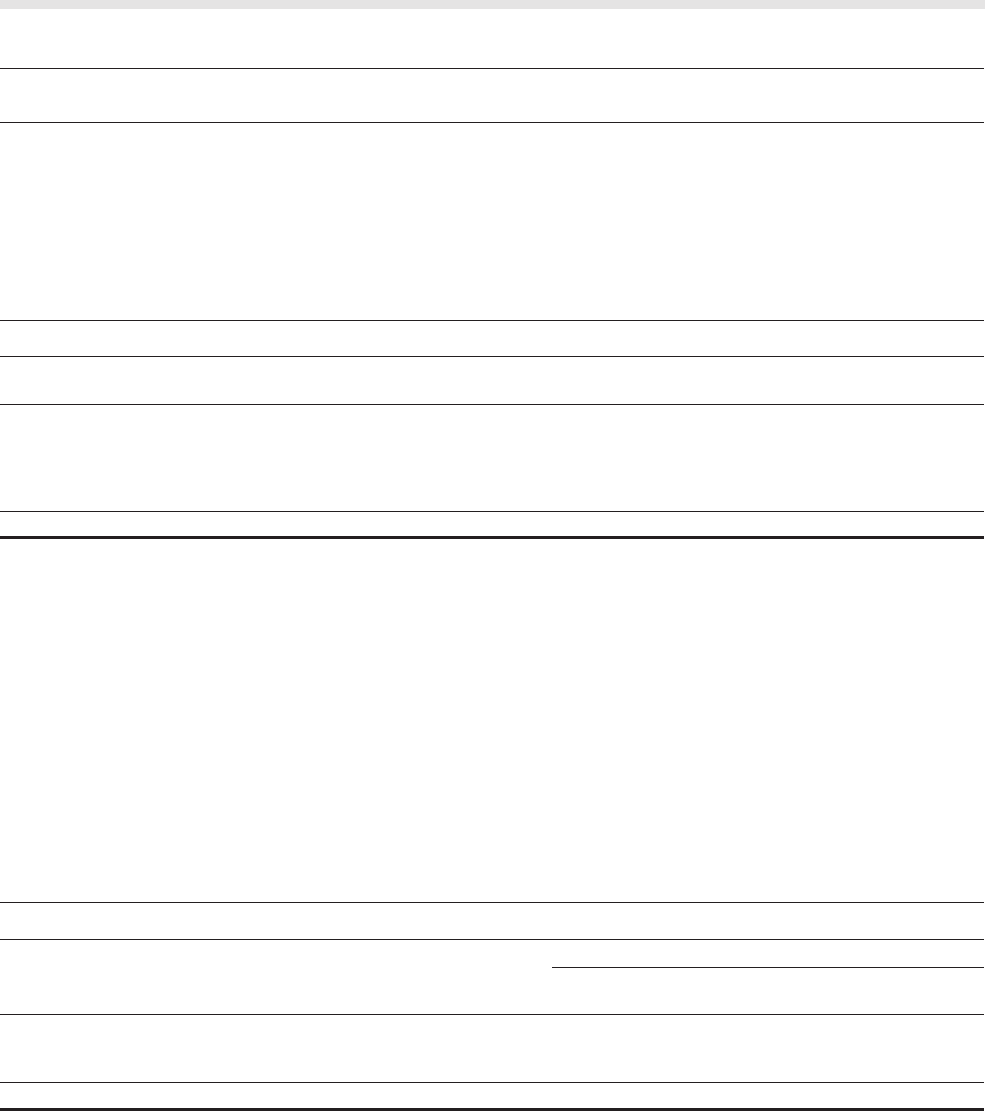

At December 31, 2011 and 2010, various tax-exempt bonds,

commercial paper issuances and money pool borrowings were

classified as Long-term Debt on the Consolidated Balance Sheets.

These variable rate tax-exempt bonds, commercial paper issuances

and money pool borrowings, which are short-term obligations by

nature, are classified as long term due to Duke Energy’s intent and

ability to utilize such borrowings as long-term financing. As Duke

Energy’s master credit facility and other specific purpose credit

facilities have non-cancelable terms in excess of one year as of the

balance sheet date, Duke Energy has the ability to refinance these

short-term obligations on a long-term basis. The following tables

show short-term obligations classified as long-term debt as of

December 31, 2011 and 2010:

Short-term obligations classified as long term

December 31, 2011

(in millions) Duke Energy

Duke Energy

Carolinas

Duke Energy

Ohio

Duke Energy

Indiana

Tax exempt bonds(a)(b)(c)(d) $ 491 $ 95 $111 $285

Notes payable and Commercial paper(e) 450 300 — 150

DERF(f) 300 300 — —

Total $1,241 $695 $111 $435

(a) Of the $491 million of tax-exempt bonds outstanding at December 31, 2011 at Duke Energy, the master credit facility served as a backstop for $287 million of these tax-exempt bonds

(of which $27 million is in the form of letters of credit), with the remaining balance backstopped by other specific long-term credit facilities separate from the master credit facility.

(b) For Duke Energy Carolinas, the master credit facility served as a backstop for the $95 million of tax-exempt bonds outstanding at December 31, 2011.

(c) All of the $111 million of tax-exempt bonds outstanding at December 31, 2011 at Duke Energy Ohio were backstopped by Duke Energy’s master credit facility (of which $27 million is

in the form of letters of credit).

(d) Of the $285 million of tax-exempt bonds outstanding at December 31, 2011 at Duke Energy Indiana, $81 million were backstopped by Duke Energy’s master credit facility, with the

remaining balance backstopped by other specific long-term credit facilities separate from the master credit facility.

(e) Duke Energy has issued $450 million in Commercial Paper, which is backstopped by the master credit facility, and the proceeds are in the form of loans through the money pool to Duke

Energy Carolinas of $300 million and Duke Energy Indiana of $150 million as of December 31, 2011.

(f) DERF is a short-term obligation backed by a credit facility which expires in August 2013.

143