Duke Energy 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

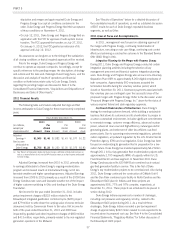

Year Ended December 31, 2010 as Compared to

December 31, 2009. Consolidated operating revenues for 2010

increased $1,541 million compared to 2009. This change was

primarily driven by the following:

• A $1,164 million increase at USFE&G. See Operating

Revenue discussion within “Segment Results” for USFE&G

below for further information;

• A $334 million increase at Commercial Power. See Operating

Revenue discussion within “Segment Results” for Commercial

Power below for further information; and

• A $46 million increase at International Energy. See Operating

Revenue discussion within “Segment Results” for International

Energy below for further information.

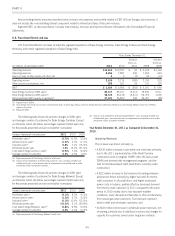

Consolidated Operating Expenses

Year Ended December 31, 2011 as Compared to

December 31, 2010. Consolidated operating expenses for 2011

decreased $204 million compared to 2010. This change was driven

primarily by the following:

• A $435 million decrease at Commercial Power. See Operating

Expense discussion within “Segment Results” for Commercial

Power below for further information; and

• A $302 million decrease at Other. See Operating Expense

discussion within “Segment Results” for Other below for

further information.

Partially offsetting these decreases was:

• A $399 million increase at USFE&G. See Operating Expense

discussion within “Segment Results” for USFE&G below for

further information; and

• A $132 million increase at International Energy. See

Operating Expense discussion within “Segment Results” for

International Energy below for further information.

Year Ended December 31, 2010 as Compared to

December 31, 2009. Consolidated operating expenses for 2010

increased $1,446 million compared to 2009. This change was

driven primarily by the following:

• A $624 million increase at USFE&G. See Operating Expense

discussion within “Segment Results” for USFE&G below for

further information;

• A $576 million increase at Commercial Power. See Operating

Expense discussion within “Segment Results” for Commercial

Power below for further information; and

• A $267 million increase at Other. See Operating Expense

discussion within “Segment Results” for Other below for

further information.

Partially offsetting these increases was:

• A $28 million decrease at International Energy. See Operating

Expense discussion within “Segment Results” for International

Energy below for further information.

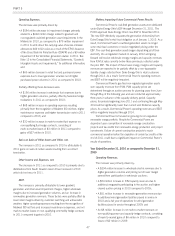

Consolidated Gains on Sales of Other Assets and Other, net

Consolidated gains on sales of other assets and other, net was a

gain of $8 million, $153 million and $36 million in 2011, 2010

and 2009, respectively. The gains in 2010 are primarily due to the

$139 million gain from the sale of a 50% ownership interest in

DukeNet Communications, LLC (DukeNet). The gains for 2009

relate primarily to sales of emission allowances by USFE&G and

Commercial Power.

Consolidated Operating Income

Year Ended December 31, 2011 as Compared to

December 31, 2010. For 2011, consolidated operating income

increased $316 million compared to 2010. Drivers to operating

income are discussed above.

Year Ended December 31, 2010 as Compared to

December 31, 2009. For 2010, consolidated operating income

increased $212 million compared to 2009. Drivers to operating

income are discussed above.

Consolidated Other Income and Expenses, net

Year Ended December 31, 2011 as Compared to

December 31, 2010. For 2011, consolidated other income and

expenses decreased $42 million compared to 2010. This decrease

was primarily due to the $109 million gain on the sale of Duke

Energy’s ownership interest in Q-Comm Corporation (Q-Comm) in

2010 and unfavorable returns on investments that support benefit

obligations; partially offset by increased equity earnings of $44

million primarily from International Energy’s investment in NMC, a

higher equity component of allowance for funds used during

construction (AFUDC) of $26 million due to additional capital

spending for ongoing construction projects, and a $20 million Peru

arbitration award.

Year Ended December 31, 2010 as Compared to

December 31, 2009. For 2010, consolidated other income and

expenses increased $256 million compared to 2009. This increase

was primarily due to the $109 million gain on the sale of Duke

Energy’s ownership interest in Q-Comm in 2010, a higher equity

component of AFUDC of $81 million due to additional capital

spending for ongoing construction projects, increased equity earnings

of $46 million primarily from International Energy’s investment in

NMC and the absence of 2009 losses from its investment in Attiki

Gas Supply S.A. (Attiki), and a $26 million charge in 2009

associated with certain performance guarantees Duke Energy had

issued on behalf of the Crescent JV (Crescent).

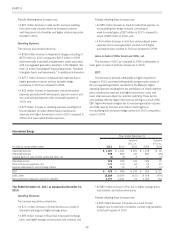

Consolidated Interest Expense

Year Ended December 31, 2011 as Compared to

December 31, 2010. Consolidated interest expense increased

$19 million in 2011 as compared to 2010. This increase is primarily

attributable to higher debt balances in 2011 and higher interest

expense related to income taxes; partially offset by deferred interest

expense related to environmental plant costs.

42