Duke Energy 2011 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

Duke Energy, to simulate Duke Energy’s relative TSR as of the end of

the performance period. For each simulation, Duke Energy’s relative

TSR associated with the simulated stock price at the end of the

performance period plus expected dividends within the period results

in a value per share for the award portfolio. The average of these

simulations is the expected portfolio value per share. Actual life to

date results of Duke Energy’s relative TSR for each grant is

incorporated within the model. Other performance awards not

containing market conditions were awarded in 2011, 2010 and

2009. The performance goal for the 2011 and 2010 award is Duke

Energy’s Return on Equity (ROE) over a three year period. The

performance goal for the 2009 award is Duke Energy’s compounded

annual growth rate of annual diluted EPS, adjusted for certain items,

over a three year period. All of these awards are measured at grant

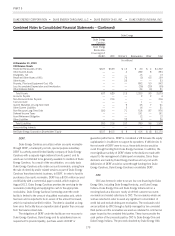

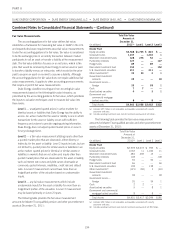

date price. The following table includes information related to Duke

Energy’s performance awards.

Shares awarded

(in thousands)

Fair value(a)

(in millions)

Years ended December 31,

2011 1,294 $20

2010 2,734 38

2009 3,426 44

(a) Based on the market price of Duke Energy’s common stock at the grant date.

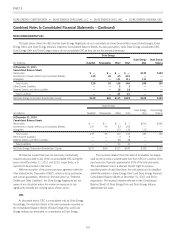

The following table summarizes information about stock-based

performance awards outstanding at the maximum level at

December 31, 2011:

Shares

(in thousands)

Weighted Average

Per Share

Grant

Date Fair Value

Number of Stock-based

Performance Awards:

Outstanding at December 31,

2010 7,550 $14

Granted 1,294 16

Vested (2,111) 16

Forfeited (363) 13

Outstanding at December 31,

2011 6,370 $14

Stock-based Performance Awards

Expected to Vest 6,212 $14

The total grant date fair value of the shares vested during the

years ended December 31, 2011, 2010 and 2009 was $33

million, $15 million and $20 million, respectively. At December 31,

2011, Duke Energy had $17 million of unrecognized compensation

cost which is expected to be recognized over a weighted-average

period of 1.5 years.

Other Stock Awards

Other stock awards issued and outstanding under the 1998

Plan vest over periods from three to five years. There were no other

stock awards issued during the years ended December 31, 2011,

2010 or 2009.

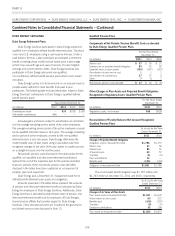

The following table summarizes information about other stock

awards outstanding at December 31, 2011:

Shares

(in thousands)

Weighted Average Per Share

Grant

Date Fair Value

Number of Other Stock

Awards:

Outstanding at

December 31,

2010 131 $28

Vested (131) 28

Forfeited — —

Outstanding at

December 31, 2011 —$—

The total fair value of the shares vested during the years ended

December 31, 2011, 2010 and 2009 was $4 million, $1 million,

and $1 million, respectively.

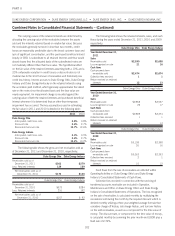

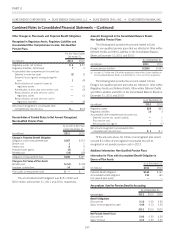

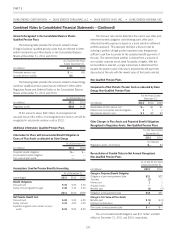

21. EMPLOYEE BENEFIT PLANS

Duke Energy

Defined Benefit Retirement Plans

Duke Energy and its subsidiaries (including legacy Cinergy

businesses) maintain qualified, non-contributory defined benefit

retirement plans. The plans cover most U.S. employees using a cash

balance formula. Under a cash balance formula, a plan participant

accumulates a retirement benefit consisting of pay credits that are

based upon a percentage (which varies with age and years of service)

of current eligible earnings and current interest credits. Certain legacy

Cinergy U.S. employees are covered under plans that use a final

average earnings formula. Under a final average earnings formula, a

plan participant accumulates a retirement benefit equal to a

percentage of their highest 3-year average earnings, plus a

percentage of their highest 3-year average earnings in excess of

covered compensation per year of participation (maximum of 35

years), plus a percentage of their highest 3-year average earnings

times years of participation in excess of 35 years. Duke Energy also

maintains non-qualified, non-contributory defined benefit retirement

plans which cover certain executives.

187