Duke Energy 2011 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

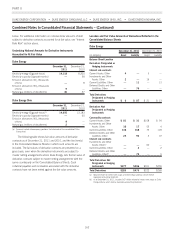

Thefollowingtableshowstheamountofthepre-taxgainsand

losses recognized on undesignated hedges by type of derivative

instrument during the years ended December 31, 2011 and 2010,

and the line item(s) in the Consolidated Statements of Operations in

which such gains and losses are included or deferred on the

Consolidated Balance Sheets as regulatory assets or liabilities.

Undesignated Hedges — Location and Amount of Pre-Tax Gains

and (Losses) Recognized in Income or as Regulatory Assets or

Liabilities

Duke Energy Year Ended

December 31,

(in millions) 2011 2010

Location of Pre-Tax Gains and (Losses) Recognized

in Earnings

Commodity contracts

Revenue, regulated electric $— $1

Revenue, non-regulated electric, natural gas and other (59) (38)

Fuel used in electric generation and purchased

power-non-regulated (1) 9

Total Pre-tax Losses Recognized in Earnings $ (60) $(28)

Location of Pre-Tax Gains and (Losses) Recognized

as Regulatory Assets or Liabilities

Commodity contracts

Regulatory Asset $(1) $5

Regulatory Liability 17 14

Interest rate contracts

Regulatory Asset(a) (165) (1)

Regulatory Liability(b) (60) 60

Total Pre-tax (Losses) Gains Recognized as

Regulatory Assets or Liabilities $(209) $78

(a) Includes losses related to interest rate swaps at Duke Energy Carolinas and Duke

Energy Indiana of $94 million and $67 million, respectively, during the year ended

December 31, 2011.

(b) Amounts relate to interest rate swaps at Duke Energy Carolinas.

Duke Energy Ohio Year Ended

December 31,

(in millions) 2011 2010

Location of Pre-Tax Gains and (Losses) Recognized in

Earnings

Commodity contracts

Revenue, non-regulated electric and other (26) (3)

Fuel used in electric generation and purchased

power-non-regulated (1) 9

Interest rate contracts

Interest expense (1) (1)

Total Pre-tax (Losses) Gains Recognized in Earnings(a) $(28) $5

Location of Pre-Tax Gains and (Losses) Recognized as

Regulatory Assets

2011 2010

Commodity contracts

Regulatory Asset $1 $5

Interest rate contracts

Regulatory Asset (4) (1)

Total Pre-tax (Losses) Gains Recognized as

Regulatory Assets $(3) $4

(a) Amounts include intercompany positions that eliminate at the consolidated Duke

Energy level.

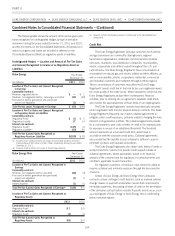

Credit Risk

The Duke Energy Registrants’ principal customers for its electric

and gas businesses are commodity clearinghouses, regional

transmission organizations, residential, commercial and industrial

end-users, marketers, local distribution companies, municipalities,

electric cooperatives and utilities located throughout the U.S. and

Latin America. The Duke Energy Registrants have concentrations of

receivables from natural gas and electric utilities and their affiliates, as

well as municipalities, electric cooperatives, residential, commercial

and industrial customers and marketers throughout these regions.

These concentrations of customers may affect the Duke Energy

Registrants’ overall credit risk in that risk factors can negatively impact

the credit quality of the entire sector. Where exposed to credit risk, the

Duke Energy Registrants analyze their counterparties’ financial

condition prior to entering into an agreement, establish credit limits

and monitor the appropriateness of those limits on an ongoing basis.

The Duke Energy Registrants’ industry has historically operated

under negotiated credit lines for physical delivery contracts. The Duke

Energy Registrants frequently use master collateral agreements to

mitigate certain credit exposures, primarily related to hedging the risks

inherent in its generation portfolio. The collateral agreements provide

for a counterparty to post cash or letters of credit to the exposed party

for exposure in excess of an established threshold. The threshold

amount represents an unsecured credit limit, determined in

accordance with the corporate credit policy. Collateral agreements

also provide that the inability to post collateral is sufficient cause to

terminate contracts and liquidate all positions.

The Duke Energy Registrants also obtain cash, letters of credit or

surety bonds from customers to provide credit support outside of

collateral agreements, where appropriate, based on its financial

analysis of the customer and the regulatory or contractual terms and

conditions applicable to each transaction.

For regulated customers, commission rules restrict the ability to

requires collateral and minimize exposure through the disconnection

of service.

Certain of Duke Energy and Duke Energy Ohio’s derivative

contracts contain contingent credit features, such as material adverse

change clauses or payment acceleration clauses that could result in

immediate payments, the posting of letters of credit or the termination

of the derivative contract before maturity if specific events occur, such

as a downgrade of Duke Energy or Duke Energy Ohio’s credit rating

below investment grade.

164