Duke Energy 2011 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

unobservable inputs (i.e., Level 3 inputs) as defined by the

accounting guidance for fair value measurements.

Duke Energy Ohio.

Duke Energy Ohio early adopted the revised goodwill

impairment accounting guidance, discussed above, during the third

quarter of 2011 and applied this revised guidance to its August 31,

2011 annual goodwill impairment test. Duke Energy Ohio’s

qualitative assessment included, among other things, reviews of

current forecasts and recent fair value calculations, updates to

weighted average cost of capital calculations and consideration of

overall economic factors and recent financial performance. Duke

Energy Ohio determined it was more likely than not that the fair value

of each of its reporting units exceeded their carrying value at

August 31, 2011 and that the two step goodwill impairment test was

not required.

In the second quarter of 2010, based on circumstances

discussed above for Duke Energy, management determined that is

was more likely than not that the fair value of Duke Energy Ohio’s

non-regulated Midwest generation reporting unit was less than its

carrying value. Accordingly, Duke Energy Ohio also impaired its entire

goodwill balance of $461 million related to this reporting unit during

the second quarter of 2010. Also, as discussed above, Duke Energy

Ohio recorded $160 million of pre-tax impairment charges related to

certain generating assets and emission allowances primarily

associated with these generation assets in the Midwest to write-down

the value of these assets to their estimated fair value.

In the second quarter of 2010, goodwill for Ohio Transmission

and Distribution (Ohio T&D) was also analyzed. The fair value of the

Ohio T&D reporting unit is impacted by a multitude of factors,

including current and forecasted customer demand, discount rates,

valuation of peer companies, and regulatory and legislative

developments. Management periodically updates the load forecasts to

reflect current trends and expectations based on the current

environment and future assumptions. The spring and summer 2010

load forecast indicated that load would not return to 2007 weather-

normalized levels for several more years. Based on the results of the

second quarter 2010 impairment analysis, the fair value of the Ohio

T&D reporting unit was $216 million below its book value at Duke

Energy Ohio and $40 million higher than its book value at Duke

Energy. Accordingly, this goodwill impairment charge was only

recorded by Duke Energy Ohio.

For the same reasons discussed above, during 2009, in

connection with the annual goodwill impairment test, Duke Energy

Ohio recorded an approximate $727 million goodwill impairment

charge to write-down the carrying value of Duke Energy Ohio’s

non-regulated Midwest generation reporting unit to its implied fair

value. Additionally, in 2009 and as a result of factors similar to those

described above, Duke Energy Ohio recorded $42 million of pre-tax

impairment charges related to certain non-regulated generating assets

in the Midwest to write-down the value of these assets to their

estimated fair value.

The fair value of Duke Energy Ohio’s Ohio T&D reporting unit for

which an impairment was recorded was determined using significant

unobservable inputs (i.e., Level 3 inputs) as defined by the

accounting guidance for fair value measurements.

Duke Energy Ohio relied heavily on the income approach to

estimate the fair value of the impaired assets.

All of the above impairment charges are recorded in Goodwill

and Other Impairment Charges on Duke Energy Ohio’s Consolidated

Statements of Operations.

Intangibles.

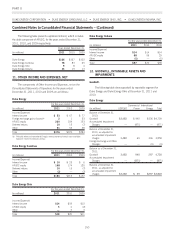

The carrying amount and accumulated amortization of

intangible assets as of December 31, 2011 and 2010 are as follows:

December 31, 2011

(in millions) Duke Energy

Duke Energy

Ohio

Duke Energy

Indiana

Emission allowances $66 $29 $37

Gas, coal and power contracts 295 271 24

Wind development rights 137 — —

Other 72 10 —

Total gross carrying

amount 570 310 61

Accumulated amortization —

gas, coal and power

contracts (169) (158) (11)

Accumulated amortization —

wind development rights (7) — —

Accumulated amortization —

other (31) (9) —

Total accumulated

amortization (207) (167) (11)

Total intangible assets, net $363 $143 $50

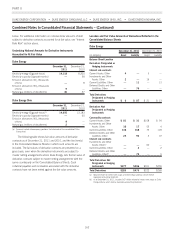

December 31, 2010

(in millions) Duke Energy

Duke Energy

Ohio

Duke Energy

Indiana

Emission allowances $ 175 $ 125 $49

Gas, coal and power contracts 295 271 24

Wind development rights 119 — —

Other 71 9 —

Total gross carrying amount 660 405 73

Accumulated amortization —

gas, coal and power contracts (157) (148) (9)

Accumulated amortization —

wind development rights (5) — —

Accumulated amortization —

other (31) (9) —

Total accumulated

amortization (193) (157) (9)

Total intangible assets, net $ 467 $ 248 $64

153