Duke Energy 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

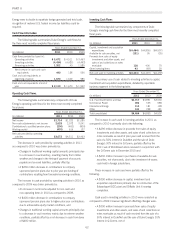

• A $300 million increase in capital, investment and acquisition

expenditures primarily due to Duke Energy’s ongoing

infrastructure modernization program.

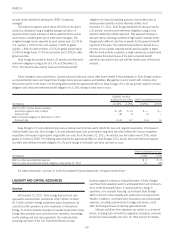

Financing Cash Flows

The following table summarizes key components of Duke

Energy’s financing cash flows for the three most recently completed

fiscal years:

Years Ended December 31,

(in millions) 2011 2010 2009

Issuance of common stock related to

employee benefit plans $67$ 302 $ 519

Issuance of long-term debt, net 2,292 1,091 2,876

Notes payable and commercial

power 208 (55) (548)

Dividends paid (1,329) (1,284) (1,222)

Other financing items (36) (14) (40)

Netcashprovidedbyinvesting

activities $1,202 $40$1,585

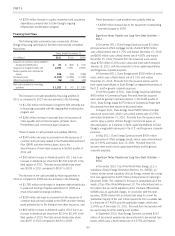

The increase in net cash provided by financing activities in

2011 as compared to 2010 was due primarily to the following:

• A $1,200 million net increase in long-term debt primarily due

to financings associated with the ongoing fleet modernization

program and

• A $260 million increase in proceeds from net issuances of

notes payable and commercial paper, primarily due to

PremierNotes and commercial paper issuances.

These increases in cash provided were partially offset by:

• A $240 million decrease in proceeds from the issuances of

common stock primarily related to the Dividend Reinvestment

Plan (DRIP) and other internal plans, due to the

discontinuance of new share issuances in the first quarter of

2011 and

• A $50 million increase in dividends paid in 2011 due to an

increase in dividends per share from $0.245 to $0.25 in the

third quarter of 2011. The total annual dividend per share

was $0.99 in 2011 compared to $0.97 in 2010.

The decrease in net cash provided by financing activities in

2010 as compared to 2009 was due primarily to the following:

• A $1,785 million net decrease in long-term debt primarily due

to advanced funding of capital expenditures in 2009 as a

result of favorable borrowing conditions,

• A $200 million decrease in proceeds from the issuances of

common stock primarily related to the DRIP and other internal

plans primarily due to the timing of new share issuances, and

• A $60 million increase in dividends paid in 2010 due to an

increase in dividends per share from $0.24 to $0.245 in the

third quarter of 2010. The total annual dividend per share

was $0.97 in 2010 compared to $0.94 in 2009.

These decreases in cash provided were partially offset by:

• A $490 million increase due to the repayment of outstanding

commercial paper in 2009.

Significant Notes Payable and Long-Term Debt Activities —

2011.

In December 2011, Duke Energy Carolinas issued $1 billion

principal amount of first mortgage bonds, of which $350 million

carry a fixed interest rate of 1.75% and mature December 15, 2016

and $650 million carry a fixed interest rate of 4.25% and mature

December 15, 2041. Proceeds from the issuances were used to

repay $750 million 6.25% senior unsecured notes which matured

January 15, 2012, with the remainder to fund capital expenditures

and for general corporate purposes.

In November 2011, Duke Energy issued $500 million of senior

notes, which carry a fixed interest rate of 2.15% and mature

November 15, 2016. Proceeds from the issuance will be used to

fund capital expenditures in Duke Energy’s unregulated businesses in

the U.S. and for general corporate purposes.

In the third quarter of 2011, Duke Energy issued an additional

$450 million in Commercial Paper. Proceeds from this issuance

were used for general corporate purposes. In the fourth quarter of

2011, Duke Energy repaid $375 million of Commercial Paper with

the proceeds from debt issuances discussed below.

In August 2011, Duke Energy issued $500 million principal

amount of senior notes, which carry a fixed interest rate of 3.55%

and mature September 15, 2021. Proceeds from the issuance were

used to repay a portion of Duke Energy’s commercial paper, as

discussed above, as it matures, to fund capital expenditures in Duke

Energy’s unregulated businesses in the U.S. and for general corporate

purposes.

In May 2011, Duke Energy Carolinas issued $500 million

principal amount of first mortgage bonds, which carry a fixed interest

rate of 3.90% and mature June 15, 2021. Proceeds from this

issuance were used to fund capital expenditures and for general

corporate purposes.

Significant Notes Payable and Long-Term Debt Activities —

2010.

In December 2010, Top of the World Wind Energy, LLC, a

subsidiary of Duke Energy Generation Services, Inc. (DEGS), an

indirect wholly-owned subsidiary of Duke Energy, entered into a long-

term loan agreement for $193 million principal amount maturing in

December 2028. The collateral for this loan is substantially all of the

assets of Top of the World Windpower LLC. The initial interest rate on

the notes is the six month adjusted London Interbank Offered Rate

(LIBOR) plus an applicable margin. In connection with this debt

issuance, DEGS entered into an interest rate swap to convert the

substantial majority of the loan interest payments from a variable rate

to a fixed rate of 3.465% plus the applicable margin, which was

2.375% as of December 31, 2011. Proceeds from the issuance will

be used to help fund the existing wind portfolio.

In September 2010, Duke Energy Carolinas converted $143

million of tax-exempt variable-rate demand bonds to tax-exempt term

bonds, which carry a fixed interest rate of 4.375% and mature

63