Duke Energy 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

stipulation and merger and again required Duke Energy and

Progress Energy to accept all conditions contained in the

order. Duke Energy and Progress Energy filed their acceptance

of those conditions on November 4, 2011.

• On July 12, 2011, Duke Energy and Progress Energy filed an

application with the FCC for approval of radio system license

transfers. The FCC approved the transfers on July 27, 2011.

On January 5, 2012, the FCC granted an extension of its

approval until July 12, 2012.

No assurances can be given as to the timing of the satisfaction

of all closing conditions or that all required approvals will be received.

Prior to the merger, Duke Energy and Progress Energy will

continue to operate as separate companies. Accordingly, except for

specific references to the pending merger, the descriptions of strategy

and outlook and the risks and challenges Duke Energy faces, and the

discussion and analysis of results of operations and financial

condition set forth below relate solely to Duke Energy. Details

regarding the pending merger are discussed in Note 2 to the

Consolidated Financial Statements, “Acquisitions and Dispositions of

Businesses and Sales of Other Assets.”

2011 Financial Results.

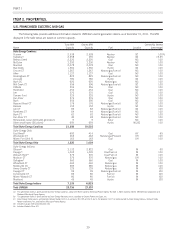

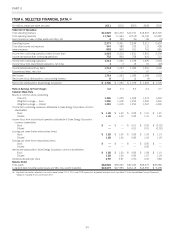

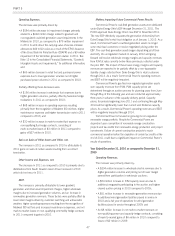

The following table summarizes Adjusted Earnings and Net

income attributable to Duke Energy for three most recently completed

years.

Years Ended December 31,

2011 2010 2009

(in millions,

except per

share amounts) Amount

Per

diluted

share Amount

Per

diluted

share Amount

Per

diluted

share

Adjusted

Earnings(a) $1,943 $1.46 $1,882 $1.43 $1,577 $1.22

Net income

attributable to

Duke Energy $1,706 $1.28 $1,320 $1.00 $1,075 $0.83

(a) See ‘Results of Operations below for Duke Energy’s definition of Adjusted Earnings as

well as a reconciliation of this non-GAAP financial measure to Net income attributable

to Duke Energy.

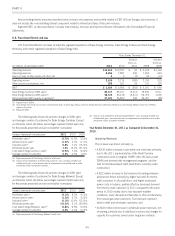

Adjusted Earnings increased from 2010 to 2011 primarily due

to earnings attributable to Duke Energy’s ongoing modernization

program and increased results at International Energy net of less

favorable weather and higher operating expenses. Adjusted Earnings

increased from 2009 to 2010 primarily as a result of the 2009 Duke

Energy Carolinas rate cases and favorable weather net of the impact

of higher customer switching in Ohio and funding of the Duke Energy

Foundation.

Net income for the year ended December 31, 2011 includes

pretax impairment charges of $222 million related to the

Edwardsport integrated gasification combined cycle (IGCC) project

and $79 million to write down the carrying value of excess emission

allowances held by Commercial Power to fair value. Net income for

both of the years ended December 31, 2010 and 2009 was

impacted by goodwill and other impairment charges of $660 million

and $413 million, respectively, primarily related to the non-regulated

generation operations in the Midwest.

See “Results of Operations” below for a detailed discussion of

the consolidated results of operations, as well as a detailed discussion

of EBIT results for each of Duke Energy’s reportable business

segments, as well as Other.

2011 Areas of Focus and Accomplishments.

In 2011, management was focused on obtaining approval of

the merger with Progress Energy, continuing modernization of

infrastructure, executing on rate case filings, continuing cost control

efforts and achieving a constructive outcome to the Standard Service

Offer (SSO) filing in Ohio.

Integration Planning for the Merger with Progress Energy.

During 2011, Duke Energy and Progress Energy conducted certain

integration planning activities including the selection of key

management personnel and financial systems integration planning

work. Duke Energy and Progress Energy also announced a Voluntary

Separation Plan (VSP) to approximately 8,200 eligible employees of

both companies. Approximately 500 employees accepted the

termination benefits during the voluntary window period, which

closed on November 30, 2011. Severance payments associated with

this voluntary plan are contingent upon the successful close of the

proposed merger with Progress Energy. Refer to the discussion under

“Proposed Merger with Progress Energy, Inc.” above for the status of

various required federal and state regulatory approvals.

Continued Modernization of Infrastructure. Duke Energy’s

strategy for meeting customer demand, while building a sustainable

business that allows its customers and its shareholders to prosper in

a carbon-constrained environment, includes significant commitments

to renewable energy, customer energy efficiency, advanced nuclear

power, advanced clean-coal and high-efficiency natural gas electric

generating plants, and retirement of older less efficient coal-fired

power plants. Due to upcoming environmental regulations, potential

carbon legislation, air pollutant regulation by the U.S. Environmental

Protection Agency (EPA) and coal regulation, Duke Energy has been

focused on modernizing its generation fleet in preparation for a low

carbon future. Duke Energy has invested approximately $6.2 billion

through 2011 in four key generation fleet modernization projects with

approximately 2,700 megawatts (MW) of capacity within its U.S.

Franchised Electric and Gas segment. In November 2011 Duke

Energy Carolinas placed its 620 MW Buck combined cycle natural

gas-fired generation facility in service. This is the first of Duke

Energy’s key modernization projects to be commissioned. Also during

2011, Duke Energy continued the construction of Cliffside Unit 6

and the Dan River combined cycle facility in North Carolina and the

Edwardsport IGCC plant in Indiana and these projects are

approximately 95%, 77% and 97% complete, respectively, at

December 31, 2011. These projects are scheduled to be placed in

service during 2012.

Duke Energy Indiana experienced a number of challenges,

including cost pressures and regulatory scrutiny, related to the

Edwardsport IGCC project during 2011. As a result of these

challenges, Duke Energy Indiana recorded a pre-tax impairment

charge of approximately $222 million related to costs expected to be

incurred above its proposed cost cap. See Note 4 to the Consolidated

Financial Statements, “Regulatory Matters” for further discussion of

the Edwardsport IGCC project.

37