Duke Energy 2011 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

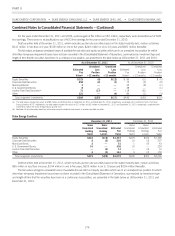

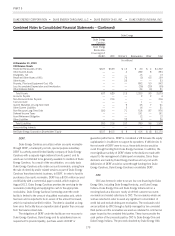

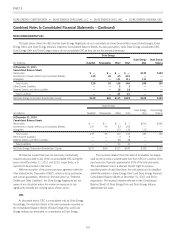

Combined Notes to Consolidated Financial Statements – (Continued)

DukeNet.

In 2010, Duke Energy sold a 50% ownership interest in

DukeNet to Alinda. The sale resulted in DukeNet becoming a joint

venture with Duke Energy and Alinda each owning a 50% interest.

In connection with the formation of the new DukeNet joint venture, a

five-year, $150 million senior secured credit facility was executed

with a syndicate of ten external financial institutions. This credit

facility is non-recourse to Duke Energy. DukeNet is considered a VIE

because it has entered into certain contractual arrangements that

provide DukeNet with additional forms of subordinated financial

support. The most significant activities that impact DukeNet’s

economic performance relate to its business development and fiber

optic capacity marketing and management activities. The power to

direct these activities is jointly and equally shared by Duke Energy

and Alinda. As a result, Duke Energy does not consolidate the

DukeNet joint venture. Accordingly, DukeNet is a non-consolidated

VIE that is reported as an equity method investment.

Unless consent by Duke Energy is given otherwise, Duke Energy

and its subsidiaries have no requirement to provide liquidity,

purchase the assets of DukeNet, or guarantee performance.

Renewables.

Duke Energy has investments in various entities that generate

electricity through the use of renewable energy technology. Some of

these entities, which were part of the Catamount acquisition, are VIEs

which are not consolidated due to the joint ownership of the entities

when they were created and the power to direct and control key

activities is shared jointly Instead, Duke Energy’s investment is

recorded under the equity method of accounting. These entities are

VIEs due to power purchase agreements with terms that approximate

the expected life of the project. These fixed price agreements

effectively transfer the commodity price risk to the buyer of the power.

Other.

Duke Energy has investments in various other entities that are

VIEs which are not consolidated. The most significant of these

investments is Duke Energy Ohio’s 9% ownership interest in OVEC.

Through its ownership interest in OVEC, Duke Energy Ohio has a

contractual arrangement through June 2040 to buy power from

OVEC’s power plants. The proceeds from the sale of power by OVEC

to its power purchase agreement counterparties, including Duke

Energy Ohio, are designed to be sufficient for OVEC to meet its

operating expenses, fixed costs, debt amortization and interest

expense, as well as earn a return on equity. Accordingly, the value of

this contract is subject to variability due to fluctuations in power

prices and changes in OVEC’s costs of business, including costs

associated with its 2,256 megawatts of coal-fired generation

capacity. As discussed in Note 5, the proposed rulemaking on

cooling water intake structures, utility boiler MACT, CSAPR and CCP’s

could increase the costs of OVEC which would be passed through to

Duke Energy Ohio. The initial carrying value of this contract was

recorded as an intangible asset when Duke Energy acquired Cinergy

in April 2006.

In addition, the company has guaranteed the performance of

certain entities in which the company no longer has an equity

interest. As a result, the company has a variable interest in certain

other VIEs that are non-consolidated.

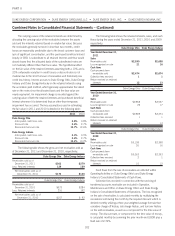

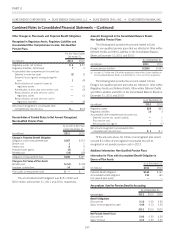

18. EARNINGS PER SHARE

Basic Earnings Per Share (EPS) is computed by dividing net

income attributable to Duke Energy common shareholders, adjusted

for distributed and undistributed earnings allocated to participating

securities, by the weighted-average number of common shares

outstanding during the period. Diluted EPS is computed by dividing

net income attributable to Duke Energy common shareholders, as

adjusted for distributed and undistributed earnings allocated to

participating securities, by the diluted weighted-average number of

common shares outstanding during the period. Diluted EPS reflects

the potential dilution that could occur if securities or other agreements

to issue common stock, such as stock options, phantom shares and

stock-based performance unit awards were exercised or settled.

183