Duke Energy 2011 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

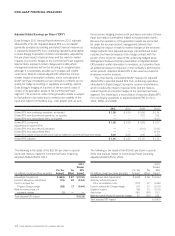

The following is the detail of the $(0.40) per share in special

items and mark-to-market in Commercial Power impacting

adjusted diluted EPS for 2009:

2009

Diluted

Pre-Tax Tax EPS

(In millions, except per-share amounts) Amount Effect Impact

Goodwill and other impairments $ (431) $ 21 $ (0.32)

Mark-to-market impact of economic hedges (60) 22 (0.03)

International transmission adjustment (32) 10 (0.02)

Crescent related guarantees and

tax adjustments (26) (3) (0.02)

Costs to achieve the Cinergy merger (25) 10 (0.01)

Total adjusted EPS impact $ (0.40)

The following is the detail of the $(0.20) per share in special

items and mark-to-market in Commercial Power impacting

adjusted diluted EPS for 2008:

2008

Diluted

Pre-Tax Tax EPS

(In millions, except per-share amounts) Amount Effect Impact

Crescent project impairments $ (214) $ 83 $ (0.10)

Emission allowances impairment (82) 30 (0.04)

Mark-to-market impact of economic hedges (75) 27 (0.04)

Costs to achieve the Cinergy merger (44) 17 (0.02)

Total adjusted EPS impact $ (0.20)

Duke Energy’s 2011 Annual Report also references

Duke Energy’s forecasted 2012 adjusted diluted EPS outlook

range of $1.40-$1.45 per share, which is consistent with the

2012 employee incentive earnings target. Due to the forward-

looking nature of this non-GAAP financial measure for future

periods, information to reconcile it to the most directly

comparable GAAP financial measure is not available at this time,

as management is unable to project special items or mark-to-

market adjustments for future periods.

Adjusted Segment EBIT for 2011 and 2012

Duke Energy’s 2011 Annual Report includes a discussion of

adjusted segment EBIT for the year ended December 31, 2011.

The primary performance measure used by management to

evaluate segment performance is segment EBIT from continuing

operations, which at the segment level represents all profits

from continuing operations (both operating and non-operating),

including any equity in earnings of unconsolidated affiliates,

before deducting interest and taxes, and is net of the income

attributable to non-controlling interests. Management believes

segment EBIT from continuing operations, which is the GAAP

measure used to report segment results, is a good indicator of

each segment’s operating performance as it represents the results

of Duke Energy’s ownership interests in continuing operations

without regard to financing methods or capital structures.

Duke Energy also uses adjusted segment EBIT as a measure

of historical segment performance.

Adjusted segment EBIT is a non-GAAP financial measure

as it represents reported segment EBIT adjusted for the impact

of special items and the mark-to market impacts of economic

hedges in the Commercial Power segment. Special items

represent certain charges and credits which management

believes will not be recurring on a regular basis, although it

is reasonably possible such charges and credits could recur.

Mark-to-market adjustments reflect the mark-to-market impact

of derivative contracts, which is recognized in GAAP earnings

immediately as such derivative contracts do not qualify for hedge

accounting or regulatory accounting, used in Duke Energy’s

hedging of a portion of the economic value of certain of its

generation assets in the Commercial Power segment (as

discussed above under “Adjusted Diluted Earnings per Share

(“EPS”)”). Management believes that the presentation of adjusted

segment EBIT provides useful information to investors, as it

provides them an additional relevant comparison of a segment’s

performance across periods. The most directly comparable

GAAP measure for adjusted segment EBIT is reported segment

EBIT, which represents segment results from continuing

operations, including any special items and the mark-to-market

impacts of economic hedges in the Commercial Power segment.

DUKE ENERGY CORPORATION 2011 ANNUAL REPORT 15